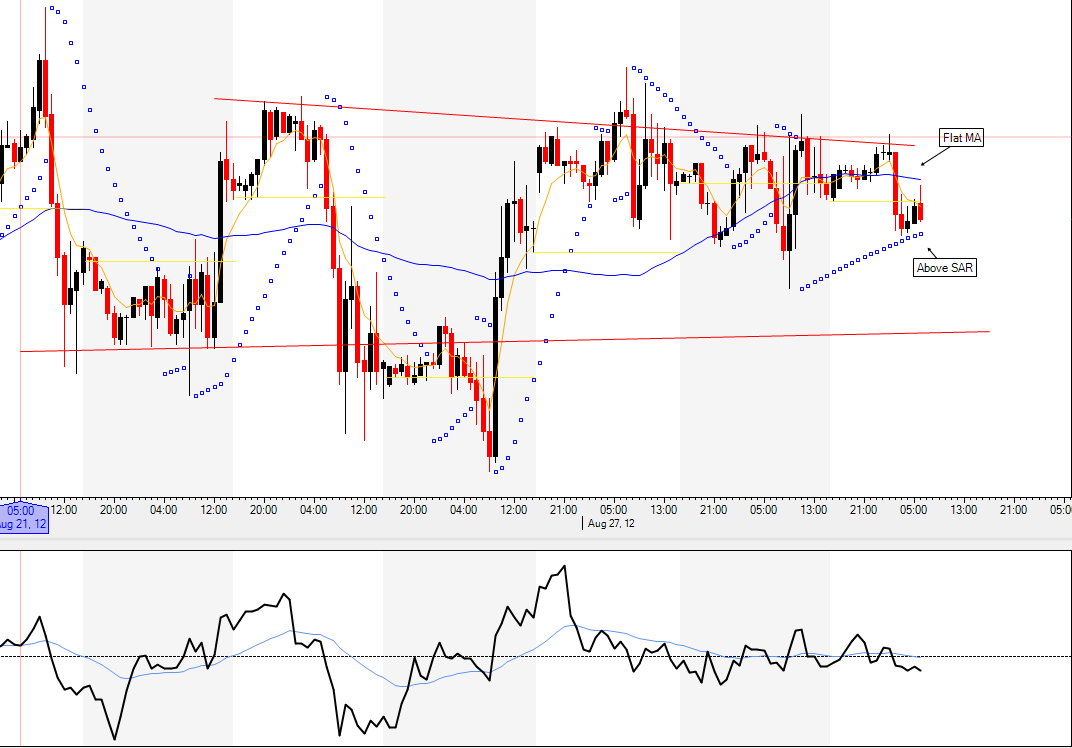

The Nasdaq-100 futures contract has been in a range between the support zone at $2,750 and the high at $2,790. Right now we are closer to the $2,790 level.

Bonds And Crude

Bonds continue to trade higher after breaking out of a triple bottom: the advance is bearish for equities. Currently, the 30-year U.S. T-Bond is between $149 and $150. Crude oil is declining -- lower lows and lower highs -- and is trading near $95.50.

Trendlines And Moving Average

As of writing, the market is trending sideways, at best. The Nasdaq-100 is trading below the flattening 50-hour simple moving average.

Momentum

The 12-hour rate of change indicator is sideways and below equilibrium: that suggests the price is below where it was 12 hour ago and is declining at a faster rate. The 24-hour rate of change indicator is sideways and below equilibrium. The 14-hour RSI is in a bear market range and is currently at the bottom of the range. The 14-hour stochastic indicator is in the oversold zone. The 14-period ADX is declining which suggests the market is consolidating. The ADX also suggested the trend is likely to change and the trend changed to sideways. The market is above the parabolic SAR, a sign that the trend is towards higher prices.

Dow Jones industrial average And S&P 500

Both averages are confirming the decline in the Nasdaq-100 and are trading in the support zone.

Stop Loss Level

The protective stop loss level is $2,575: That level represents the worst case loss level and trades may be exited prior to the market reaching that level.

Conclusion: Bullish, Caution Warranted

While almost all of the intraday indicators presented in this post suggest the intraday trend is towards lower prices, the intermediate trend is still towards higher prices.

