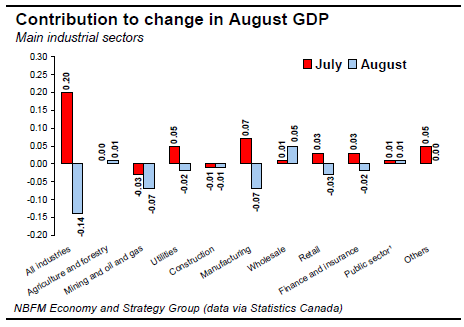

– In August, real GDP shrank 0.1%. Weakness was relatively broad based with only eight of the 19 sectors showing gains–the worst such ratio since the last recession. Goods production fell sharply (-0.5%) after increasing 0.2% the month before. Among the goodsproducing sectors, utilities (-0.8%), mining and oil and gas extraction (-0.7%) and manufacturing (-0.6%) were the worst performers.

Temporary shutdowns contributed to the weakness in mining. Agriculture (+0.7%) provided some offset. Industrial production contracted 0.7% after swelling 0.3% the previous month. Durable goods manufacturing decreased (-1.3%) while production of nondurable goods (+0.3%) rose in the month. Among the service-producing sectors, wholesale trade (+1.0%) was the top performer while retail trade lagged behind (-0.5%). Overall, the service sector was flat in the month.

Based on the first two months of data, GDP growth is tracking at an annualized 0.6% in 2012Q3. September’s reading needs to be strong if GDP is to top the BoC’s October MPR projection of 1.0% for the quarter.

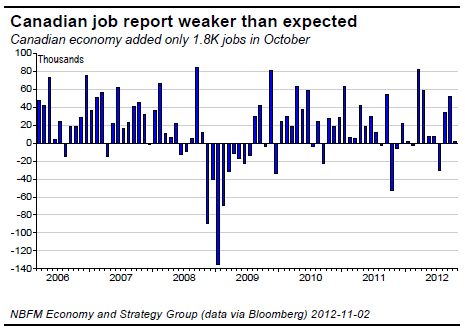

The Canadian job report was weaker than expected in October with a gain of only 1.8K. This comes on the heels of a 52.1K surge the previous month. Full-time jobs were up 7.3K while part-time jobs decreased 5.5K. Employment in the goods-producing sector was down 19.3K following a large gain in September (34.5K). Within this sector, construction was the top performer (+3.5K) while agriculture brought up the rear (-12.7K).

The service producing sector posted a gain of 21.0K after advancing 17.6K the month before. In this sector, educational services (+16.2K) were the top performer while accommodation and food services (-17.1K) were the worst. Five provinces saw employment progress. Quebec recorded the largest gain (+20.1K) while British Columbia (-10.9K) and Ontario (-9.9K) were at the back of the pack. The national unemployment rate remained unchanged at 7.4%.

Private-sector employment registered a fourth decline in six months (-21k). Looking forward, with TSX-listed corporate earnings down 30% so far in Q3, we do not expect a hiring spree in the private sector anytime soon. Instead, labour market conditions are likely to remain difficult in the coming months.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Canada: Real GDP Shrank 0.1% In August

Published 11/06/2012, 07:18 AM

Updated 05/14/2017, 06:45 AM

Canada: Real GDP Shrank 0.1% In August

Canada

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.