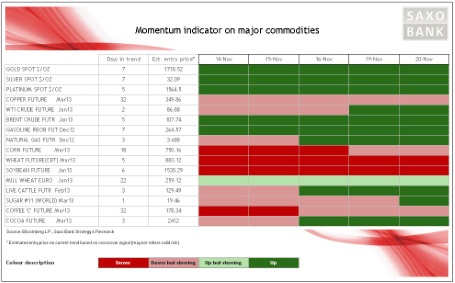

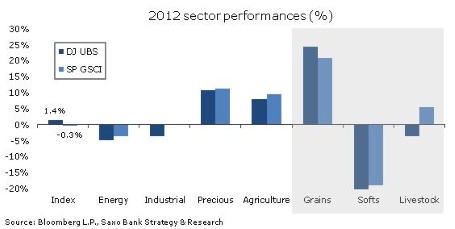

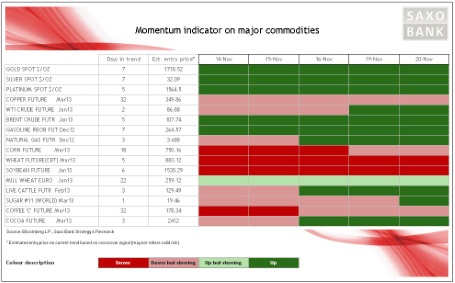

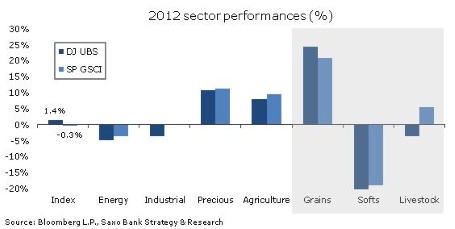

Several new commodities are starting to join the positive momentum which has been building over the last week. Yesterday it was sugar which saw momentum catch up with last Monday's price spike and copper could be turning positive today. The grains sector, which up until now has seen the strongest 2012 performance (see below), continues to suffer from elevated long liquidation. Soybeans, for example, have corrected almost 23 percent from the August peak and there are now signs of some bottom fishing emerging.

These momentum changes over the last week raise the question whether we, despite several obstacles, have an end-of-year rally coming our way. If historic data from the last ten years on the major indices are anything to go by - it does not look that promising. The DJ-UBS index has returned an average of -0.6 during November with only two out of ten Novembers showing a profitable return, the last being 2009. December looks more promising with five out of the last nine years being profitable resulting in an average return of 1 percent. The energy heavy S&P GSCI returned an average of -0.3 percent during November and -0.1 during December so not that convincing either.

On historical data it therefore looks like investors should keep their powder dry and wait for the new year as January and February historically for both indices have shown better returns.

These momentum changes over the last week raise the question whether we, despite several obstacles, have an end-of-year rally coming our way. If historic data from the last ten years on the major indices are anything to go by - it does not look that promising. The DJ-UBS index has returned an average of -0.6 during November with only two out of ten Novembers showing a profitable return, the last being 2009. December looks more promising with five out of the last nine years being profitable resulting in an average return of 1 percent. The energy heavy S&P GSCI returned an average of -0.3 percent during November and -0.1 during December so not that convincing either.

On historical data it therefore looks like investors should keep their powder dry and wait for the new year as January and February historically for both indices have shown better returns.