The secret behind well performing stocks is simple -- they outperform shareholder expectations. The outlook for Meadow Bay and its shareholders could not be better. Meadow Bay not only successfully confirmed a historic resource estimate after an initial drill program. There is much more gold and silver in and around the Atlanta Mine, which was closed in 1980s, than expected. However, this is by far not the end of the rope as Meadow Bay may have further positive surprises up its sleeve. What did not get much attention during the release of positive findings is the fact that the bulk of the 2011 drilling campaign is not yet included in the current preliminary resource estimate. A large number of high-grade intercepts will be included and released shortly. The preparation of the first NI43-101 resource estimate on the gold and silver quantities within the Atlanta deposits in eastern Nevada is ongoing and we are certain that Meadow Bay will again surprise its shareholders. If we dare to look a bit farther and believe the statement of Meadow Bay’s Project Manager, Dr. Douglas Oliver, the company just started to scratch the tip of a large goldberg.

New Management

Vancouver-based Meadow Bay Gold Corp. (“MAY“) is a junior mining company exploring and developing its main asset -- the fully-owned Atlanta Gold Mine project in Nevada, USA. In early 2011, a new management and exploration team took control of the company, raising $11.3 million in March (11.3 million shares at $1/share) and acquiring the privately-held Desert Hawk Resources Inc. The purchased portfolio included an option in the Atlanta Gold Mine (4 square km), the Colorback Gold project and the Spruce Mountain Molybdenum-Copper-Silver project. Later in 2011, MAY took full control of the Atlanta District by staking and acquiring additional claims significantly expanding the land position from an initial 404 to 4,856 ha. On January 16, 2012, the company began trading on the Toronto Stock Exchange (TSX) under the symbol “MAY.”

With a current market cap of $22 million, we value the stock of Meadow Bay Gold Corp. (TSX: MAY; Frankfurt: 20M) “undervalued“ and base our six-month price target on a market cap of $75 million, which represents $1.64/share with 46 million shares issued and outstanding. First and foremost, we are confident that the new management team will succeed in developing the Atlanta project quickly and efficiently towards a mining decision. Before becoming involved with MAY, senior geologist Bill Reed was instrumental in the discovery of the multi-million ounce San Miguel gold and silver deposit in Mexico, when he was vice president of exploration for Paramount Gold & Silver Corp. (NYSE/TSX: PZG; market cap: $363 million), a company which he co-founded. The other co-founder was Robert Dinning, who still serves as the chairman of the Paramount board and was CEO of Meadow Bay between early 2011 and late 2012 (and continuing to serve as MAY‘s Chairman). Adrian Robertson, a professional engineer whose previous experience includes roles with Inco/Vale, Teck, TVX Corp. and Golder Associates is not only a director at Meadow Bay Gold, but also serves as president & CEO of Urastar Gold Corp. (TSX.V: URS; market cap: $8 million). We initiated coverage last month on Urastar (“In the Heart of Two Giants – Why Two Major Gold Producers May Bid for This Gold Explorer“) and note that Bill Reed sits on the board there as well. Alex Khutorsky, formerly with Dahlman & Rose (a New York-based investment bank focused on the metals and mining sectors) has joined the MAY‘s Board of Directors and has been appointed interim CEO in October 2012.

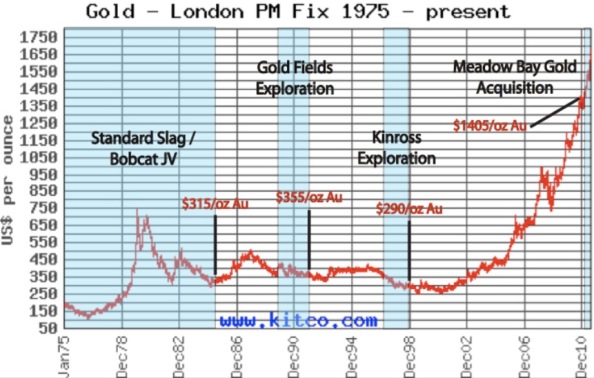

In 1970 -- when gold was priced at only $35 -- Rutherford Day bought the Atlanta property and formed Bobcat Properties Inc. purchasing a small 800 t/day mill from northern Nevada and reconstructing it on the Atlanta property. In 1975 -- when gold was trading near $200 -- Bobcat formed a joint venture with Standard Slag operating the Atlanta Gold Mine until 1985 processing 1.5 million t ore with an average grade of 2.8 g/t gold and 39 g/t silver producing 121,000 oz gold and 800,000 oz silver -- when gold was selling for $850 in 1980 and $315 in 1985. Since then, Bobcat optioned the property only to Gold Fields in 1990 ($355 Au), Kinross in 1998 ($290/oz Au) and Cordilleran in 2000 ($255 Au). Thanks to heavily depressed (bottoming) gold market phases around each of those years of optioning out the Atlanta Mine, the property was later returned to Bobcat -- conveniently by prominent seniors having used the most modern exploration methods available at that time to prepare resource estimates of the remaining gold and silver within the closed Atlanta Pit.

Worth The Effort

After 10 years of gold rising six-fold from $255 to $1,405, Bobcat transferred the property in late 2010 to (privately-held) Desert Hawk Inc. for a payment of $6 million and a 3% NSR (to be paid in gold; capped at 4,000 oz) before MAY acquired Desert Hawk in February 2011 paying $100,000 in cash and issuing 7.5 million shares worth around $11 million at that time. Apparently, the time seems ripe again to bring Atlanta back into production during times of high gold prices with the previous owner being the largest shareholder of MAY. We are also confident that MAY represents a prime opportunity for shareholders and it is now that the time seems ripe. The company is about to release the first NI43-101-compliant resource estimate not only on the remaining resources of the Atlanta Mine, but as well on other zones of mineralization that were discovered or tested during the 2011 drill program. Additionally, MAY will start another aggressive drill program shortly guaranteeing continuous news-flow and the prospect of new discoveries and significant extensions of known mineralization zones.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Nevada Gold Rush Circa 2012

Published 10/12/2012, 10:45 AM

Updated 07/09/2023, 06:31 AM

Nevada Gold Rush Circa 2012

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.