Market Notes

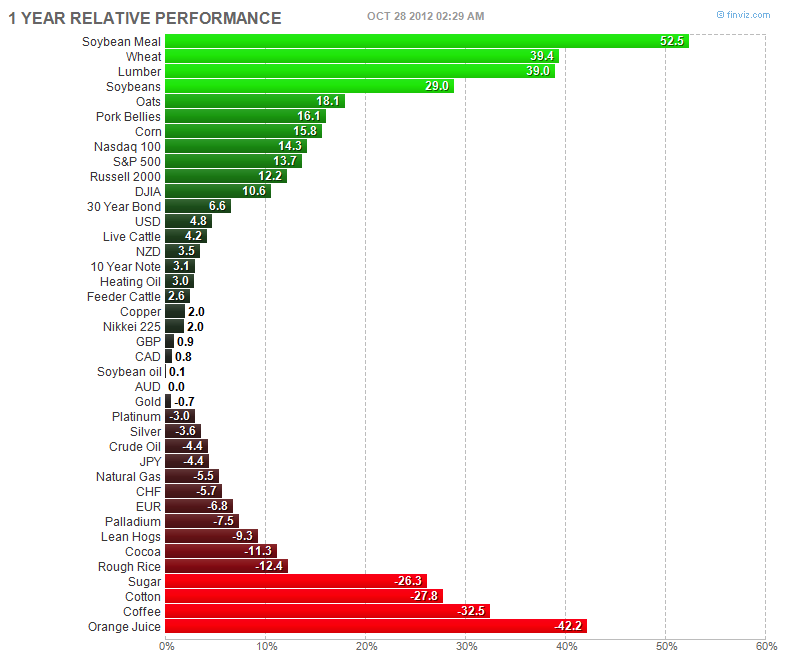

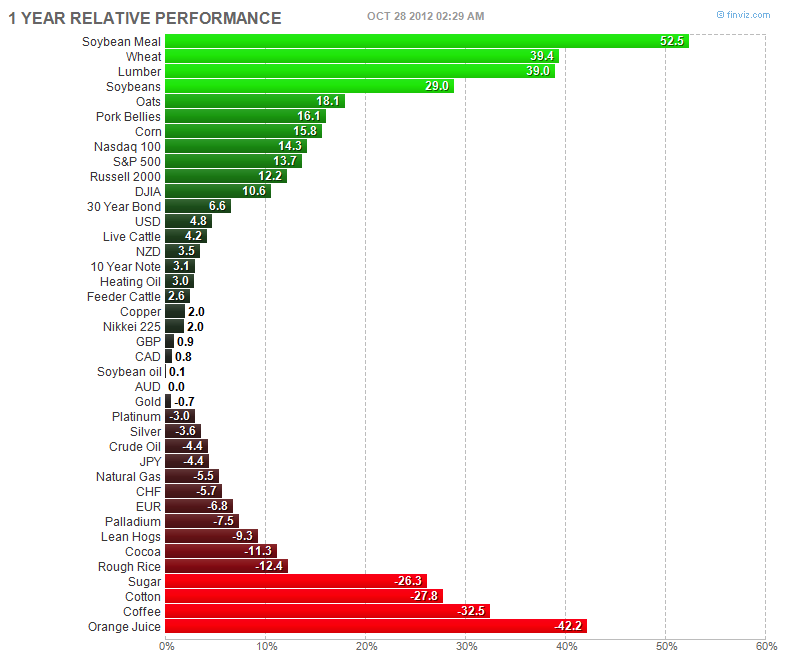

It is my opinion that there isn't much value anywhere in the financial market environment today. However, one asset class that remains out of favour with investors are Soft commodities such as Coffee, Cotton and Sugar with price currently down between 26% to 32% from a year ago.

Furthermore, Soft prices are down even more from their peak in February and March of 2011. Most retail investors have given up on these assets, while technician traders are calling charts "ugly", "awful", "value traps" etc. This is all happening as investment banking analysts forecast large surpluses for 2013 and hedge funds continue to add short positions.

When everyone is thinking the same way, the majority of the time no one is doing any thinking at all. My opinion is that those willing to go against the grain by investing today, will find handsome returns in their portfolios in a few quarters to a year or two.

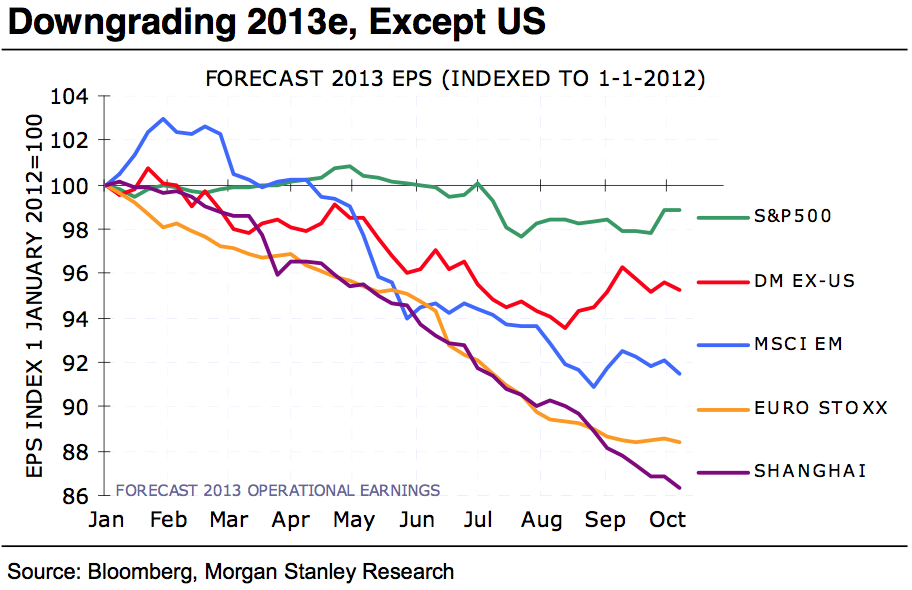

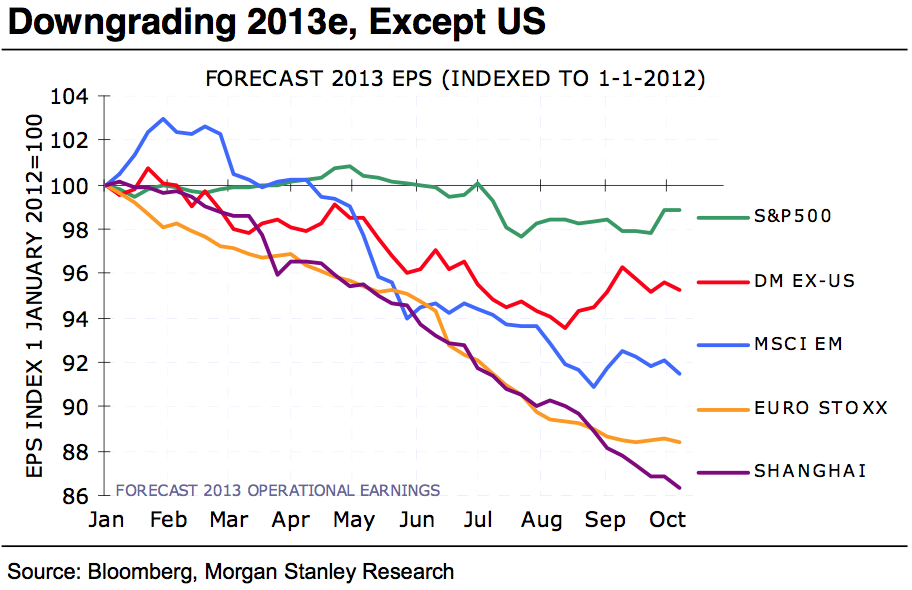

We are witnessing the first wave of meaningful earnings downgrades since the Financial Crisis began, as the slowdown starts affecting profit margins, revenues and earnings of global corporations. The Morgan Stanley research team forecasts a 14% drop in Shanghai Composite earnings, 12% drop in Euro Stoxx 50 earnings, 8% drop in MSCI Emerging Markets earnings and finally only a 1% drop in the S&P 500 earnings.

