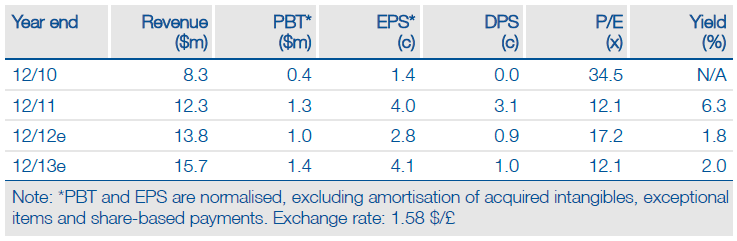

NetDimensions (NETD.L) is growing at a fast pace with organic revenue growth of 34% in H112 following 25% underlying growth in FY11. The group, which provides software that helps customers to deliver corporate training and develop talent, is positioning itself to maintain this strong growth. It is expanding into emerging markets, increasing the emphasis on direct selling and broadening its product range to enable cross-selling of new modules to its global customer base. Nevertheless, the shares are still trading at half the 2007 IPO price. The group had $7.8m of net cash at 30 June (ie, c 19.7p per share) and the P/E is attractive at c 6x FY13 earnings on a cash-adjusted basis.

Investment case: Fast grower with a healthy cash pile

NetDimensions generated 32% compound revenue growth since FY04 through the provision of its learning management system (LMS) software to enterprises. The industry dynamics are attractive, with annualised growth exceeding 14% over 2007 to 2011. Customers typically operate in highly regulated industries and the group has blue-chip clients, including the BBC, Cathay Pacific, ING and Progress Software, which provide strong references. NetDimensions is widening its product set and management believes the strategy could double sales from existing clients. The group is increasing investment in sales and marketing, reducing its dependence on resellers, and offices have recently been established in China and Germany.

Forecasts: Asia and new modules boost opportunity

Revenues surged by 34% in H1 to $5.9m and adjusted EBIT loss shrank to $0.2m. We are conservatively forecasting the group to generate 13% revenue growth in FY12 to $13.8m (hence a similar H2 to the very strong H211) and 14% growth in FY13 to $15.7m. We expect operating margins to pull back in FY12 due to the increased headcount and marketing spend, but to rise back above 10% in the medium term. The group was strongly cash generative in H1 with its net cash pile rising by $0.9m to $7.8m over the period. We assume the group is roughly cash neutral in H2, and we forecast end FY12 net cash to of c $6.8m after the payment of the maiden dividend.

Valuation: Sector has rich valuations in the US

While NetDimensions has a profitable track record, its shares trade on modest ratings of 0.4x FY13 revenues and 3.6x EBITDA. This looks appealing relative to its AIM quoted UK peers (0.9x revenues and 5.5x EBITDA) and its larger US competitors (c 4x FY13 revenues and c 29x EBITDA). Our discounted cash flow analysis, which incorporates potentially conservative assumptions, suggests a valuation of 65p.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

NetDimensions: Positioned For Strong Growth

Published 09/03/2012, 06:15 AM

Updated 07/09/2023, 06:31 AM

NetDimensions: Positioned For Strong Growth

Talent platforms for enterprises

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.