Priceline (PCLN), is one of a few online travel companies that provide hotel-reservation services, retail-airline tickets and rental-car reservations on a worldwide basis. It also offers vacation packages and optional travel insurance packages as well as its Name-Your-Own-Price demand-collection system. Priceline's stock has recently taken a tumble but is still up 37.8% YTD. Despite the pullback, it continues to be a good investment and is still the strongest player in the travel industry.

Positives

Priceline uses a unique business model known as a reverse-auction system. Not only did Priceline pioneer this model, it also patented it. The model enables Priceline to distinguish itself from its competitors by allowing consumers to purchase travel services at discounted prices through the name-your-own-rice system, which has been offered in Priceline's travel, automotive and personal finance categories. Moreover, the patents ensure that Priceline's success with the system can't be replicated (at least for now) by its competitors.

Due in large part to its innovative name-your-own-price system, Priceline has been extremely appealing to value-conscious consumers who are attracted to their ability to negotiate prices. This appeal has turned Priceline into a haven for travelers and has largely shielded its earnings from the effects of the recession.

Aggressive International Push

Another significant positive for Priceline is that it has been aggressively expanding its international presence -- international bookings currently account for 78% of its total business. Moreover, there is huge opportunity for Priceline in the international online travel-booking business, which is still nascent and relatively untapped. Thus, Priceline has been aggressively pushing into Europe and the emerging markets. As Piper Jaffray‘s Michael Olson notes, "We performed a hotel search query in 34 emerging markets and found Priceline’s paid ads were in 97% of the results vs. 62% for Expedia ads." International bookings currently account for only 39% of Expedia's total bookings.

Priceline is significantly gaining share in the European hotel bookings market through its Booking.com site and its Agoda.com site is gaining market share in the Asian travel market. Recently, one of Priceline's subsidiaries, Egencia, announced the acquisition of VIA Travel, the largest travel management company in the Nordics. Moreover, Priceline is also reportedly bidding for the U.K travel site thetrainline.com, an online ticket agent that has approximately 12 million users in the UK. Priceline's international strategy is much more aggressive than its competitors, which should serve it well in the future.

Healthy Revenue Growth

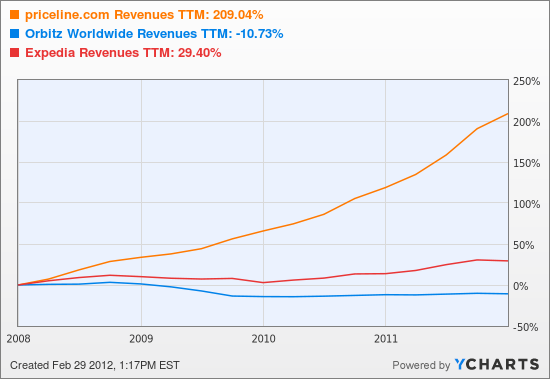

Finally, Priceline has been destroying its competition in terms of generating revenue. As YCharts notes, Priceline has increased its revenues by more than 209% from 2008 to February of 2012, compared to 29.4% for Expedia and -10.73% for Orbitz ).

Priceline also trumps its main competitors in other areas of growth. It has a three-Year sales growth rate of 35%, compared with 7% for Expedia and -1% for Orbitz. Moreover, the average EPS growth of Priceline's last three quarters is 68%, compared with 39% for Expedia.

Negatives

Although Priceline definitely has factors going its way, there are some significant developments that can be potentially detrimental to its future performance. For one, the ongoing European sovereign-debt crisis is having an impact on Priceline's growth. As noted in Priceline's 2012 Q1 earnings call, "Growth rates were impacted by slowing growth in Southern European markets..." Also, economic conditions in Europe are forcing many Europeans to tighten their budget and thus limit their vacations, a phenomenon that is also adversely affecting not only Priceline, but the entire European travel industry too. Moreover, the weakness of the euro is a negative for Priceline, as it puts pressure on the company's dollar-denominated results.

As more and more companies become attracted to the lucrative travel industry, one with relatively low barriers to entry, Priceline will face increasing competition and potentially lower profit margins. Microsoft (MSFT) launched Bing Travel while Google (GOOG) has acquired ITA Software Inc., a major flight information software company along with HomeAway, a vacation home-rental service. Moreover, Priceline is facing increased domestic competition in terms of discounted hotel prices -- Travelocity and Expedia are growing their opaque price-disclosed booking services, which also result in significant discounts for customers. These discounted services may result in more difficulty for Priceline to effectively differentiate its products and services to its domestic costumers.

The Verdict

Recently, Goldman Sachs released its Q1 2012 Hedge Fund Trend Monitor report, which reveals the 50 most important hedge-fund stocks. Priceline was No. 8, with 29 hedge funds including it in their Top 10 holdings, and with good reason. Although Priceline faces increasing competition and may be adversely impacted by the crisis in Europe, it is in an unparalleled position to benefit from international travel. Overall, Priceline has much more upside potential and is a solid investment.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Is Priceline a Deal?

Published 06/11/2012, 02:39 PM

Updated 07/09/2023, 06:31 AM

Is Priceline a Deal?

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.