Only a 1% drop in the US? Is this a 2008 deja vu moment with the famous buzz phrase "de-coupling" all over again? With the current disappointment mainly skewed towards China and the eurozone, it should come as no surprise that the Shanghai Composite has had a disaster of a run, while US equities have significantly outperformed EU & GEMs over the last several quarters.

My personal opinion is that US equities are overvalued right now (on both a nominal and relative basis) and even though the majority of hot-shot ace analysts state that the P/E multiple is historically low, where they will go wrong is with the "E" component. In other words, I expect US earnings to be downgraded rather swiftly in the up-and-coming 2013/14 rescission, bringing the "P" component down with it.

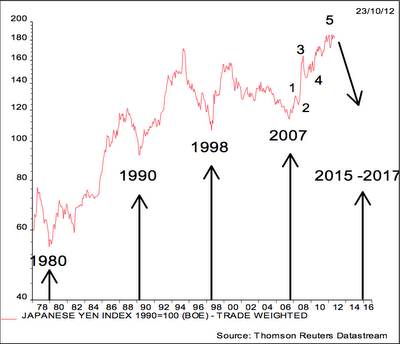

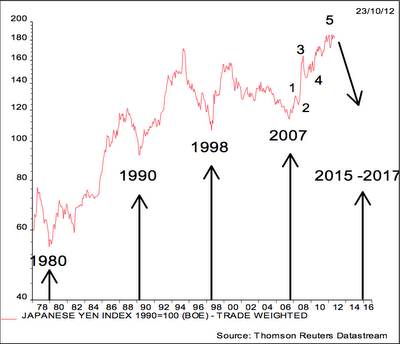

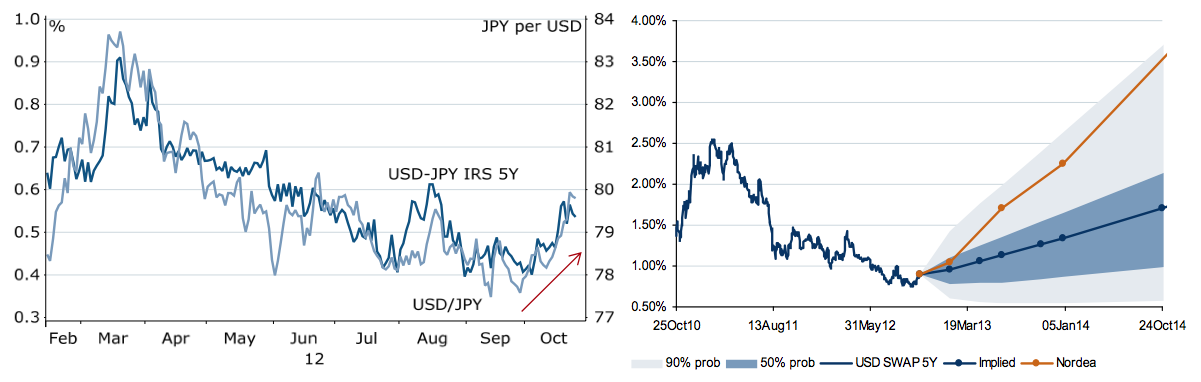

Reading the recent UBS Technical Newsletter, one of the sections was titled "JPY Completing A Major Long-Term Top!!" The article went on to say that:

With last week’s break of 79, the pair has completed an important tactical trading bottom and is on track with our next target at 80.50 to 81.50. The key message is that the current USDJPY strength reflects broad-based JPY weakness and if we look at the JPY index and the relevant cycles we can see how far reaching a major trend reversal in the USDJPY could be.

All this suggests that the JPY index is about to completed a major wave 5 pattern from its 2007 price low and if so then its clear that the JPY is at the very beginning of a several years lasting bear market with a potential 35% correction into the 2015 to 2017 time frame, where we have the next long-term low projection for the JPY.

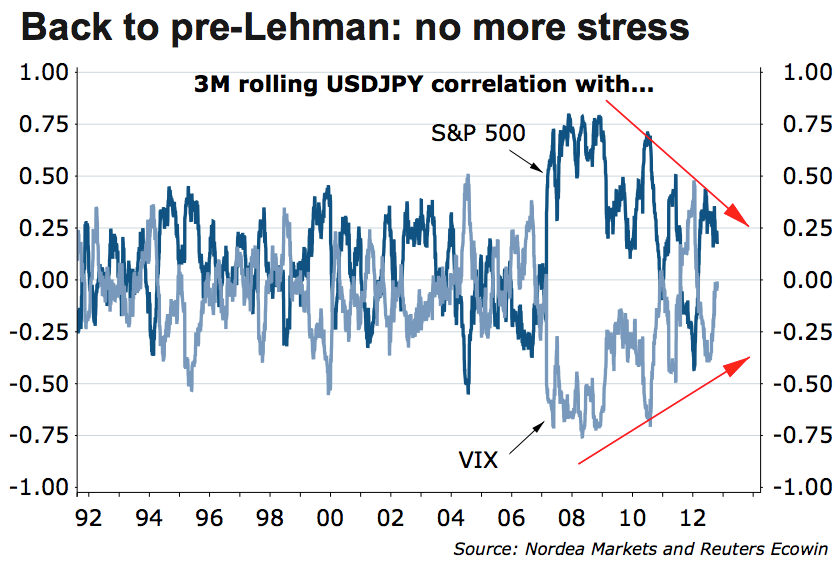

After I finished reading that newsletter, it was only a matter of minutes before I opened up Nordea Investment Bank's research note titled "JPY View: Years of strength. Over." The overall newsletter explained why the yen has been strong up to this point and then explained why the strength is now over. The article's main points for yen weakness were:

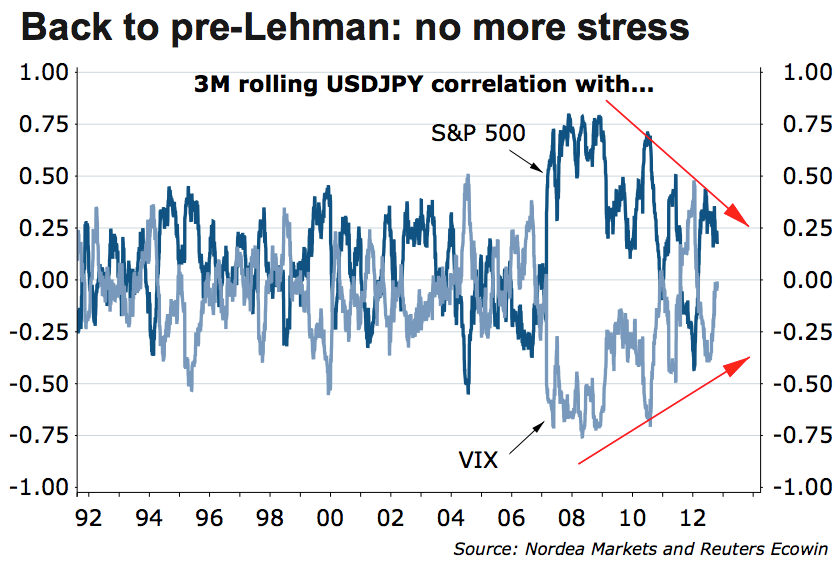

One of the major points Nordea analysts pointed towards when it comes to reasoning behind shorting the Japanese yen, was the fact that you will have to believe that the there will be no more stress within the financial system (chart above).

