Looking for undervalued dividend paying stocks? Like many Basic Materials stocks, BHP Billiton PLC, (BBL), has been under pressure in 2012, due to slowing growth and tightening financial policy in China. However, the Chinese government has begun loosening its policies, in order to keep growth moving near their targeted 7.5% GDP rate, which should help Basic Materials stocks such as BBL regain some of their luster.

BHP Billiton was formed in June 2001 from the merger of BHP Limited (an Australian listed company) and Billiton Plc (a UK listed company). The merger was effected by way of a dual listed companies structure, meaning that although the companies technically continue to be separate legal entities, now renamed BHP Billiton Limited, (BHP), and BHP Billiton Plc, (BBL), with separate share listings and share registers, they are managed and run as a single economic entity. The companies have a common Board of Directors and management team. Shareholders in BHP Billiton Limited and BHP Billiton Plc have equal economic and voting rights, as if they held shares in a single company.

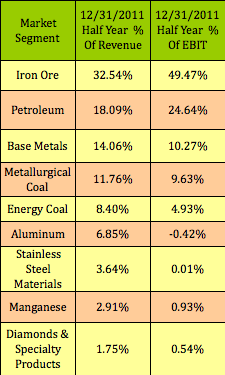

Here’s a breakdown of BBL’s various mining and energy segments, as of its last report, on 12/30/11. The company greatly expanded its petroleum production in 2011, with its acquisition of Petrohawk Energy, which is active in the Fayettville shale oil and gas area. BBL is a world leader in many of these commodities:

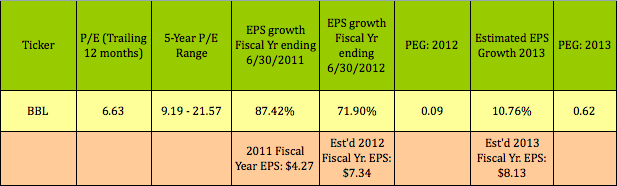

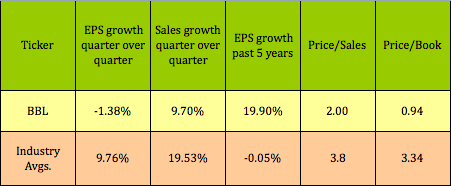

Undervalued Growth: BBL, whose fiscal year ends 6/30/12, looks undervalued on a PEG basis for 2012 and 2013:

BBL reports semi-annually, and has had earnings which outperformed its peers over the past 5 years, but it had a mild earnings stumble for the last 6 months of 2011:

BBL’s Price/Book and Price/Sales also look cheaper than its peers.

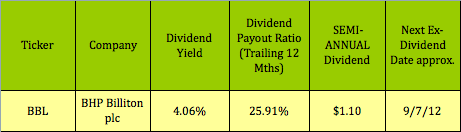

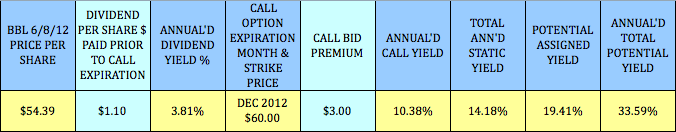

Dividends: With its 4%-plus dividend yield, BBL is listed in the Basic Materials section of our High Dividend Stocks By Sector Tables. One US ADR of BBL equals two Australian shares, so, BBL’s interim dividend of $.55 actually paid out $1.10 per US ADR share. BBL pays dividends twice a year, with ex-dividend dates typically in early September and late February-early March. BBL increased its semi-annual dividend in Feb. 2012 by 20%, to $1.10, from $.92. Indeed, BBL has been one of the best stocks to buy for dividend growth, with a 5-year dividend growth rate of 23%:

Covered Calls: BBL’s December $60.00 covered call options offer nearly 3 times the next dividend payout, and a nearly 20% potential assigned yield, which should ward off getting assigned before the ex-dividend date in September. (More info is listed in our Covered Calls Table, which has over 30 other trades):

Cash Secured Puts: BBL’s September $55.00 puts have higher options yields, since they’re in the money, (above BBL’s stock price). This put option trade gives you a breakeven that’s below BBL’s 52-week low of $49.90.

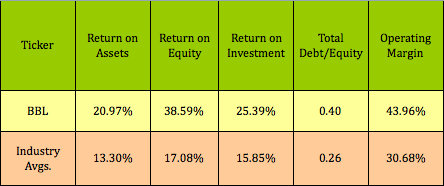

Financials: BBL’s Financial metrics outshine its peers, with the exception of slightly higher debt levels:

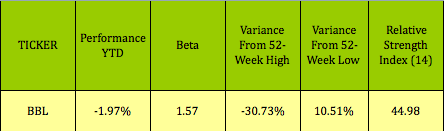

Technical Data:

Disclosure: Author had no positions in BBL or BHP at the time of this writing.

Disclaimer: This article is written for informational purposes only and isn’t intended as investment advice.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

BHP Billiton: Undervalued Basic Materials Dividend Stock

Published 06/10/2012, 12:56 AM

Updated 07/09/2023, 06:31 AM

BHP Billiton: Undervalued Basic Materials Dividend Stock

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.