The Fukushima Daiichi catastrophe brought the inherent safety concerns of current nuclear technology to the forefront of the world's attention. And with the focus on Japan's energy system, questions were again asked about the long-term friendliness of nuclear fuels to mankind. Storage of spent fuel has become a lightning rod for environmental groups and nuclear proponents alike. It is unlikely that the nuclear industry can survive using technology in place since man discovered its power.

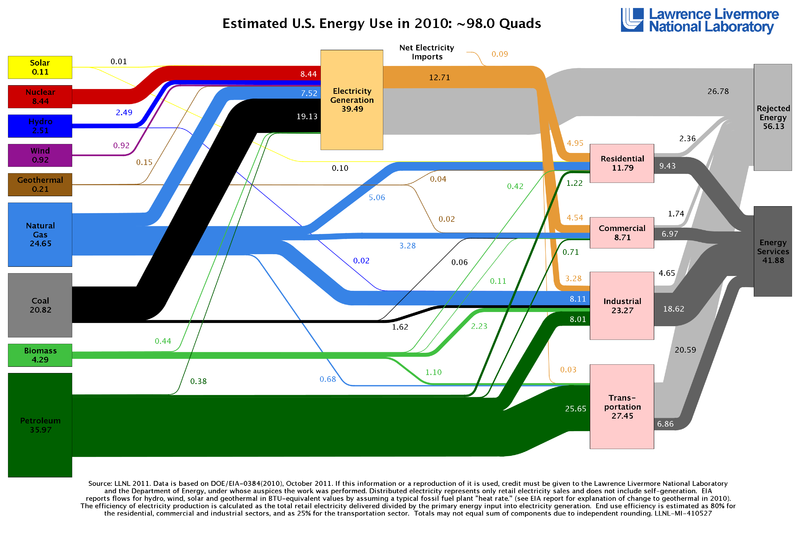

People are demanding safer, cleaner energy sources to power their homes and businesses into the future. Solar and wind power, while attractive to environmentalists, are not cost-effective and scalable beyond small localized installations. Constructing transmission lines is so expensive as to limit the expansion of a national power grid based upon these renewable resource options.

Fossil fuels are constantly debated as a source of local pollution and global warming, though at this point in time much of the global warming debate has 'cooled' based upon further analysis of the data. Fossil fuels are also getting harder and more expensive to find in sufficient quantities to meet the growing demands of the planet. While the debate over peak oil, gas, and coal rages on, the simple fact is that regardless if we will run out anytime soon, the costs of extracting and transporting these fuels is going up (natural gas supply in the US being a rare exception).

Nuclear is the densest energy option abundantly available to supplement or replace fossil fuels. That is why nuclear is making a comeback in a new generation of technology that is safer and cleaner. The industry is eagerly meeting the call to develop alternatives, and one option in particular may be an effective long-term solution to the current limitations of nuclear fuel.

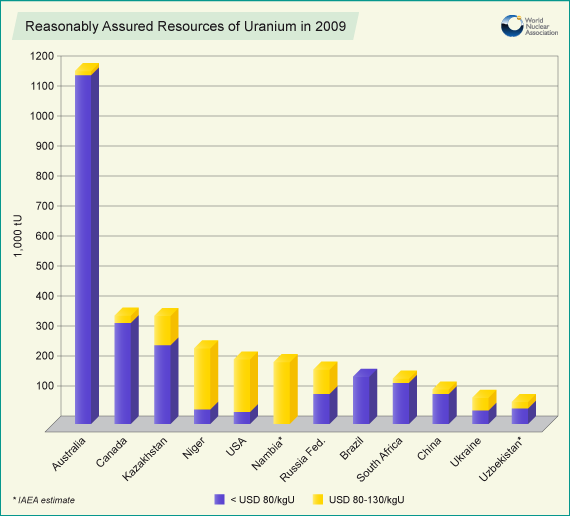

How do you get cleaner and safer nuclear energy? You turn to Thorium, a naturally occurring material in great abundance. Thorium was discovered in the 1800s and its use as a fuel was first confirmed at Oak Ridge National Laboratory (ORNL) in the 1960s. ORNL, located in Tennessee, produced a working design for several years running on thorium in a molten salt reactor. Thorium has also been used in various current reactor designs as a co-fuel with uranium. Thorium burns cleaner and produces less waste than uranium does and we have much, much more of it. Thorium is 3x more abundant than uranium and is reactor ready straight out of the ground, which makes it several hundred times more abundant than pre-processed, fuel-ready uranium.