Another major point made by Nordea analysts were for US rates to rise in the up and coming quarters, which will give the the US dollar a yield advantage and therefore weaken the yen. And I quote:

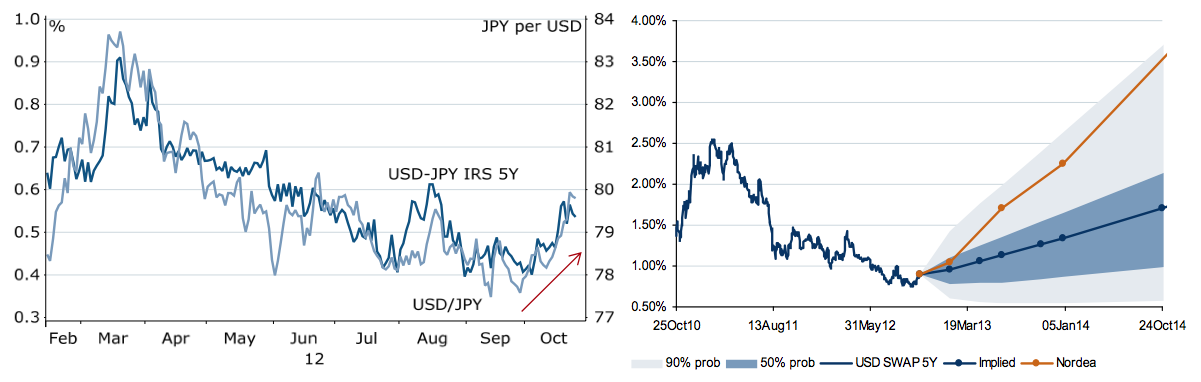

"The spread between USD and JPY interest rates (in particular 5Y maturity) tracks the USD/JPY closely. We expect JPY rates to remain low while US rates will pick up more than markets imply."

Several minutes later, I opened up a Danske Bank's newsletter titled "IMM Positioning: JPY bears prepare for Bank of Japan". The article states:

"Investors made an outright turnaround on the yen last week, turning from net bullish to net bearish, leading up to this week’s Bank of Japan (BoJ) meeting. At the meeting, we look for the BoJ to increase its asset-purchase programme by JPY10trn to JPY65trn, which seems to be widely expected in the market. We still target USD/JPY at 83 on a 12M horizon..."

Moving along, many of you might know CNBC's famous Money in Motion currency show, which is usually played on the weekend here in Asia. The reason I regularly watch the show is to watch for investment ideas these "gurus" on TV state and than make sure I do not follow any of them.

As a matter of fact, sometimes I even do the opposite of what they say. The recent segment titled "Crisis Coming For Japan" put forward a variety of reasons as to why one should short JGBs and the yen. Give it a watch yourself and do not be surprised that all the "gurus" agree that shorting the yen is the right thing to do.

Finally, a recent Bloomberg article described the overall mood of the market quite well. And I quote:

"All but one of 27 economists surveyed by Bloomberg News expect the central bank to add to stimulus for the second time in two months at a policy board meeting on Oct. 30. At its last meeting that ended Oct. 5, the bank held off from more easing after expanding its asset-purchase program in September."

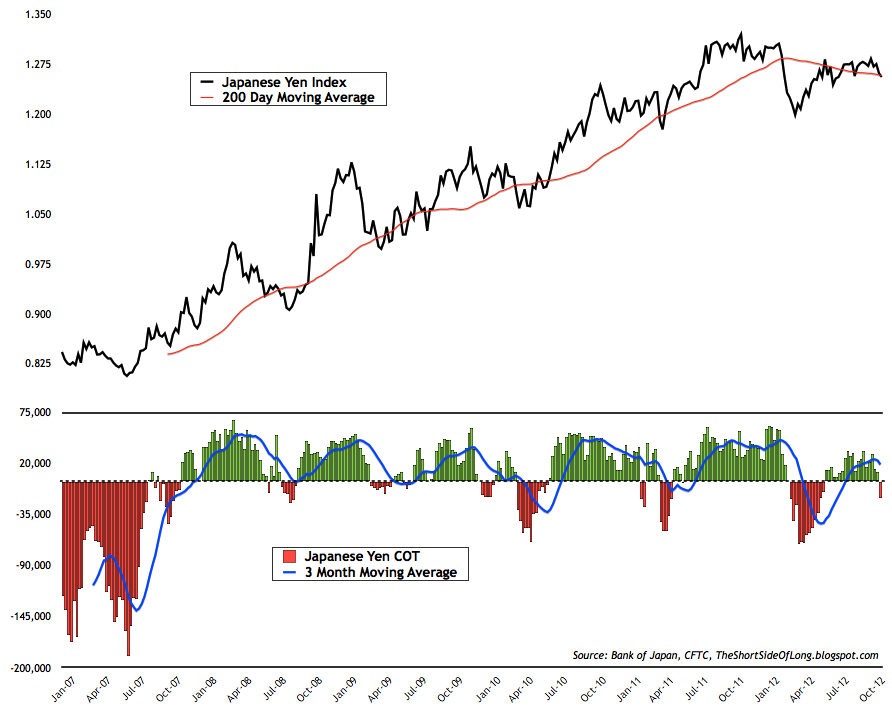

So essentially you get the point. As I stated at the beginning of the article, almost everyone, everywhere has turned negative on the Japanese yen. But it is not only about what they are saying on TV, radio or internet. The proof is in all the indicators US traders track. Consider the following:

