Gold and silver faced another selling onslaught at the Comex futures market yesterday, with the most actively traded gold contract (February) losing 1.5% on the day to settle at $1,695.80 per troy ounce. Silver was down 2.28% to $32.99. Both metals have regained some ground in trading this morning, and are holding above key round numbers at $1,700 and $33 respectively. Somewhat surprisingly given this action in precious metals, the dollar also sold off yesterday -- the Dollar Index down 0.25% to 79.68.

On Monday we talked about the rapid rise in American Eagle gold coin sales in America, and Robert Wenzel’s blog now carries news of shortages of small silver bars in Tokyo. Reports from Japan seem anecdotal at this stage, but given all the talk over there about new beefed-up efforts from the Bank of Japan to devalue the yen, it wouldn’t be at all surprising if the Japanese were increasingly looking to precious metals as a way of preserving wealth.

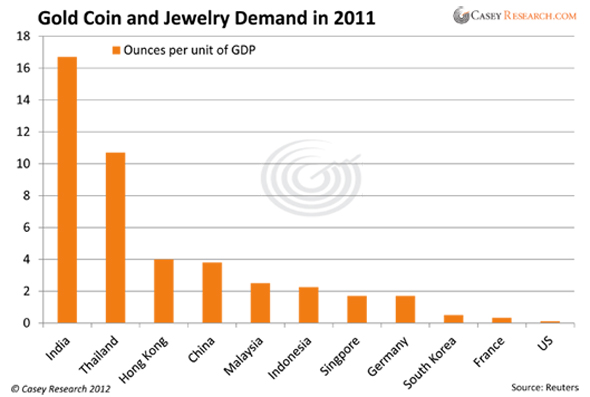

The key point of course is that, as the chart below from Casey Research suggests, the number of people in many developed countries who have even seen bullion coins or bars -- let alone owned them -- is vanishingly small. Saving via precious metals instead of bank deposits or bonds remains a fringe activity, to say the least. Great for those of us wise enough to see the opportunity.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Silver Demand Surging In Japan?

Published 12/05/2012, 09:39 AM

Updated 05/14/2017, 06:45 AM

Silver Demand Surging In Japan?

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.