U.S. Dollar Trading (USD)

Stock markets continued to rally around the world as the loose monetary policy from China, Europe and US added to investor risk appetite. Moody’s warned on US AAA rating given the looming budgetary issues. House Republican Speaker Boehner commented he was ‘not confident at all’ of avoiding a fiscal cliff next year. The dollar was on the back foot for most of the day with euro leading the charge higher. Looking ahead, Weekly Crude Oil Inventories.

The Euro (EUR)

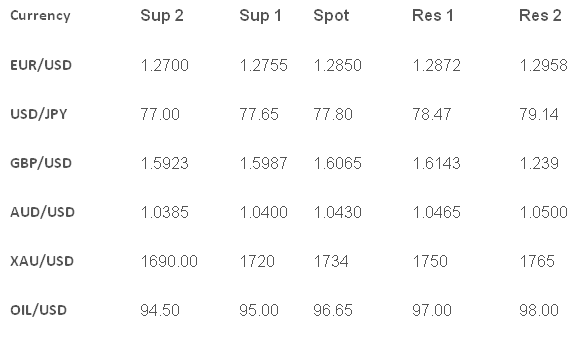

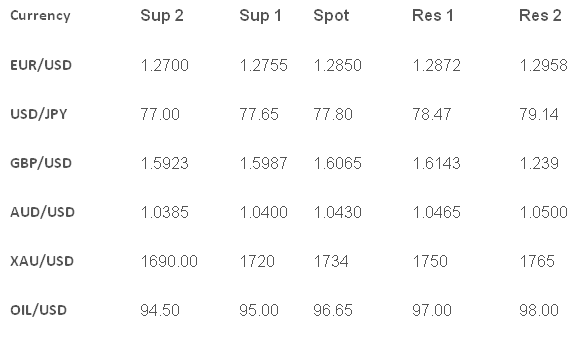

The EUR/USD rallied to fresh highs above 1.2850 as the German Court is expected and the US AAA rating warning added to USD woes. The outlook is for further gains especially if the FOMC announce QE3 on Thursday night. The EUR/JPY was mixed with large USD/JPY drops countering the EUR/USD surge.

The Sterling (GBP)

GBP/USD lifted off the 1.6000 levels and rallied to 1.6080 tracking EUR/USD higher. UK data has been improving of late and yesterday’s Trade balance was no exception with the July figure dropping to -7.1bn vs. -9bn. Looking ahead, August German CPI forecast at 0.3% m/m. Also July EU Industrial Production is forecast at 0 vs. -0.6% previously. German Constitutional Court Decision.

The Japanese Yen (JPY)

The Moody’s warning saw an immediate fall of the USD/JPY towards the Y78 and then a break to new cycle lows of Y77.70. QE3 expectations are also weighing on the major and we may test Y77 in coming days if USD weakness continues. BOJ/MOF Intervention talk will grow louder as the USD/JPY rate falls closer to Y75.50.

Australian Dollar (AUD)

Another strong day for the risk currency with Iron ore prices surging on calming Chinese fears and US stock indices continuing to press higher. AUD/USD has changed from downtrend to at least neutral in last few sessions and has caught a lot of the market on the wrong foot. Stronger resistance is seen between 1.0500-1.0600.

Oil And Gold (XAU) XAU/USD consolidated in the recent highs capped at $1740 and supported at $1730. OIL/USD was capped at $97 and eased back to $96.50 in quiet trade.

Pairs To Watch

EUR/USD: Buy the Rumor Sell the fact?

USD/JPY: Broken Range to the Downside?

TECHNICAL COMMENTARY

Stock markets continued to rally around the world as the loose monetary policy from China, Europe and US added to investor risk appetite. Moody’s warned on US AAA rating given the looming budgetary issues. House Republican Speaker Boehner commented he was ‘not confident at all’ of avoiding a fiscal cliff next year. The dollar was on the back foot for most of the day with euro leading the charge higher. Looking ahead, Weekly Crude Oil Inventories.

The Euro (EUR)

The EUR/USD rallied to fresh highs above 1.2850 as the German Court is expected and the US AAA rating warning added to USD woes. The outlook is for further gains especially if the FOMC announce QE3 on Thursday night. The EUR/JPY was mixed with large USD/JPY drops countering the EUR/USD surge.

The Sterling (GBP)

GBP/USD lifted off the 1.6000 levels and rallied to 1.6080 tracking EUR/USD higher. UK data has been improving of late and yesterday’s Trade balance was no exception with the July figure dropping to -7.1bn vs. -9bn. Looking ahead, August German CPI forecast at 0.3% m/m. Also July EU Industrial Production is forecast at 0 vs. -0.6% previously. German Constitutional Court Decision.

The Japanese Yen (JPY)

The Moody’s warning saw an immediate fall of the USD/JPY towards the Y78 and then a break to new cycle lows of Y77.70. QE3 expectations are also weighing on the major and we may test Y77 in coming days if USD weakness continues. BOJ/MOF Intervention talk will grow louder as the USD/JPY rate falls closer to Y75.50.

Australian Dollar (AUD)

Another strong day for the risk currency with Iron ore prices surging on calming Chinese fears and US stock indices continuing to press higher. AUD/USD has changed from downtrend to at least neutral in last few sessions and has caught a lot of the market on the wrong foot. Stronger resistance is seen between 1.0500-1.0600.

Oil And Gold (XAU) XAU/USD consolidated in the recent highs capped at $1740 and supported at $1730. OIL/USD was capped at $97 and eased back to $96.50 in quiet trade.

Pairs To Watch

EUR/USD: Buy the Rumor Sell the fact?

USD/JPY: Broken Range to the Downside?

TECHNICAL COMMENTARY