EpiCept’s (EPCT) search for a strategic transaction has resulted in a planned reverse-merger with Immune Pharmaceuticals, a private, Israel-based biopharma company focused on antibodies for inflammatory disease and cancer. The resulting company – to be called Immune Pharmaceuticals Inc – will have bertilimumab, which is ready to enter Phase II trials for ulcerative colitis, as its lead product, together with three other clinical-stage programmes. EpiCept shareholders will end up with 22.5% of the new entity. EpiCept believes the deal offers its shareholders the best option to participate in economic value created by a potential future development/commercial partnership for AmiKet, its topical product for chemotherapy-induced peripheral neuropathy.

Merger to form Immune Pharmaceuticals Inc

The proposed transaction would effectively reverse-merge Epicept and Immune Pharmaceuticals. EpiCept will issue ordinary shares to acquire all of Immune’s outstanding shares, which would leave EpiCept’s shareholders with approximately 22.5% ownership of the resulting company (fully diluted). Registration statements have not yet been filed, so the exact financial terms are not known. However, the transaction will likely require in excess of 300m new shares to be issued. The deal is expected to close during Q113, following shareholder approval.

Immune develops next-generation antibodies

Immune is a privately held Israeli biopharmaceutical company focused on the development of antibody therapeutics for treating inflammatory diseases and cancer. Its lead product, bertilimumab (previously CAT-213), is licensed for non-ophthalmic indications from the Canadian biotech iCo Therapeutics (and originated at Cambridge Antibody Technology in the UK). Immune also has a technology, NanomAbs, for generating antibody drug conjugates, in preclinical studies.

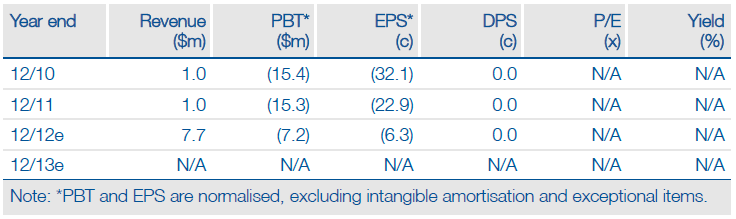

Financials: Funded to Q113

EpiCept ended Q3 with $1.1m in cash and $1.1m in restricted cash. A pro forma cash figure for the new company is not yet known. However, it is likely that the new company would have to raise additional funds in the short term.

Valuation: EV of $9m

EpiCept has an EV of $9m, based on its market cap of $7m, a senior secured loan of $4.1m and Q3 cash/restricted cash of $2.2m. Our previously published rNPV for EpiCept alone, which principally reflected AmiKet, was $29m.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EpiCept Corporation Merges With Immune Pharmaceuticals

Published 11/22/2012, 06:46 AM

Updated 07/09/2023, 06:31 AM

EpiCept Corporation Merges With Immune Pharmaceuticals

Deal to form Immune Pharma

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.