How does one make money on a portfolio of alternative energy companies? Here are a few possible ways such an investment could work:

1. You hit a motherload by having a portfolio company invent some technology that would successfully compete with traditional energy sources on price and availability. It's a nice dream to have, but so far significant advances toward this goal have been elusive. This would not be a good investment strategy/thesis because it can not be relied upon to generate consistent returns (unless of course you focus on socially responsible investments irrespective of the return expectations).

2. You could have your portfolio companies lobby politicians to provide attractive tax breaks for alternative energy, benefiting your portfolio.

The Motley Fool: Most politicians love renewable energy, because it gives them a good excuse to increase the taxes on non-renewable energy, and it lets them buy votes and campaign donations by giving taxpayers' money to the renewable energy industry.

Naturally, whenever a government is giving away money, you get a big queue of people who want a piece of the action, and some renewable energy companies have been much more successful in getting subsidies than in producing commercially profitable applications.

Consequently, there have been several subsidy-related scandals, such as the one that surrounds the politically connected solar cell manufacturer Solyndra, which obtained hundreds of millions of dollars in US federal government loans and loan guarantees shortly before filing for bankruptcy. Solyndra is now being investigated by the Federal Bureau of Investigation!

Well, maybe relying on tax incentives to generate returns isn't such a great idea.

3. You work with your portfolio companies to convince politicians to punish traditional energy firms for using traditional energy sources (by increasing their costs) in order to encourage alternative energy uses.

The Motley Fool: In 2008, [the UK] parliament passed the Climate Change Act to encourage the adoption of renewable energy by deliberately increasing the cost of non-renewable energy. I also see it as providing a strong incentive to invest overseas, as it will damage British industry, since our energy costs are going to increase at a much greater rate than those of our foreign competitors.

The government's own figures indicate that this act will cost industry some £400 billion and increase the average British household's energy costs by around £760 a year. That's a big burden to bear, and it looks as if green policies will continue to put pressure upon domestic and commercial budgets.

Hmmm, that doesn't seem too sustainable or profitable for that matter.

4. Your final alternative, and the one that is most likely to succeed, is to bet on peak oil. When crude goes above $150, these alternatives should do well.

The Motley Fool: One thing that's guaranteed to improve renewable energy's economics is an oil crisis, preferably one which sends prices soaring to well above $150 a barrel for a long period of time.

But wait, if you are betting on peak oil, why not just buy traditional energy companies that would do well in a significant oil price appreciation? You don't have to bet on smaller firms or rely on tax breaks. With traditional energy firms, one may do well even without an oil crisis. Better yet, why not just go long on oil futures. This way you have no business risk at all - the peak oil effect would go straight into income.