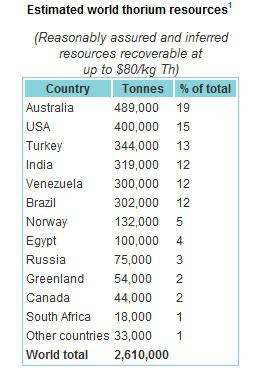

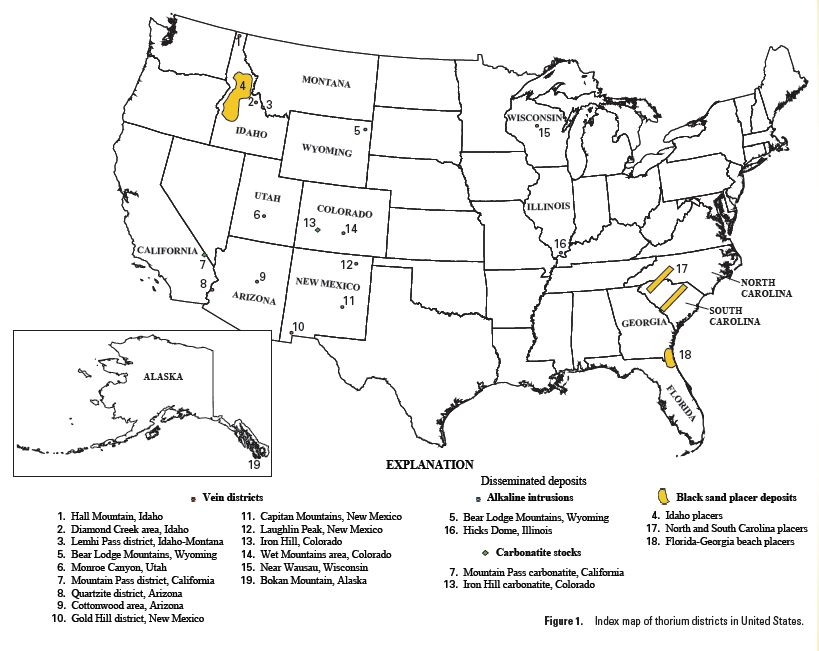

According to the world nuclear association, economically viable thorium is in great supply. The USA has a large deposit in Lehmi Pass in Montana and Idaho, and several other countries have large sources. In fact, thorium is present in just about every continent. Accessibility makes it attractive as a global solution to the world's energy problems.

Thorium in Current Reactor Technology

Thorium is known to work together with uranium in 90% of the world's existing PHWR (pressurized heavy water reactors) with no large increase in fuel or infrastructure costs. Thorium power requires seed fuel to get the reaction going, and as such, thorium-based reactors are seen as a positive way to reduce existing troublesome spent nuclear fuel deposits various countries are grappling with.

China started a molten salt reactor project in 2011, and Australia and the Czech Republic are JV on a project for a molten salt reactor fueled on thorium. Canada and China, in the meantime, have finished research on the inclusion of thorium into existing CANDU reactors in service today. The CANDU reactors are thought to have the shortest path to production of any existing nuclear reactor capable using thorium as fuel. The China Academy of Science Annual Budget is $3 Billion per year and rising for the molten salt reactor and other nuclear projects using thorium.

