Actionable ideas for the busy trader delivered daily right up front

- Monday lower, low confidence.

- ES pivot 1454.92. Holding below is bearish.

- Rest of week bias lower technically.

- Monthly outlook: bias uncertain.

- ES Fantasy Trader remaining short at 1448.50.

Ayn Rand's novel Atlas Shrugged sold more copies (1.5 million) since Obama was elected than in 1957, the year it was published, when it was a best seller.

Recap

Last Friday's call was, once again "uncertain", and I'd say the results support that: Dow down just 17, Naz u[ 4, and SPX down all of a tenth of a point. There's no way to make a precise call of higher or lower when you're looking at dojis like that. We are now back in the same sort of congestion we saw last month when the Dow essentially did nothing between August 7th and the 15th. So when will this run break? Let's go to the charts for clues.

The technicals (daily)

The Dow: The Dow gave us a fourth doji in row while remaining stuck in a narrow trading range on Friday. There's no way to call the close when you have so little direction. We also got a volume spike distorted by index rebalancing, further complicating the picture. The indicators are similarly conflicted: RSI and momentum have begun falling, money flow is up, and OBV is lower. Since we've now exited the rising RTC, the best guess is that we're going lower - eventually.

Of interest is that the weekly chart formed a doji star. That could be a reversal warning, but frustratingly enough, it requires confirmation. So we're still in sit back and wait mode here.

The VIX: And the VIX on Friday gave us its third doji star in five days as it continued to trade in a narrow range of 13.85 to 14.75. With nothing better to go on, I'd say that since Friday's close of 13.98 was near the bottom of this range then Monday will go higher, ergo bad for stocks.

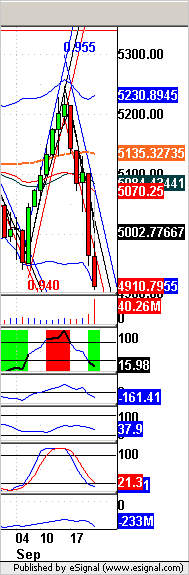

Market index futures: Tonight all three futures are down at 1:21 AM EDT with ES lower by 0.15%. Like the other charts, ES has just been pumping out a string of dojis lately as it tries to find a direction to move in. Tonight we're at the lower end of the recent range. What's different now is that the indicators have begun moving down off overbought in a concerted fashion. And the weekly indicators are also starting to move lower. The net takeaway here is that this chart has the flavor of favoring the downside more than the up.

ES daily pivot: Tonight the pivot drops from 13450.75 to 1454.92. We broke below the old level at 9 PM and with ES unable to make any headway since then, that just leaves us even lower now, a negative sign.

Dollar index: After posting gains most of last week, the dollar on Friday lost 0.1% and that was enough to take it to the edge of its latest rising RTC for a bearish setup. The candle was a hammerish doji, but without a real downtrend behind it, it doesn't count for much. The indicators though, just coming off oversold, suggest higher on Monday.

Euro: The euro on Friday managed some weak gains but remained firmly inside its descending RTC. It continues to move lower in the Sunday overnight and its indicators continue to move lower as well, now about halfway between overbought and oversold. That all adds up to continued lower for the euro on Monday.

Transportation: On Friday the trans lost another 1.03% to form the steepest continuous slide of the year so far. It sure doesn't look good as one alert reader commented last week. Take a look at the daily chart. The Dow is flat but the trans are tanking. I put this chart up last Thursday and it looked bad then. Now it looks worse. Looks like the end of the world, right? Um well, maybe. But maybe not.

Although the trans have now broken support from both the August and July lows, we're still above the May and June lows. And this is the seventh time this year the trans have taken a sharp dump. The other six times before, when we got to these levels, both on the chart and in the indicators, the market rebounded.

And note how oversold the indicators are and how the stochastic (bottom line) is gearing up for a bullish crossover. I'd be very cautious in assuming this chart means the Dow will collapse on Monday - or Tuesday.

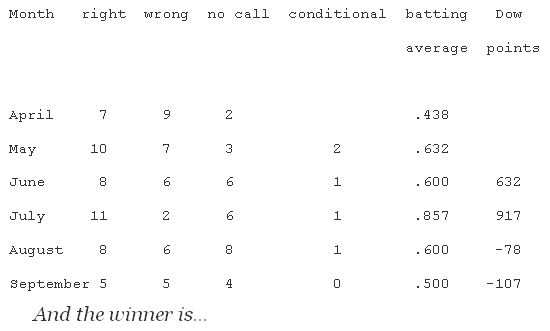

Accuracy (daily calls):

Overnight weakness in the market futures, plus negative currency trends, a rising TLT, copper now definitely having put in a top (I was about eight days early on that call), a VIX looking ready to move higher, the start of the historically weakest period of September, and that ugly $TRAN chart - add 'em all up and you've got the call: Monday lower.

ES Fantasy Trader

Portfolio stats: with no trade last night the account remains at $180,750 after 64 trades (49 wins, 15 losses) starting from $100,000 on 1/1/12. Tonight we're still staying short from 1448.50.

CUA (Commonly Used Acronyms)

BB - Bollinger Bands

DCB - Dead Cat Bounce

MA - Moving Average

RTC - Regression Trend Channel

YTD - Year To Date

Disclaimer: (My lawyer made me do it) This blog is not trading or investment advice, account management or direction. All trades listed here are presented only as examples of the author's personal trading style. Investing entails significant risk and trading entails even greater risks. Act accordingly.