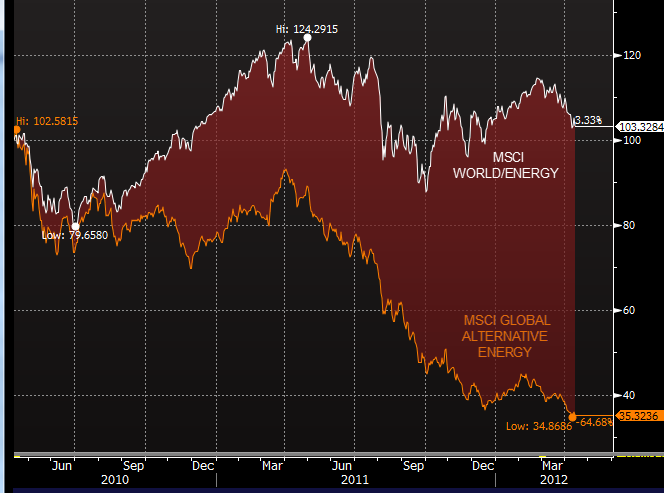

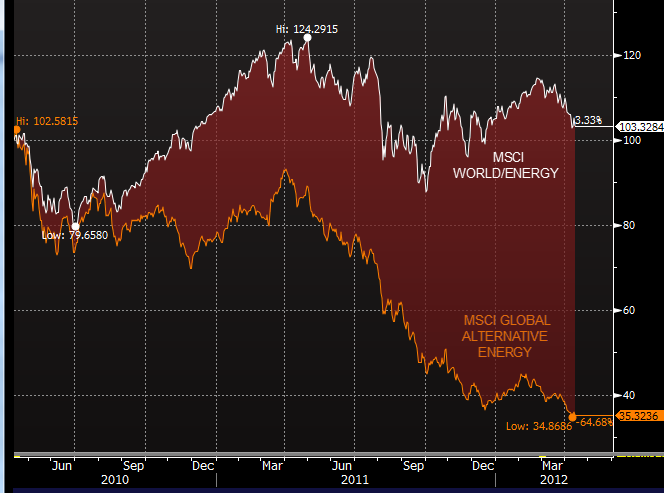

These four options just don't sound appealing, making the alternative energy asset class fairly unattractive as an investment. And the markets happen to agree. Over the past couple of years the overall energy sector globally has been flat to up slightly. The alternative energy space however is down some 65% over the same period.

MSCI World Energy Sector Index vs. MSCI Global Alternative Energy Index

1. You hit a motherload by having a portfolio company invent some technology that would successfully compete with traditional energy sources on price and availability. It's a nice dream to have, but so far significant advances toward this goal have been elusive. This would not be a good investment strategy/thesis because it can not be relied upon to generate consistent returns (unless of course you focus on socially responsible investments irrespective of the return expectations).

2. You could have your portfolio companies lobby politicians to provide attractive tax breaks for alternative energy, benefiting your portfolio.

The Motley Fool: Most politicians love renewable energy, because it gives them a good excuse to increase the taxes on non-renewable energy, and it lets them buy votes and campaign donations by giving taxpayers' money to the renewable energy industry.

Naturally, whenever a government is giving away money, you get a big queue of people who want a piece of the action, and some renewable energy companies have been much more successful in getting subsidies than in producing commercially profitable applications.

Consequently, there have been several subsidy-related scandals, such as the one that surrounds the politically connected solar cell manufacturer Solyndra, which obtained hundreds of millions of dollars in US federal government loans and loan guarantees shortly before filing for bankruptcy. Solyndra is now being investigated by the Federal Bureau of Investigation!

Well, maybe relying on tax incentives to generate returns isn't such a great idea.

3. You work with your portfolio companies to convince politicians to punish traditional energy firms for using traditional energy sources (by increasing their costs) in order to encourage alternative energy uses.

The Motley Fool: In 2008, [the UK] parliament passed the Climate Change Act to encourage the adoption of renewable energy by deliberately increasing the cost of non-renewable energy. I also see it as providing a strong incentive to invest overseas, as it will damage British industry, since our energy costs are going to increase at a much greater rate than those of our foreign competitors.

The government's own figures indicate that this act will cost industry some £400 billion and increase the average British household's energy costs by around £760 a year. That's a big burden to bear, and it looks as if green policies will continue to put pressure upon domestic and commercial budgets.

Hmmm, that doesn't seem too sustainable or profitable for that matter.

4. Your final alternative, and the one that is most likely to succeed, is to bet on peak oil. When crude goes above $150, these alternatives should do well.

The Motley Fool: One thing that's guaranteed to improve renewable energy's economics is an oil crisis, preferably one which sends prices soaring to well above $150 a barrel for a long period of time.

But wait, if you are betting on peak oil, why not just buy traditional energy companies that would do well in a significant oil price appreciation? You don't have to bet on smaller firms or rely on tax breaks. With traditional energy firms, one may do well even without an oil crisis. Better yet, why not just go long on oil futures. This way you have no business risk at all - the peak oil effect would go straight into income.

These four options just don't sound appealing, making the alternative energy asset class fairly unattractive as an investment. And the markets happen to agree. Over the past couple of years the overall energy sector globally has been flat to up slightly. The alternative energy space however is down some 65% over the same period.

MSCI World Energy Sector Index vs. MSCI Global Alternative Energy Index