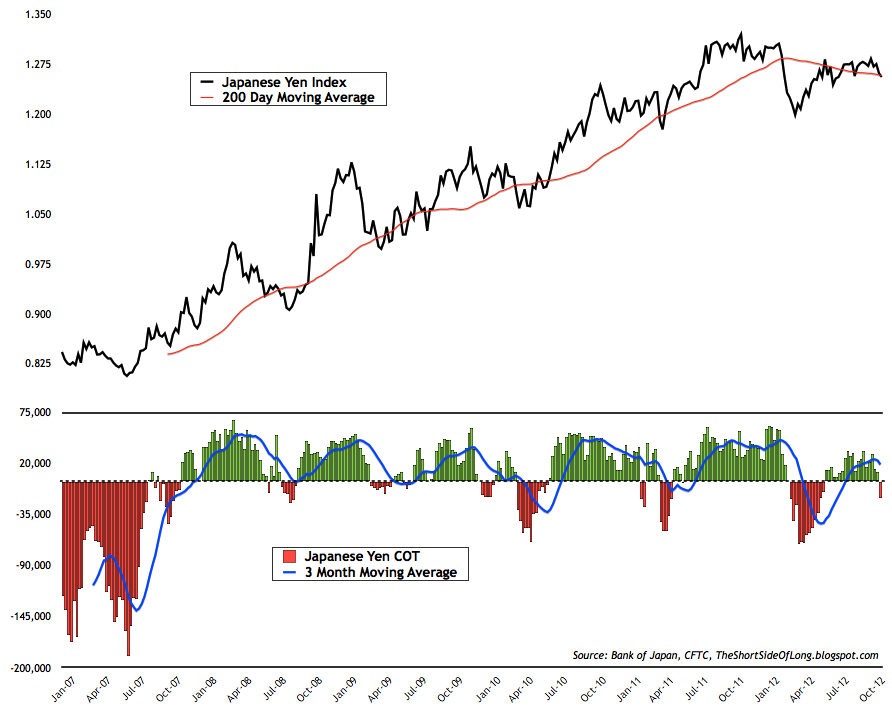

Recent data as of last Tuesday showed that market participants like hedges funds and other speculators now hold a net short position on the Japanese yen with a view of further declines. Since the data is delayed by a week or so, we can expect an even larger net short build-up by the time new figures come out, as prices have declined further and the consensus view has grown larger.

And when have hedge funds ever been right?

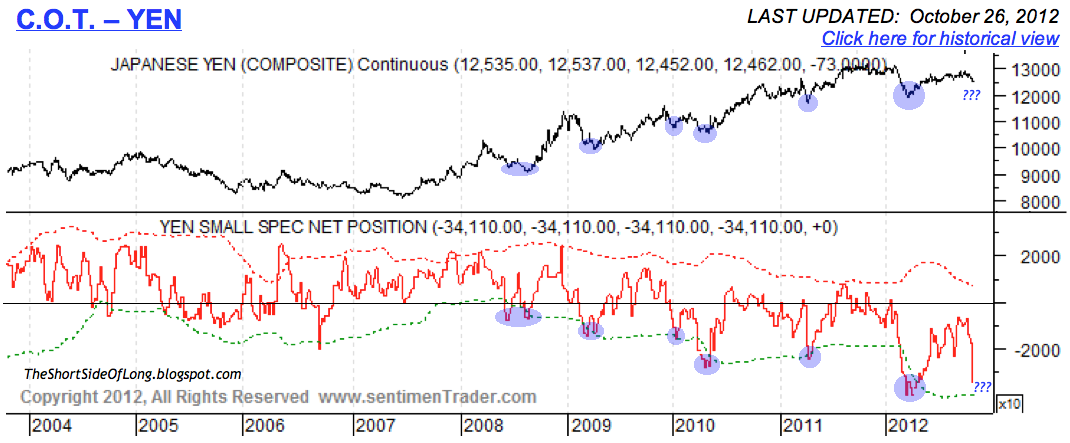

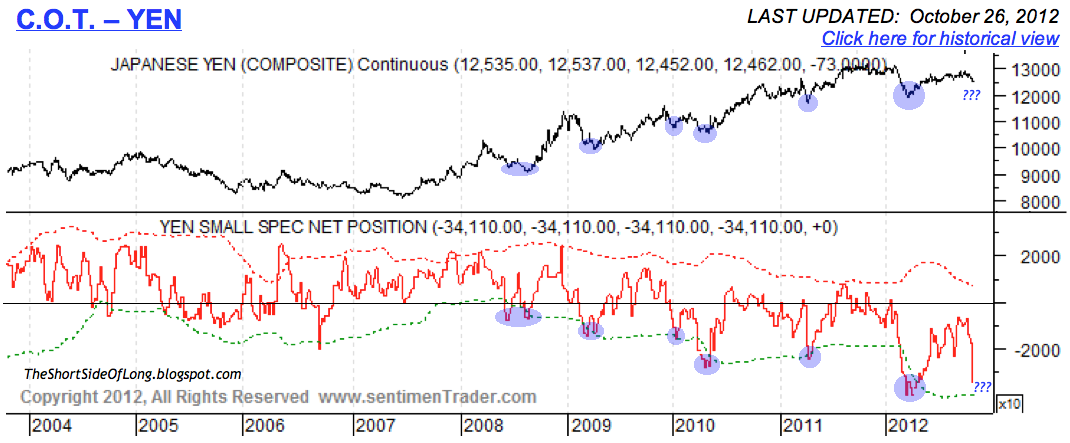

Even more importantly, small speculators also known as Dumb Money, are extremely short Japanese yen as of last Tuesday. Since the data is delayed, here too we can expect an even larger net short build up by the time new figures come out. Do keep in mind that this is now the second highest bearish bet against the yen, with March 2012 being a record bearish position.

And when have the small spectators ever been right?