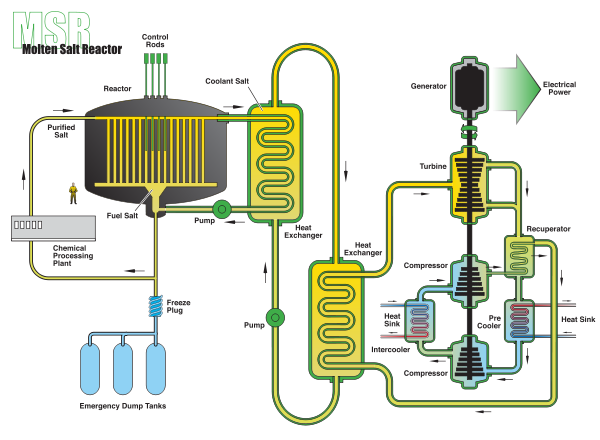

A molten salt reactor diagram

The Lightbridge company, together with the Kurchatov Institute in Russia and the Brookheaven National Lab in the US are developing a thorium-based LWR (light water reactor) and have been working on the design since 1996. The reactor design is a Generation IV, gas-cooled fast reactor using accelerator systems.

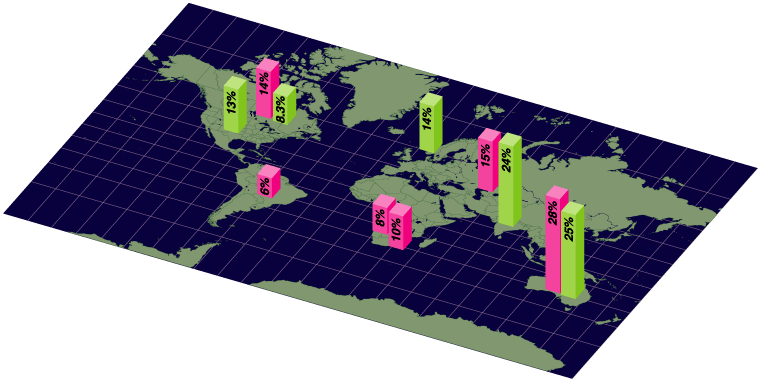

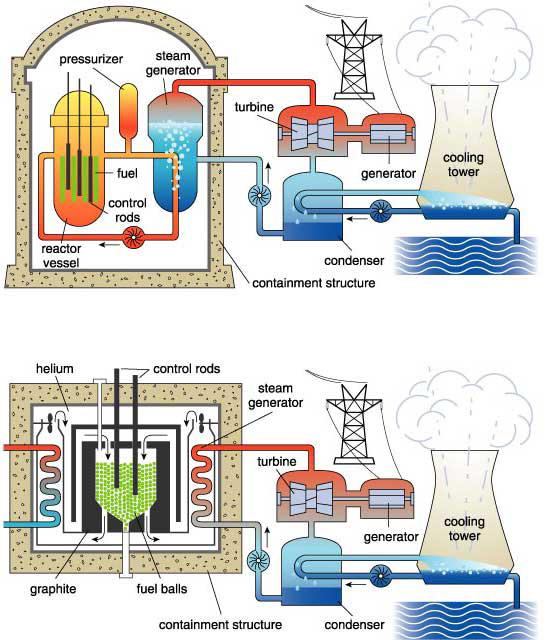

Current nuclear reactor designs used in majority of installations

India has reached the final stage of a 3-phase study using thorium as a long-term nuclear program using an Advanced Heavy Water Reactor (AHWR). India intends to use Plutonium 239 as the seed fuel and sees thorium as a long-term primary source of energy.

Japanese company Thorium Tech Solution, Inc. was established in 2010 to produce Fuji and Mini Fuji Thorium Molten Salt Reactors. A demonstration plant has already been planned. AMR has signed on with Thorium Tech Solution, Inc. to represent Fuji Thorium reactors including building a reactor in Turkey.

The Laboratoire de Physique Subatomique et de Cosmologie in France is building models of a molten salt reactor based upon Weinberg's designs to see if they can make them efficiently.

The race is on to develop the best new thorium reactor solution. However, the best design, with the ability to use nearly 100% of thorium in a very simple, safe, and scalable factor, has sprung from the original molten salt reactor used at Oak Ridge.

