It seems that the stabilization in the eurozone, even potentially a temporary one, is having a healing effect on the global economy. We've seen some indications of improvement in China (see post), but now there are also positive signs in Brazil's economy.

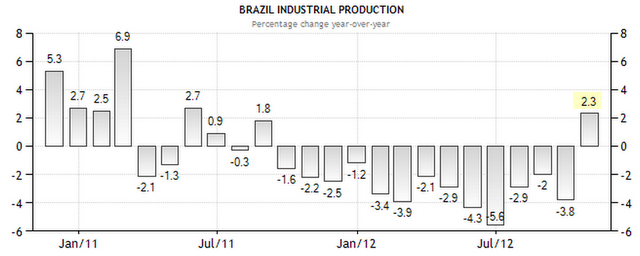

A great deal of that improvement is driven by a highly accommodative monetary policy and the recovery remains quite slow, but it's progress, nevertheless (see discussion from July). Brazil's industrial production, though still weaker than expected, came in positive on a year-over-year basis for the first time since August of 2011.

Reuters: Output from Brazilian factories and mines expanded 2.3 percent in October from a year earlier, government statistics agency IBGE said on Tuesday, though less than the 2.5 percent rise forecast in a Reuters poll of 33 analysts. Industrial production dropped 3.6 percent on a year-over-year basis in September, IBGE said, revised from a 3.8 percent drop.

"There is a gradual recovery happening," said Jankiel Santos, chief economist with BES Investimento in Sao Paulo. "Bit by bit we are getting more signals of it and today's numbers confirm it."

October's figures were the first annual rise in industrial production since August 2011, when Brazil's central bank began a series of interest rate cuts aimed at protecting Latin America's largest economy from the effects of a global slowdown.

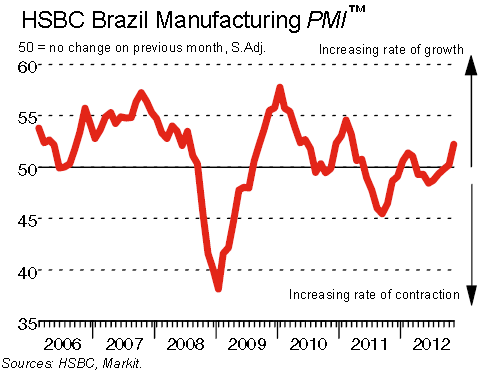

The November indicators also register improvements in Brazil's growth. The HSBC manufacturing PMI is showing Brazilian output beginning to grow again.

Andre Loes, Chief Economist, HSBC Brazil (via Markit): “The November HSBC Manufacturing PMI results reinforce our view that the cyclical rebound expected for the end of 2012 is finally materializing. The headline PMI jumped from 50.2 in October to 52.2, indicating that the manufacturing sector is expanding at the fastest pace since Q1 2011, with solid increases in both output and new orders. Firms also reported positive growth in stocks of finished goods for the first time in 15 months, indicating a more supportive stage in the inventory cycle.”

One significant factor helping Brazil has been its currency weakness. The dramatic decline in the Brazilian real over the past year makes Brazilian products more attractive, particularly versus natural resource competitors such Australia, whose currency has been relatively strong (see discussion). Whether intentional or not, devaluation helps in certain cases. Of course Brazil may be facing inflationary pressures as a result, but that's a topic for another day.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Brazil's Economy On The Mend

Published 12/05/2012, 03:51 AM

Updated 07/09/2023, 06:31 AM

Brazil's Economy On The Mend

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.