The United States is engaged in a fierce debate over energy strategy, policy and production. Today there is wave after wave of new Federal regulation designed to favor clean energy strategies at the expense of fossil fuels that still provide most of our energy resources. These rules are being promulgated as a consequence of a Supreme Court decision (EPA vs. Massachusetts), which held that the EPA does have the authority to regulate carbon dioxide emissions under the Clean Air Act even though there is no explicit authorization to do so in the law. The Court found that to trigger that authority to regulate, the EPA could issue an ‘endangerment’ finding. The agency did so amidst broad controversy and has begun to roll out its detailed regulations aimed at reducing greenhouse gas emissions.

There is broad public support for environmental quality but just as broad political controversy over Federal energy policy increasingly seen as hugely expensive, highly disruptive and creating uncertainty just when the economy needs more certainty to restore confidence, unlock investment and encourage job creation.

Meanwhile, we have seen phenomenal growth in domestic oil and natural gas production made possible by disruptive yet innovative technologies like horizontal drilling and hydraulic fracturing in unlocking the economic value of previously uneconomic energy supplies. This dichotomy between Federal policy and the actions of the private sector in exploiting growth opportunities in the energy sector is profound.

There is a big shift in energy transformation underwayproducing clear and measurable results:

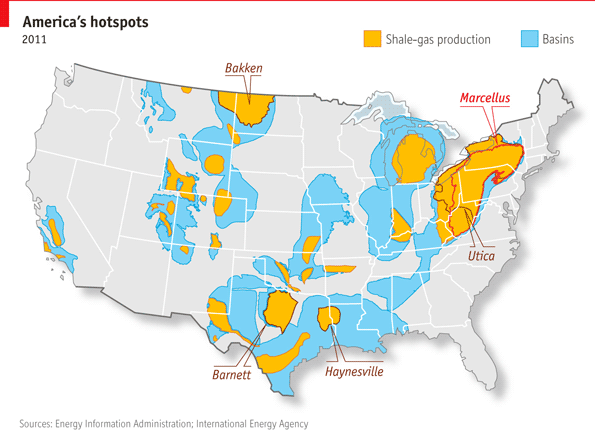

- Domestic oil and gas production is growing from shale development in many U.S. locations.

- 96% of domestic energy production growth has been on private and state lands over the past five years according to the Institute for Energy Research.

- Domestic natural gas prices are near historic lows as supply exceeds demand and prices been decoupled from oil prices thus increasing incentives for exports of natural gas as LNG.

- The belief that the U.S. must import LNG to make up for the decline in conventional natural gas production has been turned completely on its head by growth in unconventional shale gas.

- By 2011, the U.S. began to export natural gas as LNG and began to rationalize energy pipeline infrastructure to bring supply from the shale basins to the Gulf coast storage, liquids processing and refining infrastructure and enable exports of oil and LNG from these new sources.

- Meanwhile, Federal regulation has resulted in a decrease in energy production on Federal lands despite more than two trillion barrels of estimated recoverable oil from that land.

The combination of the drive to get our economy growing and Americans back to work is converging with new technology and the entrepreneurial spirit of private enterprise. The contrast between the public sector and private sector energy strategy results is evidence of the big shift taking place all across America.

Big Shift Drives Private-Sector Energy Development

The private sector accounts for 96% of this growth because the U.S. is one of the few countries that protects private property rights including the right of land owners to benefit from the mineral resources their property contains. So energy producers avoided Federal government regulations that inhibits production of public lands by working with private property owners and states to develop domestic energy resources that helped the states create jobs, increase tax revenue and put more money into the pockets of the private sector. Those revenues and profits are rippling through the economy. That is why North Dakota has an unemployment rate of about 4% compared to a national average twice that.

Exports Grow

Despite the waves of new Federal regulations on coal, the private sector has adapted, changing the economics of fossil fuels by driving down the price of cleaner natural gas and exporting unused coal for use in emerging markets. The irony in this is low natural gas prices are more ruthlessly efficient at undermining the economics of coal-fired generation than all of the EPA's rules combined. But low natural gas prices are an equal opportunity competitor, forcing nuclear power and renewable energy to also compete with grid parity natural gas prices for a place in the energy value chain.

The Clean Energy Compromise

Natural gas is 40% cleaner than coal and expanding its use produces substantial environmental benefits over coal at a fraction of the cost of all the EPA regulations, litigation and political infighting.

Energy And Tax Policy Align

Low natural gas prices also help restore America’s economic competitiveness in manufacturing, in chemicals and job creation by repatriating outsourced production driven out of the country by high energy costs. To realize this revival in manufacturing and production in the private sector, the Federal Government must fix the problems that make the U.S. corporate tax rate the highest in the world and remove tax barriers that confiscate 35% of the revenue brought home by repatriating earnings.

Too Much Dependence Is Risky Business

While today we have natural gas prices below $3 per MMBTU, it was not long ago that gas prices were above $13 per MMBTU. Indeed, natural gas prices are among the most volatile of the world’s commodities. The way to avoid getting hurt by fuel-price volatility is to diversify. That's why we need baseload coal and nuclear. That is why we need rooftop solar and wind energy. That is why we need strong markets for energy efficiency and demand response.

Private Sector search For Equilibrium -- that sweet spot in the market that assures high reliability of energy supply, the cleanest practicable balance of fuels and resources at the lowest possible price. Low energy prices are one big advantage for America’s economic recovery but they are not the only one.

Disruptive Innovation Technology Is Our Friend

Just as horizontal drilling, hydraulic fracturing and other disruptive but innovative technologies are transforming America’s energy value chain, information technology and operations technology are converging into strategies, applications and best practices to streamline and optimize the way America does business.

Instead of trying to pick winners and losers, the private-sector message to the Government is clear -- create a competitive marketplace with fair rules, no subsidies, then turn the private sector loose. The genius of America is its ability to continuously reinvent itself to adapt to change. The failure of government is impeding that disruptive, innovative change.