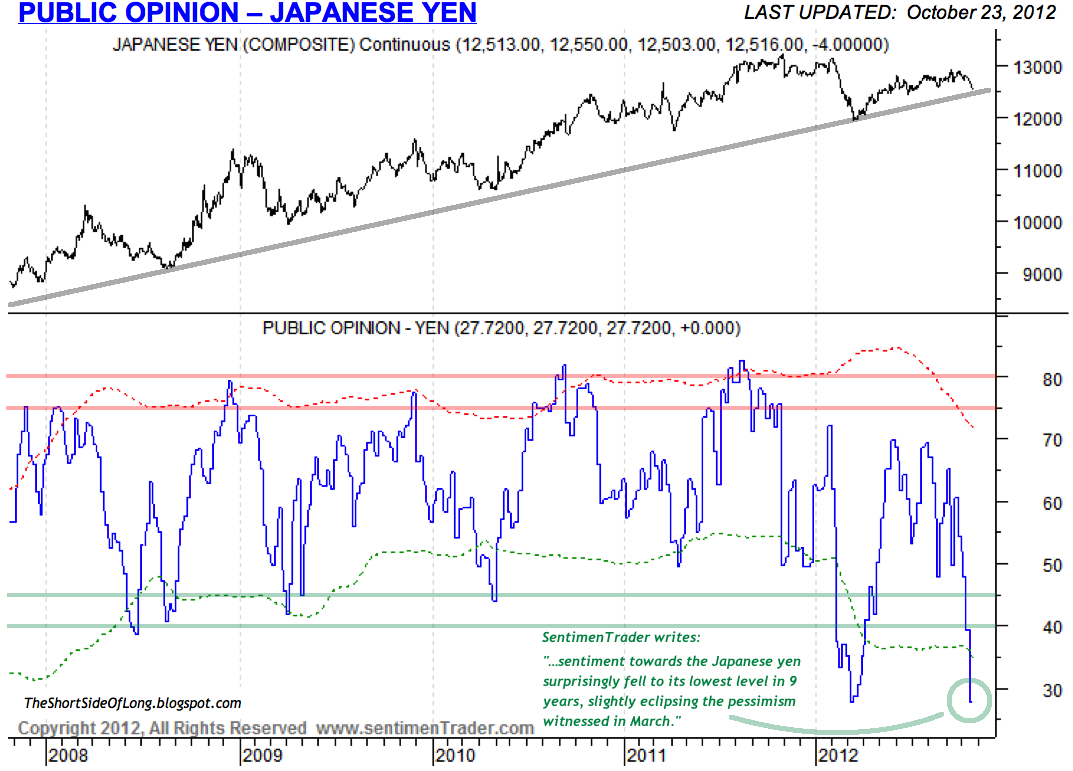

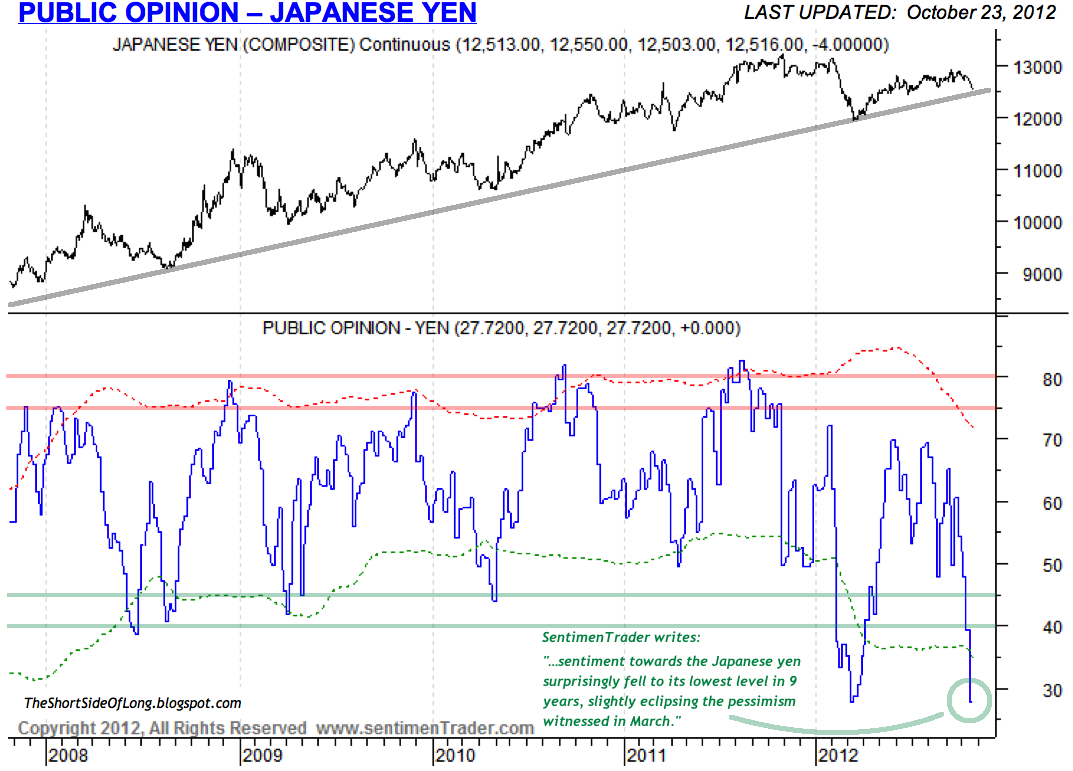

Cumulative amounts of sentiment surveys put together by the lovely people over at SentimenTrader.com into a tool called Public Opinion show that the overall mood on the yen is currently at 9 year lows. In other words, there is now outright consensus panic that the yen will decline very quickly and very rapidly.

And when has the retail crowd ever been right?

