Iran's leadership is now openly admitting that the nation is facing an economic crisis. Of course the cause according to them is a "temporary" form of economic "soft war" waged by the US.

FARS: "The economic crisis is, in fact, a war waged by the enemy against Iran after its failure in previous confrontations (against Iran)," Ayatollah Jannati said, addressing a large and fervent congregation of worshippers on Tehran University Campus on Friday.

He said that economic problems will not continue and are limited to a short period, and urged the Iranian nation to resist the West's economic pressure.

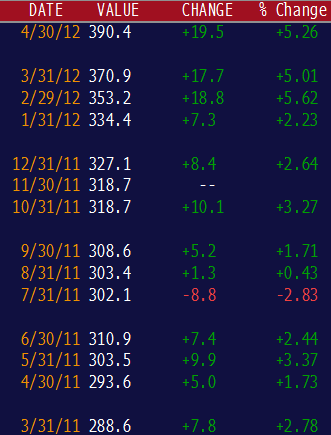

Iran's inflation is now out of control. Bloomberg no longer reports Iran's official inflation numbers, but the last reports through April of 2012 show some 24% CPI and runaway food inflation (running at over 5% a month). Keep in mind that this was before the North American drought that sent global agricultural commodities prices flying.

WSJ: - ... it is already apparent that sanctions have had a real effect on Iran's economic health. Statistics issued by Iran's central bank show inflation at 21%, but with the cost of staple goods rising by leaps and bounds, the actual experience of inflation is bound to be graver. The price of bread increased by 40% in the month of June alone, causing a nationwide outcry. The price of chicken and vegetables increased by 3.7% and 10% in a period of just two weeks last month. Iranian households now have to pay on average half of their monthly salaries just to keep food on the table.

Iran's central bank is now in a crisis mode.

AFP: - Iran's central bank has established a special cell to fight back against Western economic sanctions that the institution's chief described as "no less than military war," the official IRNA news agency reported on Tuesday.

"We have established a headquarters in the central bank, which meets on a daily basis" and whose task is "to manage the sanctions," central bank chief Mahmoud Bahmani was quoted as saying.

As the reserves of foreign currency dwindle, the central bank instituted currency controls for the citizens traveling abroad.

IRNA: - Governor of Central Bank of Iran Mahmoud Bahmani said on Wednesday travelers will no longer get foreign currency at official rate except for those going to pilgrimage.

Bahmani told reporters at the end of the Majlis formal session that the decision was made in the joint meeting of the government and Majlis economic teams.

The abundance of "hard currency" generated from oil and petrochemicals exports in the past had made Iran highly dependent on imports from abroad - from tools and agricultural products to gasoline.

NYTimes: - Western sanctions have hurt, economists say, particularly in denying Iran access to foreign currency reserves, which it had used to prop up the rial. Yet economists also agree that much of the damage to the economy has been self-inflicted, saying that the Ahmadinejad government went on an import spending spree after oil revenues started hitting record levels from 2005 on.

With the government buying so many goods from abroad, many domestic producers were forced to lay off workers and close factories. That, in turn, has made Iran more vulnerable to international sanctions, they say. Companies that might have helped produce goods to replace those blocked by sanctions have long since gone out of business, as the owners shifted their wealth to speculation, building and selling properties, foreign currency or raw materials.

Iran will use this opportunity to blame the West and the sanctions for all the economic problems. What's particularly troubling however is that the sanctions are not the only cause of Iran's crisis. Between years of mismanagement and the global spike in food prices it was only a matter of time.

NYTimes: - Many economists, though, say that even without the sanctions, Iran would still have big problems: a legacy of inflationary oil spending and budget-busting state subsidies of food, gasoline and other basic items that encouraged overconsumption and the steady erosion of the country’s industrial base.

“Many fundaments of the economy of our country have been destroyed over the past years,” said Mr. Raghfar, the economist. “And now, slowly but surely, the chickens have come home to roost.”

As the economic crisis escalates, Iran faces increased likelihood of civil unrest and power struggles within the government. The authorities are already preparing an army of trained volunteer thugs to take on protests, all of which would be dealt with and portrayed as an act of foreign aggression.

FARS: - Addressing a large gathering of Basij forces here in Tehran on Thursday evening, Jafari pointed to a new formation within the Basij forces known as Salehin Circles, and stated, "One of the main strategies for confronting the soft war of the enemy in cultural, political and social fields is the formation of Basij's Salehin circles."

He added that members of Salehins are taught properly how to confront enemies' cultural, political and social aggression against Iran.

The possibility of a fully destabilized Iran is becoming quite real.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Iran's Economic Crisis Escalates

Published 08/05/2012, 02:47 AM

Updated 07/09/2023, 06:31 AM

Iran's Economic Crisis Escalates

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.