Just a few years ago, alternative energy sources were all the rage. A booming economy and record-high oil prices meant that the market had the capital and motivation to look into wind, solar, geothermal, biofuels -- even rain or ocean tide currents to create energy. A rising stock market and a high tax revenue base meant plenty of capital for start-ups to build wind farms and for the government to grant generous subsidies to help get new plants off the ground.

This momentum came to a screeching halt with the bursting of the housing bubble and ensuing credit crisis.

The peak nearly coincided with Texas oil baron T. Boone Pickens's lofty goal of building a giant wind farm in his home state. He announced his ambitions in July 2008, when oil prices had peaked during the previous month at close to $150 per barrel, yet halted them a year later when they fell dramatically, bottoming out near $30 per barrel in early 2009. This, of course, speaks to the necessity of high oil prices to help encourage alternative energy projects.

Since then, oil prices have been volatile again and just recently rose above $100. So the question is, after a multi-year period of alternative energy being "dead money," should investors be looking at alternative energy once again?

In today's economic and political environments, it's extremely difficult to sound a bullish tone on alternative energy investments. The plummet in price of the Market Vectors Alternative Energy ETF (NYSE: GEX), as shown in the table above, only serves as a case in point. It peaked at $60 back in late 2007 and currently trades at about $11.

Right now, the economy continues to improve, and this could help encourage alternative energy development. Yet the federal debt now exceeds $15 trillion and leaves little room for subsidies. The government recently ended subsidies to corn-based ethanol, which had been championed as an alternative to gasoline prior to the credit crisis. The recent failure of solar panel maker Solyndra, which received government funding, also speaks to the risk of letting politicians influence the development of new industries and technologies.

The alternative energy industry still needs help to reach the scale to compete with coal, natural gas, and other fossil fuels. One study estimated that solar energy sources cost triple that of coal and twice that of natural gas. Wind energy is about 33% more expensive than coal, and at least 14% more expensive than natural gas.

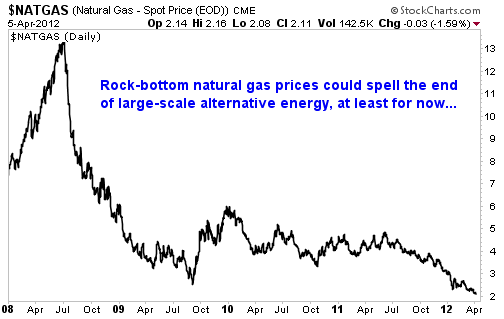

Massive natural gas discoveries in the United States have further shifted the power to this fossil fuel over alternative energy sources. Natural gas burns much cleaner than coal, and has plummeted in price to well below $3 per million British thermal units.

The low price and abundance of natural gas could prove the smoking gun to suggest that alternative energy development in the United States has slowed down indefinitely. And until the economy improves and the government starts bringing in more tax revenue than it spends annually, there is little reason to see spending on alternative energy sources rebounding significantly.

Risks to Consider: The past few years have demonstrated that energy prices can be extremely volatile. Any unexpected rise in oil prices, be it from an external shock such as geopolitical tensions in the Middle East, could easily shift the balance of power back to alternative energy sources. Increased regulations out of Washington could also force fossil fuels to give way to solar, wind, and related alternative energy sources.

Action to Take --> Ironically, the boom in natural gas discoveries in the U.S. has meant that leading firms in the space, such as Devon Energy (NYSE: DEV) and Chesapeake Energy (NYSE: CHK) are also questionable near-term investment candidates. Their long-term potential is much more positive, though.

By Ryan Fuhrmann

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

2 Charts Tell You Everything You Need To Know About Alternative Energy

Published 04/11/2012, 01:47 AM

Updated 07/09/2023, 06:31 AM

2 Charts Tell You Everything You Need To Know About Alternative Energy

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.