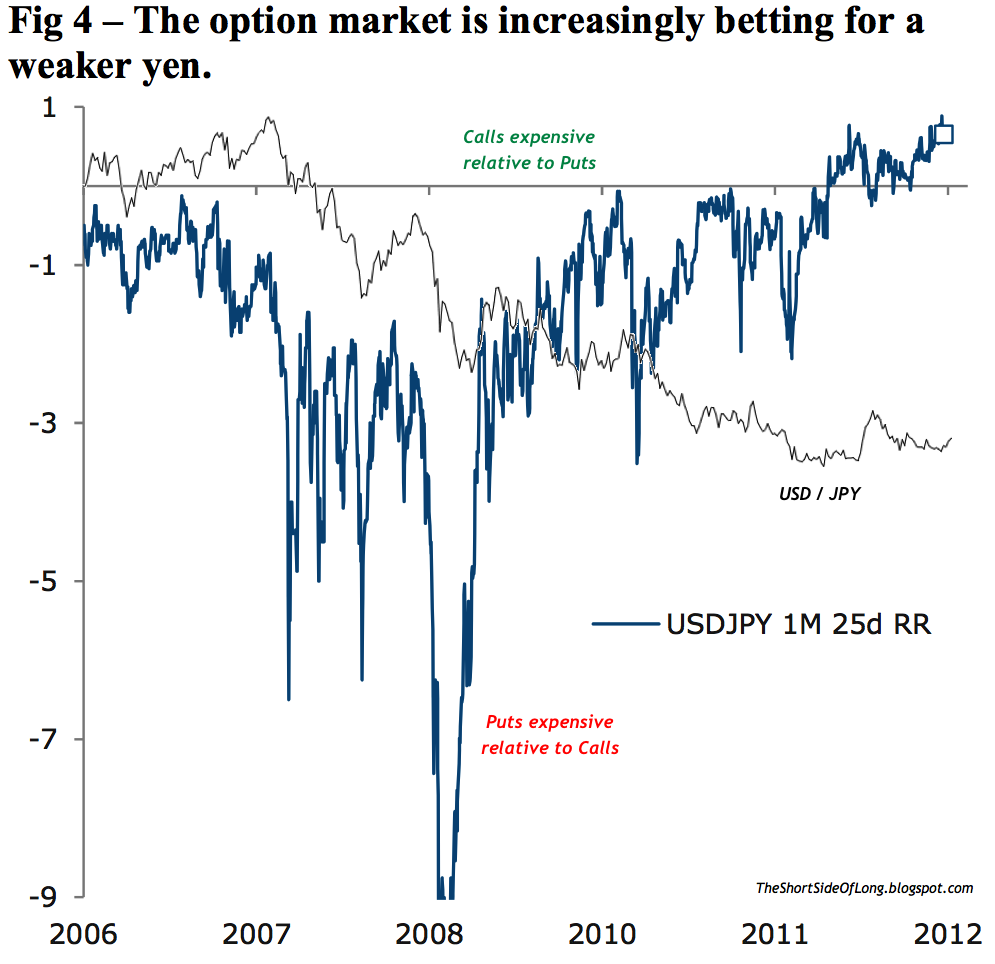

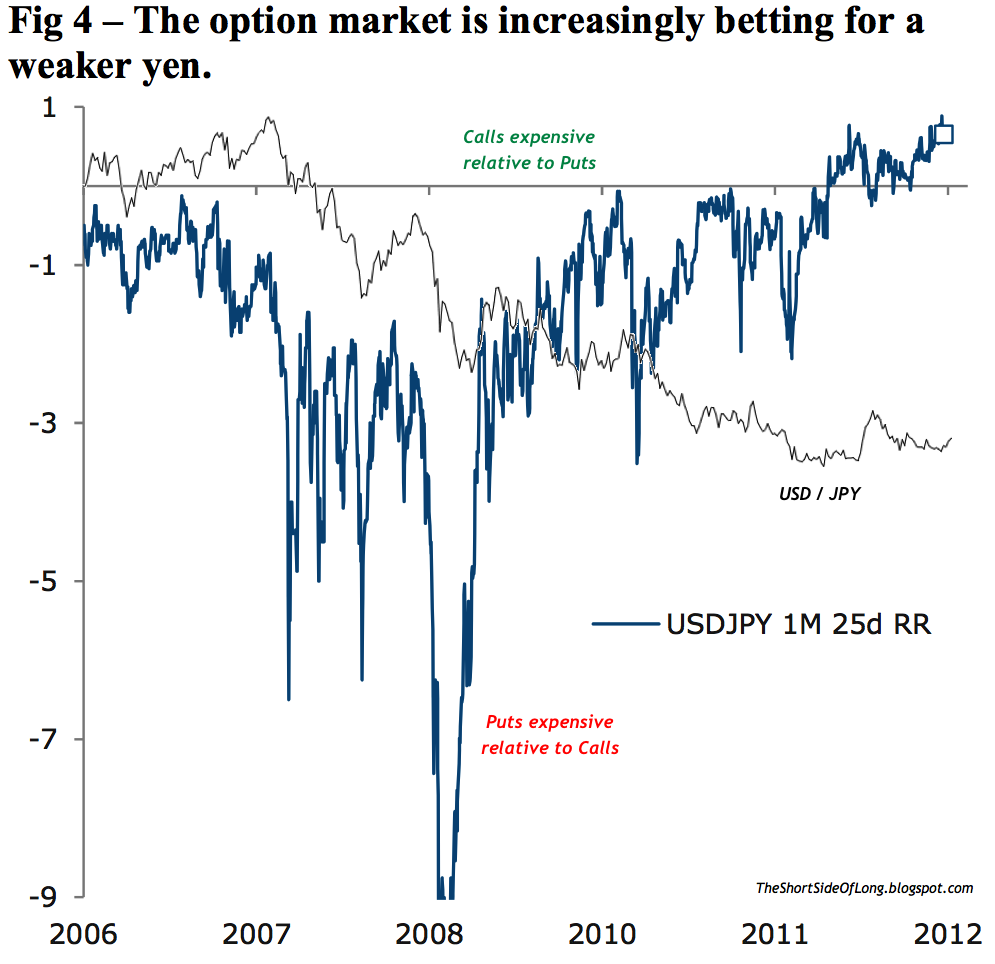

The options market has placed an amazingly high premium cost on USD/JPY Calls relative to Puts as measured by the Skew Index. That means the consensus in the options market is for the yen to weaken against the US dollar, as traders overpay for the value of Calls. They seem to be very eager to position aggressively against the possibility of further yen weakness, with Skew Index rising even above 2007 levels.

And when have the options traders ever been right?

You are going to have to believe these guys and their opinions, because I do not. They claim we are in for a rise in rates by global central banks, that we are in for a period of low volatility, that we are in for a period of no financial market stress and we are in for a period of a weak yen which will drive the risk on trade.

My view is completely different as I expect the Japanese yen to surprise and strengthen from the current levels to all time new record highs. I do not see any reason for the yen to weaken just yet because historically the yen weakens substantially if and when interest rates by the Fed rise (or any other CB). The reasoning behind this is that Japanese capital chases higher yield abroad.

However, quite to the contrary, the yen has strengthened and most likely will continue its uptrend as the world remains in a ZIRP environment (Zero Percent Interest Rate Policy). What happens when the Fed (and other CBs) keep rates at zero (plus engage into QE activity) is capital repatriation by Japanese households. Keep in mind that currently, the Japanese household wealth held aboard is relative to 55% of Japans GDP and that Japan is about to overtake China as the largest holder of Treasuries. So there are a lot of assets to repatriate!

To add fuel to this fire, the world economy is slowing with the eurozone already in a recession. If and when economic activity deteriorates even further, chances are that global central banks like the Fed and ECB will flood the system with liquidity similar to 2008, as they engage into even more stimulus measures and currency debasement. This will most likely increase the speed of capital repatriation by Japanese households and in turn strength the yen even more.

There is only one investor who remains bullish on the Japanese yen and seems to understand the underlying dynamics amazingly well. His name is Hugh Hendry and I highly recommend you watch his recent interview in the What I Am Watching section below.

He seems to understand that for the Bank of Japan to really be pushed into a Swiss Bank type of intervention of "fixing" or "pegging" the yen, the currency itself will have to appreciate much higher. Furthermore, Mr Hendry knows that "positioning yourself outside of an accepted belief system" and "rejecting the status quo" is one of the best ways to approach an investment. In other words, as I frequanelty say here on the blog... you are either a contrarian or a casualty and when its obvious to the public... it is obviously wrong!

What I Am Watching

It is my opinion that there isn't much value anywhere in the financial market environment today. However, one asset class that remains out of favour with investors are Soft commodities such as Coffee, Cotton and Sugar with price currently down between 26% to 32% from a year ago.

Furthermore, Soft prices are down even more from their peak in February and March of 2011. Most retail investors have given up on these assets, while technician traders are calling charts "ugly", "awful", "value traps" etc. This is all happening as investment banking analysts forecast large surpluses for 2013 and hedge funds continue to add short positions.

When everyone is thinking the same way, the majority of the time no one is doing any thinking at all. My opinion is that those willing to go against the grain by investing today, will find handsome returns in their portfolios in a few quarters to a year or two.

We are witnessing the first wave of meaningful earnings downgrades since the Financial Crisis began, as the slowdown starts affecting profit margins, revenues and earnings of global corporations. The Morgan Stanley research team forecasts a 14% drop in Shanghai Composite earnings, 12% drop in Euro Stoxx 50 earnings, 8% drop in MSCI Emerging Markets earnings and finally only a 1% drop in the S&P 500 earnings.

Only a 1% drop in the US? Is this a 2008 deja vu moment with the famous buzz phrase "de-coupling" all over again? With the current disappointment mainly skewed towards China and the eurozone, it should come as no surprise that the Shanghai Composite has had a disaster of a run, while US equities have significantly outperformed EU & GEMs over the last several quarters.

My personal opinion is that US equities are overvalued right now (on both a nominal and relative basis) and even though the majority of hot-shot ace analysts state that the P/E multiple is historically low, where they will go wrong is with the "E" component. In other words, I expect US earnings to be downgraded rather swiftly in the up-and-coming 2013/14 rescission, bringing the "P" component down with it.