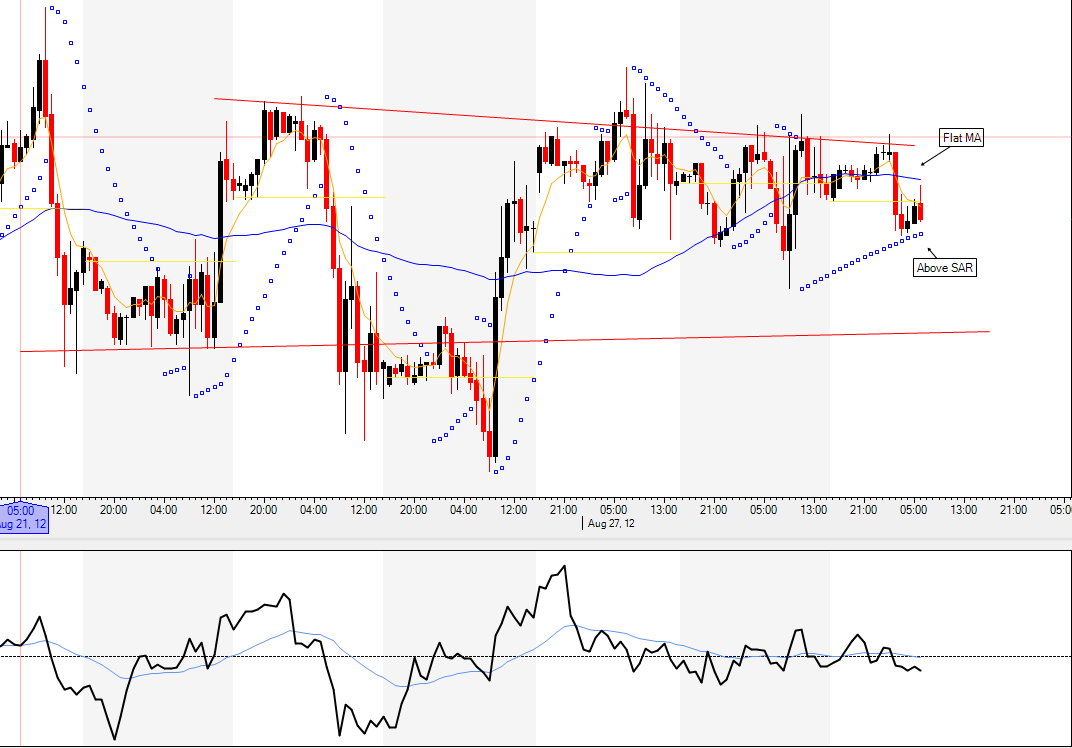

Bonds And Crude

Bonds continue to trade higher after breaking out of a triple bottom: the advance is bearish for equities. Currently, the 30-year U.S. T-Bond is between $149 and $150. Crude oil is declining -- lower lows and lower highs -- and is trading near $95.50.

Trendlines And Moving Average

As of writing, the market is trending sideways, at best. The Nasdaq-100 is trading below the flattening 50-hour simple moving average.

Momentum

The 12-hour rate of change indicator is sideways and below equilibrium: that suggests the price is below where it was 12 hour ago and is declining at a faster rate. The 24-hour rate of change indicator is sideways and below equilibrium. The 14-hour RSI is in a bear market range and is currently at the bottom of the range. The 14-hour stochastic indicator is in the oversold zone. The 14-period ADX is declining which suggests the market is consolidating. The ADX also suggested the trend is likely to change and the trend changed to sideways. The market is above the parabolic SAR, a sign that the trend is towards higher prices.

Dow Jones industrial average And S&P 500

Both averages are confirming the decline in the Nasdaq-100 and are trading in the support zone.

Stop Loss Level

The protective stop loss level is $2,575: That level represents the worst case loss level and trades may be exited prior to the market reaching that level.

Conclusion: Bullish, Caution Warranted

While almost all of the intraday indicators presented in this post suggest the intraday trend is towards lower prices, the intermediate trend is still towards higher prices.