Liquid Fluoride Thorium Reactor (LFTR)

The purpose of the ORNL experiment with thorium was based upon a military program for developing a nuclear jet. While the research did not produce a viable nuclear fighter, it did discover a very simple and effective method of controlling the chain reaction of thorium/uranium fuel mixture in a custom version of the molten salt format. Think of the ability to quickly control the chain reaction and thereby the speed of the jet.

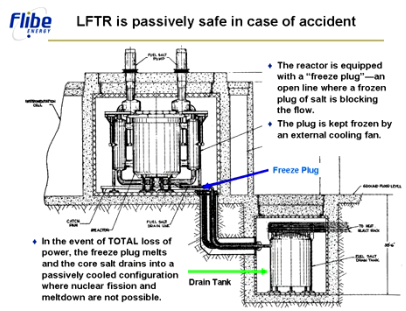

In essence, a fluoride-based liquid salt molten fuel containing the thorium/uranium mixture is self-regulating. When the fuel gets too hot, the reaction automatically slows and vice versa. So instead of engineers designing a system to combat pressure wanting to spew radioactive materials into the surrounding environment at the same time as maximizing power production, they are learning to harness the reaction organically. The LFTR design includes a frozen plug at the bottom of the reactor which melts automatically when power is lost, causing the fuel to run into a drain tank underground where it will safely reside until pumped out. And without power, the chain reaction with thorium simply stops.

In addition, the LFTR design promises to use 99% of thorium's power and leave very little waste in the end, compared with a much lower use rate in uranium fuels. The uranium start fuel is also burned up and can be supplied by existing spent nuclear fuels already in storage, thereby relieving the issue of storing radioactive elements for thousands of years. Indeed, the US has a strategic reserve of 3200 tons of thorium that would meet almost all of the world's energy requirements for an entire year! The reserve is stored in metal containers set aside (not inside) a mountain and has been there for years.

LFTR mock diagram

One of the greatest benefits of the LFTR design is scalability. A megawatt design could be shipped on a truck and requires no site-built containment dome or cooling systems. LFTR can be cooled passively and constructed on site in varying sizes. Californians have an energy crisis? Just ship a few of the smaller reactors and setup where necessary, not a problem! LFTR would become both affordable and available to much of the world's population where other energy solutions are not.

Weapons Proliferation and Byproducts

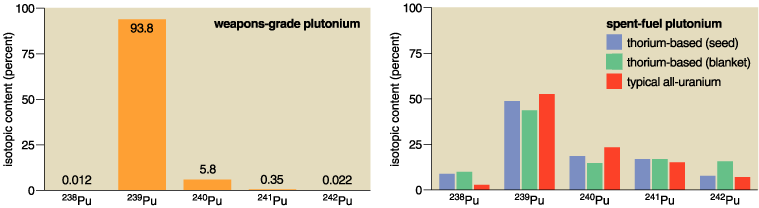

The US has known about thorium for a long time. We chose to use uranium because of the ability to weaponize the material. Thorium is much more difficult to weaponize than uranium, and indeed thorium reactors would be much less of a target for terrorists.

With the Atomic Energy Commission and President Nixon giving full support, the US opted for a uranium-based fast breeder nuclear reactor design and the thorium-based molten salt reactor at ORNL was de-funded. Alvin Weinberg, the founder of molten salt reactor technology, was fired from his job.

In addition to all of this great news, the byproducts of a LFTR based reactor design may be largely beneficial in other applications. Kirk Sorensen, former NASA engineer and founder of Flibe Energy, has almost single-handedly revived the work of Alvin Weinberg and molten salt reactors in the US. According to Sorensen, almost all of the byproducts of LFTR reactors fueled by thorium are useful in other industries.

For example, where nuclear reactors are cooled by seawater, steam from the coolant can be used as fresh water having the salt taken out of it. Secondly, iodine-131 and thorium 229 are used as in cancer treatments. Plutonium-238, very hard to form naturally, is produced in modest amounts and is one of the principal components of propulsion in NASA spacecraft. The stable form of xenon, produced after a short decay cycle, is also used in NASA fuels. Neodymium, rhodium, ruthenium, and palladium are all very valuable metals used in wide ranging industrial applications, including high strength magnets and catalysts (auto industry).