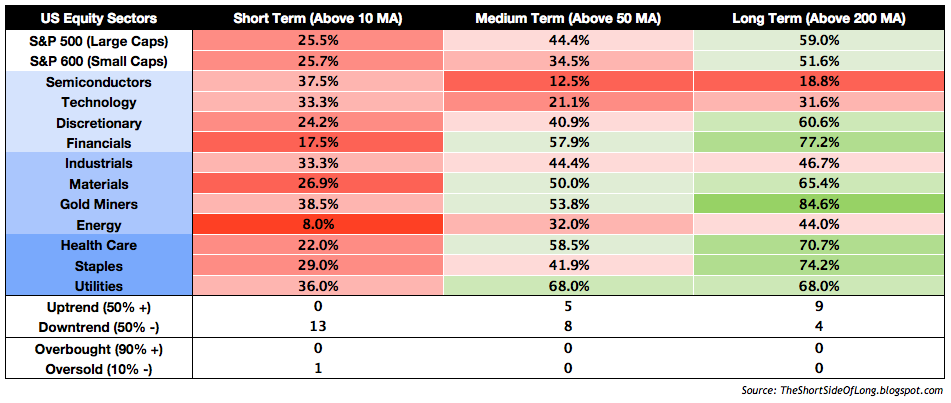

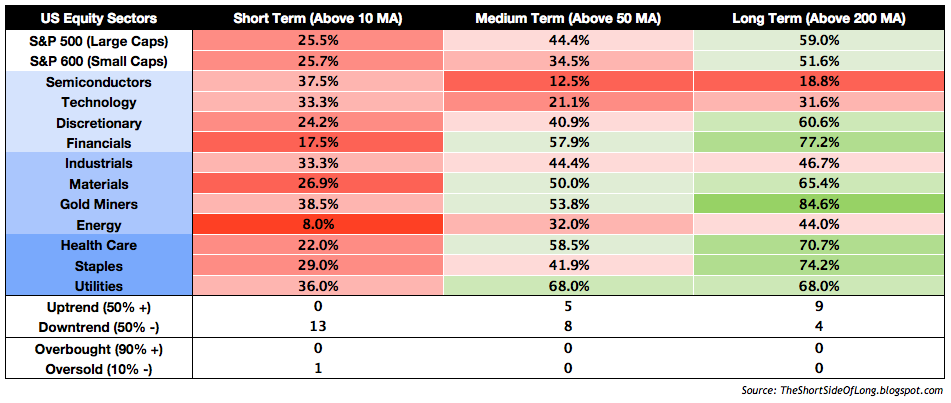

- Despite continuous selling of US equities over the last few weeks, especially in the Nasdaq index, it is very surprising to see only one major sector (Energy) currently oversold in the short term. No sectors are oversold in the medium or long term, but alarmingly we now have the majority of sectors in a downtrend from the medium term perspective. With the S&P only a few percent from the bull market highs, it is also worrying to see long term 200 day MA weak participation from leading cyclical sectors such as Semiconductors and Technology. Remember, it was Technology that led us out of the March 09 lows with a powerful performance, so could it lead us into 2013 with a bear market disappointment? Furthermore, economically sensitive small caps also look quite weak too. Finally, gold bugs should be pleased to see that PMs miners have the strongest long term participation, with 85% of stocks within the sector trading above the 200 day moving average. Those that follow the blog closely should remember that only several weeks ago, Gold Miners were largely out of favour with investors.

Reading the recent UBS Technical Newsletter, one of the sections was titled "JPY Completing A Major Long-Term Top!!" The article went on to say that:

With last week’s break of 79, the pair has completed an important tactical trading bottom and is on track with our next target at 80.50 to 81.50. The key message is that the current USDJPY strength reflects broad-based JPY weakness and if we look at the JPY index and the relevant cycles we can see how far reaching a major trend reversal in the USDJPY could be.

All this suggests that the JPY index is about to completed a major wave 5 pattern from its 2007 price low and if so then its clear that the JPY is at the very beginning of a several years lasting bear market with a potential 35% correction into the 2015 to 2017 time frame, where we have the next long-term low projection for the JPY.

After I finished reading that newsletter, it was only a matter of minutes before I opened up Nordea Investment Bank's research note titled "JPY View: Years of strength. Over." The overall newsletter explained why the yen has been strong up to this point and then explained why the strength is now over. The article's main points for yen weakness were:

- Stress is off – USD/JPY correlation with global risk factors declining

- More easing from BoJ to come

- Higher US rates ahead

- Worsening current account balance

- Stock market relative “cheapness” amid global easing

- Aging population – lower savings/higher consumption

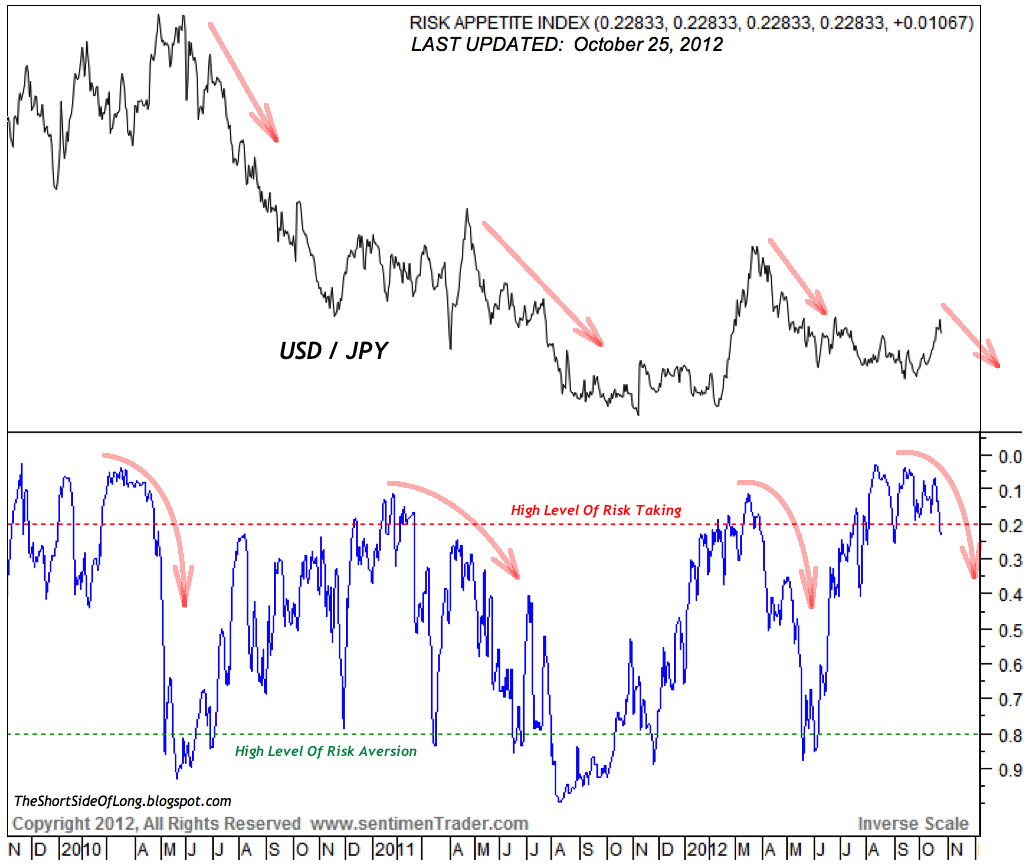

One of the major points Nordea analysts pointed towards when it comes to reasoning behind shorting the Japanese yen, was the fact that you will have to believe that the there will be no more stress within the financial system (chart above).

Another major point made by Nordea analysts were for US rates to rise in the up and coming quarters, which will give the the US dollar a yield advantage and therefore weaken the yen. And I quote:

"The spread between USD and JPY interest rates (in particular 5Y maturity) tracks the USD/JPY closely. We expect JPY rates to remain low while US rates will pick up more than markets imply."

Several minutes later, I opened up a Danske Bank's newsletter titled "IMM Positioning: JPY bears prepare for Bank of Japan". The article states:

"Investors made an outright turnaround on the yen last week, turning from net bullish to net bearish, leading up to this week’s Bank of Japan (BoJ) meeting. At the meeting, we look for the BoJ to increase its asset-purchase programme by JPY10trn to JPY65trn, which seems to be widely expected in the market. We still target USD/JPY at 83 on a 12M horizon..."

Moving along, many of you might know CNBC's famous Money in Motion currency show, which is usually played on the weekend here in Asia. The reason I regularly watch the show is to watch for investment ideas these "gurus" on TV state and than make sure I do not follow any of them.

