We told you last week of our belief that Mario Draghi, the ECB President, could hole Europe’s feet closer to the fire by refusing to cut interest rates in Europe. All things considered, we did however think that the rest of the council would overrule and a cut would be forthcoming. It seems like Draghi got his way in the end (although the vote was by consensus and therefore not unanimous), with the tone of the press conference not antagonistic but certainly assertive as to where further decisions need to be made; and it wasn’t the ECB.

Draghi told the assembled journalists that “some euro problems have nothing to do with ECB policy” and EURUSD and other risky assets saw that as confirmation that no extraordinary measures would be forthcoming from the ECB today. They were right, although the major price action was seen as a result of Draghi’s insistence that the ECB is watching the data closely and stands ready to act.

Risk rallied hard after that statement from the President as investors continue to believe that some form of stimulus is only just round the corner. I don’t think there is anyone out there who believes European economic data is going to get better anytime soon and so, ceteris paribus, we should see some stimulus from the ECB. Further impetus is also expected from the Federal Reserve when they meet later in the month and this will also be helping the general risk-on flows.

As a result, we have seen sterling slink into the 1.22s versus the euro and GBPUSD ease away from over the 1.55 mark. The market is looking for a lower pound today for 2 reasons.

Firstly, the Bank of England meeting is going on today with the decision due at Midday. There will have to be further quantitative easing in the UK economy but we believe that it will not happen this month. Data from the UK has continued to deteriorate between the previous meeting and the time of writing and so has the state of the global economy. The Bank of England has previously taken a pro-active stance in an attempt to try and protect the UK and were we to have a vote we would cast it for an additional £50bn of asset purchases at this meeting.

Risks to this forecast are numerous however. The Bank will not want to look like it has been “told-off” by the IMF and is reacting to their calls for further easing whilst some members have said that the previous injection simply hasn’t had time to work its way through into the economy yet. Inflation has dipped in recent months, thanks to oil prices and sterling’s rally, but still remains a risk. On the balance of things we therefore expect the Bank to hold interest rates at 0.5%, and also hold asset purchases at £325bn.

Secondly, and we think more importantly, is the latest news from the UK’s services sector due at 09.30. Manufacturing reported a real horror of a number last week, falling to its lowest level in PMI terms since May 2009, but yesterday’s construction number remained resiliently growing although this has not been mirrored in the official numbers. We think that the services number mirrors the manufacturing data and while staying positive will shrink back from the 52.4 level that is expected.

If that wasn’t enough fun for you we have a Spanish bond auction just after 09.30 as well, which is obviously going to be on everyone’s minds when given the fact that Spain, and its banking system, is the new pressure point in the Eurozone.

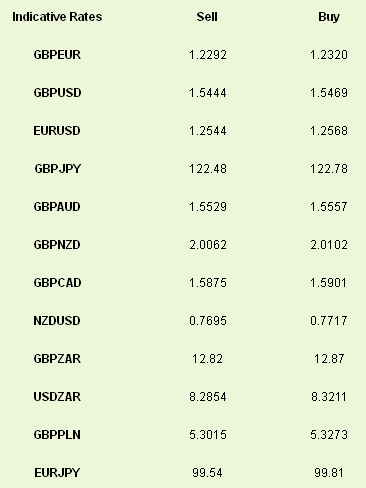

Latest exchange rates at time of writing

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Draghi Insists European Responsibility Lies With Politicians

Published 06/07/2012, 07:26 AM

Updated 07/09/2023, 06:31 AM

Draghi Insists European Responsibility Lies With Politicians

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.