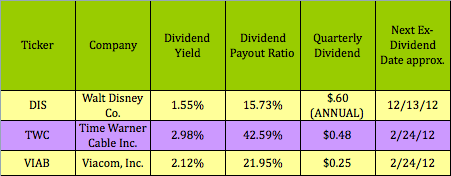

Whether its theme parks, movies, or TV – we all love to be entertained, and modern society rewards greatly those who entertain us. This week we’ve found 3 dividend stocks which profit handsomely from the endless demand for entertainment. These may be some of the best stocks to buy in 2012 for undervalued growth and income within the Entertainment Industry:

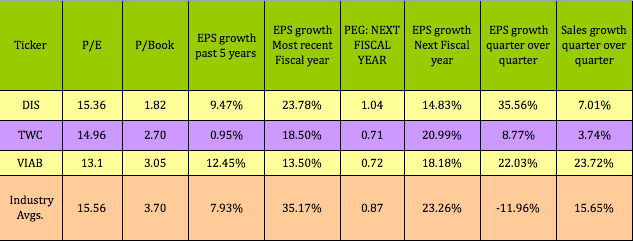

Valuations: Compiling meaningful Industry Avgs. is complicated for these companies – although they all operate within the Cable TV industry, Disney and Viacom also are active in the film industry.

Viacom and Time Warner Cable both look very undervalued on a Next Fiscal Year PEG basis, (P/E dividend by EPS Growth), while Disney is close to the 1.00 undervalued PEG threshold. TWC also looks undervalued on a cash basis – its Price/Free Cash/Share is only 3.15 vs. the 10.05 industry avg.

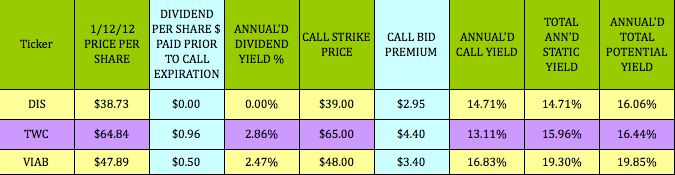

High Options Yields: These firms have modest to avg. dividend yields, but by using options, you can achieve much higher yields, as seen below.

Covered Calls: Disney’s next annual ex-dividend date isn’t until December, but you can create a much higher “virtual” dividend by selling covered call options, plus, you won’t have to wait until December to get paid – option sales are credited to your account within 3 days of trading, often the same day. However, unlike qualified dividends, which receive a 15% tax treatment, options are taxed as short term capital gains.

The TWC and VIAB call options now yield over 4 to 6 times the amount of their dividends over the 5-6 month period for these trades. (The call and put options listed for Disney and Time Warner expire in July, and those listed for Viacom expire in June.)

You can see additional info on over 30 high yield Covered Calls trades that we’ve discussed in recent articles in our Covered Calls Table.

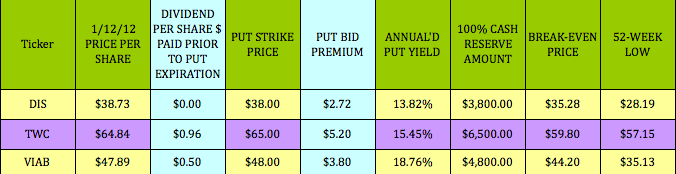

Cash Secured Puts: What can you do if you’d like to own a stock, but you feel that the stock’s price is too high? You can sell cash secured puts at or below the stock’s current price, get paid your put premium $ now, and have a lower break-even – essentially, you’ll get paid to wait.

If you want to be more conservative, you could sell put options at strike prices even further below a stock’s current price and get an even lower break-even. The catch is that the further “out of the money” you sell, the less put premium $ you’ll receive. The key with selling cash secured puts is to only sell puts on a stock that you’d like to own, so that, even if the stock gets assigned/put to you, you end up owning it at a price you’re comfortable with.

Some options skeptics argue that, if you just wait for a market pullback, you can end up owning the stock cheaper anyway. This may or may not happen, but meanwhile you wouldn’t receive any income by just waiting.

TWC’s puts have a break-even closest to its 52-week low. Similar to the call options, these put options pay 4 to 7 times the dividend payouts during this term:

(Note: You can find more info on over 30 high yield Cash Secured Puts trades in our Cash Secured Puts Table.)

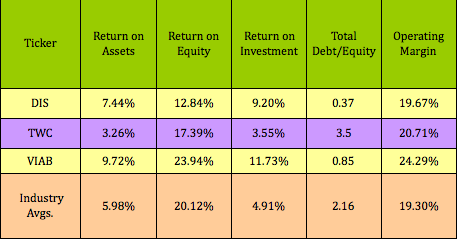

Financials: TWC’s Debt/Equity ratio of 3.5 is higher than the industry avg. of 2.16, but its 1.44 Current ratio is better than its industry peers’ 1.06. Viacom has the best ratios of this group:

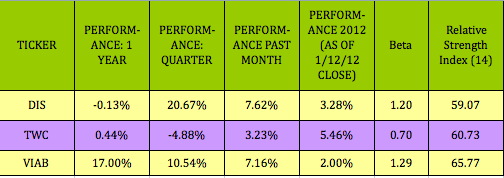

Performance: Although DIS and TWC are just about flat for the past 12 months, they’ve gathered momentum in the past month. VIAB h,as been the most loved of the group, having made impressive gains during the past year, quarter, and month, and continues to have its fans thus far in 2012:

Disclosure: Author owns no shares at time of publication, but has always been a fan of Jiminy Cricket.

Disclaimer: This article is written for informational purposes only and isn’t intended as investment advice.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Hollywood Dividend Stocks With High Yields And Growth

Published 01/16/2012, 03:31 AM

Updated 07/09/2023, 06:31 AM

Hollywood Dividend Stocks With High Yields And Growth

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.