As a matter of fact, sometimes I even do the opposite of what they say. The recent segment titled "Crisis Coming For Japan" put forward a variety of reasons as to why one should short JGBs and the yen. Give it a watch yourself and do not be surprised that all the "gurus" agree that shorting the yen is the right thing to do.

Finally, a recent Bloomberg article described the overall mood of the market quite well. And I quote:

"All but one of 27 economists surveyed by Bloomberg News expect the central bank to add to stimulus for the second time in two months at a policy board meeting on Oct. 30. At its last meeting that ended Oct. 5, the bank held off from more easing after expanding its asset-purchase program in September."

So essentially you get the point. As I stated at the beginning of the article, almost everyone, everywhere has turned negative on the Japanese yen. But it is not only about what they are saying on TV, radio or internet. The proof is in all the indicators US traders track. Consider the following:

Recent data as of last Tuesday showed that market participants like hedges funds and other speculators now hold a net short position on the Japanese yen with a view of further declines. Since the data is delayed by a week or so, we can expect an even larger net short build-up by the time new figures come out, as prices have declined further and the consensus view has grown larger.

And when have hedge funds ever been right?

Even more importantly, small speculators also known as Dumb Money, are extremely short Japanese yen as of last Tuesday. Since the data is delayed, here too we can expect an even larger net short build up by the time new figures come out. Do keep in mind that this is now the second highest bearish bet against the yen, with March 2012 being a record bearish position.

And when have the small spectators ever been right?

Cumulative amounts of sentiment surveys put together by the lovely people over at SentimenTrader.com into a tool called Public Opinion show that the overall mood on the yen is currently at 9 year lows. In other words, there is now outright consensus panic that the yen will decline very quickly and very rapidly.

And when has the retail crowd ever been right?

The options market has placed an amazingly high premium cost on USD/JPY Calls relative to Puts as measured by the Skew Index. That means the consensus in the options market is for the yen to weaken against the US dollar, as traders overpay for the value of Calls. They seem to be very eager to position aggressively against the possibility of further yen weakness, with Skew Index rising even above 2007 levels.

And when have the options traders ever been right?

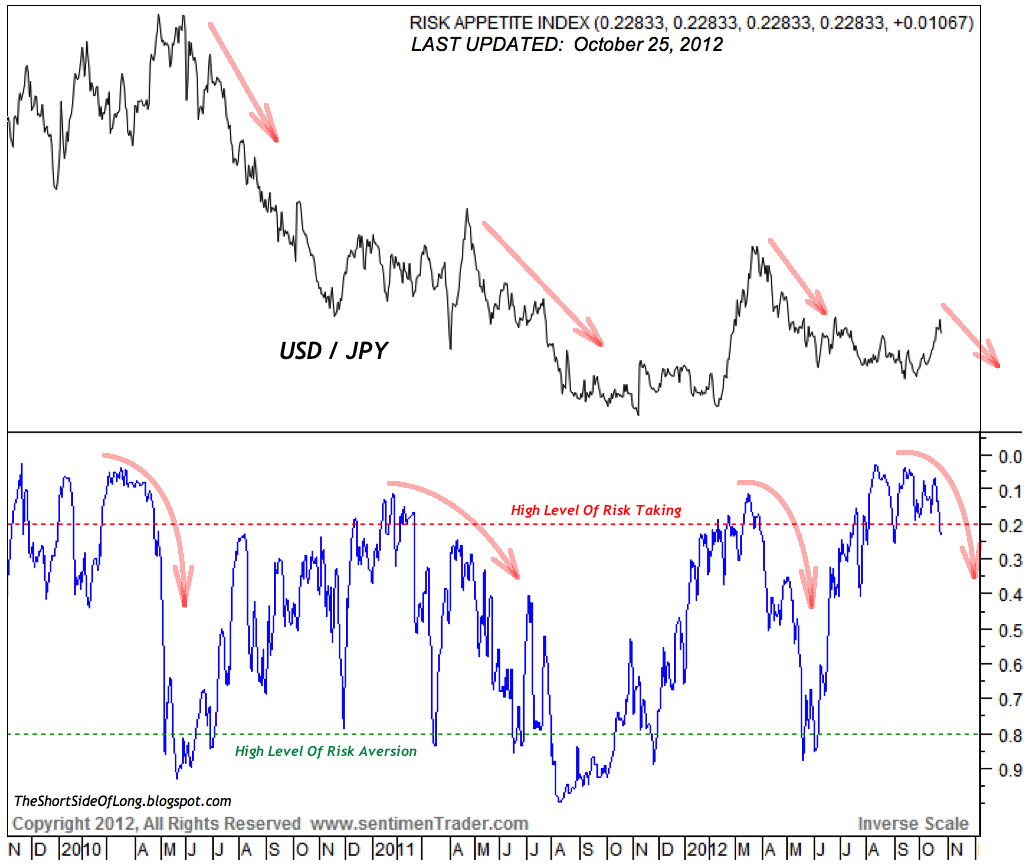

- Finally, according to the SentimentTrader tool, the risk appetite within the market environment is currently very strong. That indicates market participates have more tendency to sway towards anything risky like equities, industrial commodities and higher yield currencies. The yen, on the other hand, tends to trade as a safe haven and tends to do well when risk aversion is widespread. Having said that, from a contrarian point of view, the best time to buy the yen is when the risk appetite is buzzing and that seems to be right now. After all when has the herd ever been right?

You are going to have to believe these guys and their opinions, because I do not. They claim we are in for a rise in rates by global central banks, that we are in for a period of low volatility, that we are in for a period of no financial market stress and we are in for a period of a weak yen which will drive the risk on trade.

My view is completely different as I expect the Japanese yen to surprise and strengthen from the current levels to all time new record highs. I do not see any reason for the yen to weaken just yet because historically the yen weakens substantially if and when interest rates by the Fed rise (or any other CB). The reasoning behind this is that Japanese capital chases higher yield abroad.

However, quite to the contrary, the yen has strengthened and most likely will continue its uptrend as the world remains in a ZIRP environment (Zero Percent Interest Rate Policy). What happens when the Fed (and other CBs) keep rates at zero (plus engage into QE activity) is capital repatriation by Japanese households. Keep in mind that currently, the Japanese household wealth held aboard is relative to 55% of Japans GDP and that Japan is about to overtake China as the largest holder of Treasuries. So there are a lot of assets to repatriate!

To add fuel to this fire, the world economy is slowing with the eurozone already in a recession. If and when economic activity deteriorates even further, chances are that global central banks like the Fed and ECB will flood the system with liquidity similar to 2008, as they engage into even more stimulus measures and currency debasement. This will most likely increase the speed of capital repatriation by Japanese households and in turn strength the yen even more.

There is only one investor who remains bullish on the Japanese yen and seems to understand the underlying dynamics amazingly well. His name is Hugh Hendry and I highly recommend you watch his recent interview in the What I Am Watching section below.

He seems to understand that for the Bank of Japan to really be pushed into a Swiss Bank type of intervention of "fixing" or "pegging" the yen, the currency itself will have to appreciate much higher. Furthermore, Mr Hendry knows that "positioning yourself outside of an accepted belief system" and "rejecting the status quo" is one of the best ways to approach an investment. In other words, as I frequanelty say here on the blog... you are either a contrarian or a casualty and when its obvious to the public... it is obviously wrong!

What I Am Watching