The LFTR's efficient and effective design lend it to a more natural and sustainable form of abundant, accessible, and portable energy for the world. As such, LFTR is destined to become the poster child for the green energy movement.

Challengers

There are a few challengers to thorium LFTR based nuclear facilities. Almost all current nuclear designs use uranium. While they can be modified to use a thorium/uranium mixture, however, they are far from being 99% efficient like LFTR. In addition, they put off more harmful byproducts that have to be dealt with. And perhaps the most important part is they are not scalable, and therefore may not serve the energy needs of all communities.

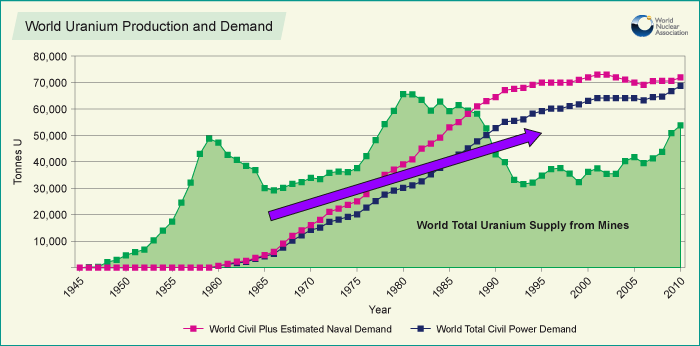

Uranium is also in such wide demand now that demand exceeds supply. The destruction of nuclear weapons bridged that gap for a time, but in 2013 the dynamics will shift into negative territory. While this is bullish for uranium producers, it is not for energy consumption! Therefore, an alternative must be developed and quickly.

This is why designs to merge uranium and thorium in existing reactors WILL initially receive the bulk of funding and attention. We are simply at a crossroads in energy where all known sources are in supply deficit by the middle to end of this decade, with the possible exception of natural gas in North America.

However, due to the safety, storage, efficiency, and scalability limitations of current generation nuclear design, options such as LFTR should take center stage in the longer timeline of the coming nuclear age. And the benefits of investing in such technology will be explosive. LFTR using thorium may herald the next great energy age and lift up the lifestyles of the world with it.

Legislation

The US has enacted several pieces of legislation that focus on thorium as an important strategic energy supply. Senate Bill S.3680 was proposed to amend the Atomic Energy Act of 1954 to provide for thorium in nuclear energy development. Congressional Bill HR1534 directs the Secretary of Defense and the Chairman of the Joint Chiefs of Staff to study thorium in nuclear reactors and for other purposes. House Bill HR2015 instructs the Secretary of Energy to study thorium fueled nuclear reactors and to determine where the US compares to the world in development of this technology.

Investments

There is good news and bad news with regards to investment in thorium. While no short term, direct thorium miners exist, there are several short- and long-term indirect thorium investment options.

Immediate-Term Investments

Another way to take advantage of thorium energy is to invest in nuclear plant production companies such as Westinghouse, AREVA (AREVA.PA) and General Electric (GE). These investments will specifically target the medium term boom in thorium/uranium co-fuel reactor designs and may eventually spill over into LFTR technologies. With worldwide demand in nuclear energy going nuclear, plant manufacturers look to profit from increased sales.

Westinghouse: Westinghouse is a division of the Toshiba Group (TOSBF.PK), which makes nuclear plants and products. Westinghouse has submitted an application for funding from the Department of Energy for a pressurized water reactor (PWR). In addition, the Nuclear Regulatory Commission has granted design certification for the Westinghouse AP1000 PWR nuclear reactor.

Areva (ARVCF.PK) French conglomerate and world's largest nuclear plant builder installs both EPR (European pressure reactor) and BWR (boiling water reactor) that are considered older generation technology. It is partnering with Mistubishi to design and build a new generation reactor capable of 1MWe called Atmea. Areva also operates in the solar, wind, and biomass power sectors. And it mines uranium, although unprofitably. Predictably, fuel sales are down this year due to Fukushima, but renewables are up 198% in Q1 of this year.

