Crude oil and copper are telling very different stories right now.

Crude oil is basically drifting sideways, in a manner that does not suggest great confidence in the forward movement of the global economy. If expectations for a global recovery -- not to mention further U.S. dollar decline -- were genuine, then crude oil should be maintaining its uptrend, instead of stalling below $100 a barrel.

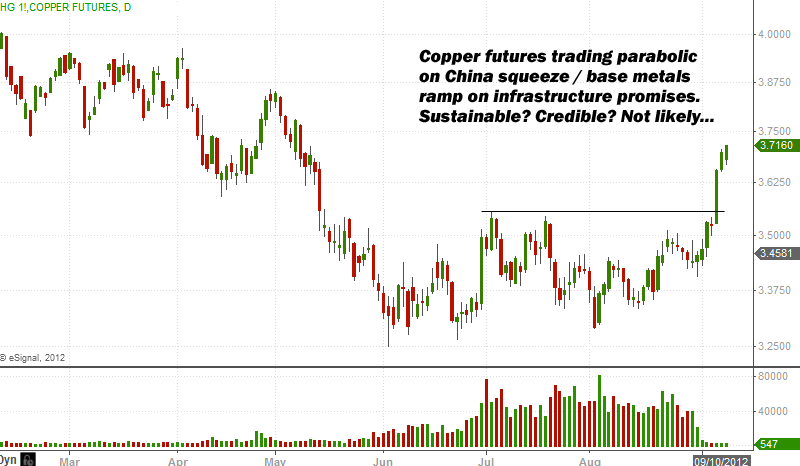

Copper, in contrast, has gone nearly parabolic in recent days. The “metal with a PhD in economics” is trading like it was shot out of a cannon.

We see two possible reasons for this:

Possibility number one: The global recovery is actually underway… China is bouncing back… and crude oil traders are simply slow to get the message, while copper is telegraphing the new bullish trend.

Possibility number two: Copper is a tiny and easily manipulated market in comparison to the much larger crude oil market. Copper is also ground zero for epic levels of ponzi-finance base metals shenanigans used for speculation purposes within the opaque Chinese economy. Copper is thus ripping higher on a vicious short squeeze, less related to fundamentals than a massive stop hunt as China seeks to aggressively prop up its rapidly imploding economic miracle, in a desperate attempt to avoid hard landing.

Guess which one is more likely?

The data flow out of China has continued to impress -- not by how strong or resilient it is, but how horrible it is. Some recent examples:

Not to put too fine a point on it, markets continue to trade on a hope-and-bullshit cocktail in which real world factors, like positioning and bullying capability, matter more than how the macroeconomics are “supposed” to work.

As of now we continue to see the continued near-absolute dominance of hope-inducing central bank factors, with governments manipulating price signals and pushing valuations like drunken whales at the poker table.

Can't Last

Paradoxically, though, copper’s price action also indicates (to us at least) why this kind of thing cannot last. Parabolic moves are not healthy and rarely end well. They are more often an indicator of frenzy and underlying gamesmanship than constructive fundamental change.

Gold and silver are moving in concert with copper. But again we have to ask, do these moves make sense? Are there real, sustainable drivers behind this vertical rocket shot? Or does such amount to a combination of massive short covering and myopic “this time we get inflation” positioning that does not take into account the reality of global slowdown?

As September gets underway we grow increasingly excited by two things: The return of volatility and the ability to put distorting central bank influences in the rearview mirror, at least temporarily.

Short-Term Conviction

Our highest conviction position, short AUDUSD, has been closed for a modest profit -- much more modest than we would have liked -- as central bank games once again abort a developing trend. We have little doubt that, eventually, the Aussie is going to trade much, much lower, for reasons previously stated. But for now the gamesmanship continues, as our short-term conviction levels rapidly recede back toward zero.

What does Ben Bernanke want? What does Beijing want? What do all the central banks want?

They want a fantasy world, with prices that please them, and they will move mountains to bring about that result. Of course, because they are fighting economic reality, such efforts eventually lead to disaster and dislocation on a massive scale.

Watch The Major Trend

But in the meantime, as they do their thing -- and before their efforts fail -- discretion is the better part of valor. This, too, is copper’s message. If you were short copper on a long-term view of inevitable Chinese hard landing, then risk management served you in good stead. If you were short with no controls, then you got burned (perhaps badly) by the powers that be.

This, in part, is what trading (especially macro-themed trading) is all about… positioning for major trends whose power is paradoxically enabled by government forces fighting the tides… the balance is in being there when the dam finally breaks, adding size as it does, while keeping risk tightly reined in before then.