General Electric (GE): GE's design was used in the Fukushima reactors. The shares got pounded, but they are back up. GE produces boiling reactors and next generation liquid sodium cooled reactors. Its price to book is not too high and it is still immensely profitable, but it has a lot of long-term debt to service as well.

Medium-Term Investments

Thorium and rare earth elements exist together mostly in monazite and placer deposits. It is difficult to get thorium directly, but the benefits of mining both are that both elements are in increasing demand profiles. Once demand for thorium takes hold, any rare earth miner will benefit from increased profits by not only reducing disposal costs of thorium, but in selling it as a valuable world commodity. Some interesting rare earth companies include:

MolyCorp (MCP) owns the largest rare earth deposit outside of China. It may also be the most written about rare earth company on the planet. I'll keep it short and just say this: the company just spent a ridiculous amount in CAPEX to get the mine finished, it's share price is very reasonable compared to book value right now, and recent acquisitions are designed to vertically integrate the company from miner to end producer. Very few rare earth companies outside of China have this capability, and it is a distinct advantage for Molycorp. But it paid a price in financial leverage to get there.

Great Western (GWMGF.PK) is another vertically integrated rare earth company. With its subsidiaries - LCM (Less Common Metals) and Great Western Technologies - Great Western can mine it and process it for the market. This will increase margins for the company over other rare earth mining-only companies.

Rare Earth Elements (REE) is perhaps my favorite rare earth stock because it also owns a significant deposit of gold. When you look at three elements the world is sure to need in the very near future, gold, rare earths, and thorium all sit at the top of this list. This is a triple play stock, where once you could say gold would finance and reduce the cost of mining rare earths, now you can say thorium will pay for the mining of both rare earths and gold in the future. What a deal, what a deal! Automotive companies, large users of rare earth metals, are engineering out rare earths due to a recent spike in price. However, I see this is a short-term phenomenon, as the alternative engine designs are less efficient and heavier, which will lead to increased fuel use. The normal supply and demand dynamics of rare earths will lead to a stable price that both miners and manufacturers can agree on, while rare earths continue to be used in advanced technology in many industries.

Longer-Term Investments

Lightbridge (LTBR) was formed in 1992 by Dr. Alvin Radkowsky, one of the founding fathers of the nuclear industry. LTBR doesn't build nuclear plants, but it does build critical components that may be used in rod-design nuclear plants. Its metallic fuel rod design is supposed to increase power output by 10-17% for existing builds, and up to 30% on new plant builds. The rod is solid, instead of hollow, which increases safety and reduces the likelihood of radioactive elements being transmitted outside containment. The company will charge license fees of 5-10% and expects to be in commercial production in 2020. Its share price has recently fallen since the Japanese disaster, but there is no reason to suspect it will not rise again with the continued insistence of the world on cheap energy that can only be supplied in the form of nuclear power.

US Rare Earths (UREE) holds the rights to the largest deposit of rare earths and thorium in the US. The USGS has confirmed this deposit to be the largest in the US and that it contains critical heavy rare earth elements. In addition to Lehmi Pass, it hold a large deposit of REE and thorium in Colorado. Because of the strategic impact of these deposits, investors should expect UREE to become a major player in both the rare earth and thorium fields for a long time.

Flibe Energy was formed by Kirk Sorensen to market and develop the LFTR molten salt reactor. The company is currently private and investors cannot purchase shares. However, it is very likely that as the company nears a production ready design, financing in the form of share issuance will be needed. Sorensen is on record as saying that due to existing technology and the simple design of LFTR, a concerted effort could lead to a testable design in 18 months, but more likely based upon market support, LFTR will be ready in a few years.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Capitalizing on the Energy Scarcity Myth

Published 07/03/2012, 11:42 PM

Updated 07/09/2023, 06:31 AM

Capitalizing on the Energy Scarcity Myth

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.