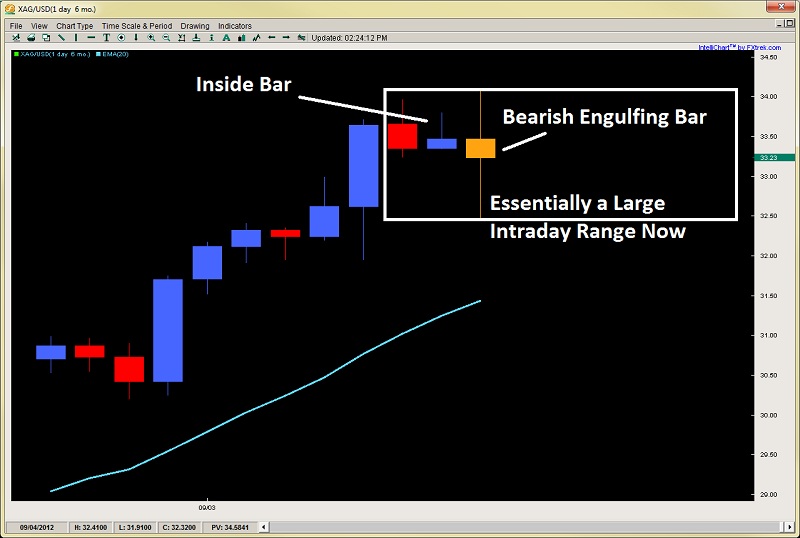

Silver

After closing last week strong, silver has been rather muted lately, forming a false breakout and then an inside bar. Today however is a little more interesting as the metal formed a large bearish engulfing bar, but more of what I would describe as a 2-way bar. Generally, bearish engulfing bars look a little more menacing and close towards the lows if the selling pressure is strong.

Not this bar. This one closed right in the middle, but this was after making an intraday high above the prior days highs, then selling off from $34-$32.45. So the initial breakout to the upside was a fake breakout and sellers took over while current longs dumped positions. But then, after hitting the intraday low at $32.45, the buyers came back in and bought the metal on the cheap, suggesting they were willing to pick some up at lower prices.

End result? It closed almost where it started, suggesting strong 2-way price action (hence the name).

An engulfing bar following a small inside bar is less impressive than usual, so we have to discount it a bit. Best to look at it as more of a large one day range. This gives us the intraday options of playing fades of both sides prior to the FOMC meeting where liquidity will likely decrease leading up to the announcement. But try to be flat going into it until Ben and his beard speak. And expect volatility after.

XAG/USD" title="XAG/USD" width="600" height="336">

XAG/USD" title="XAG/USD" width="600" height="336">

Global Market Commentary:

The main thing on the day was German Court’s ruling approving the EZ’s new rescue fund which alleviated sentiment and pressure on the zone.

Stocks and the euro gained on the day, with the EUR/USD closing just a nick below 1.2900, while the Dow gained 10pts and the DAX gaining 33pts on the day.

The big announcement comes tomorrow with the FOMC decision.

Original post

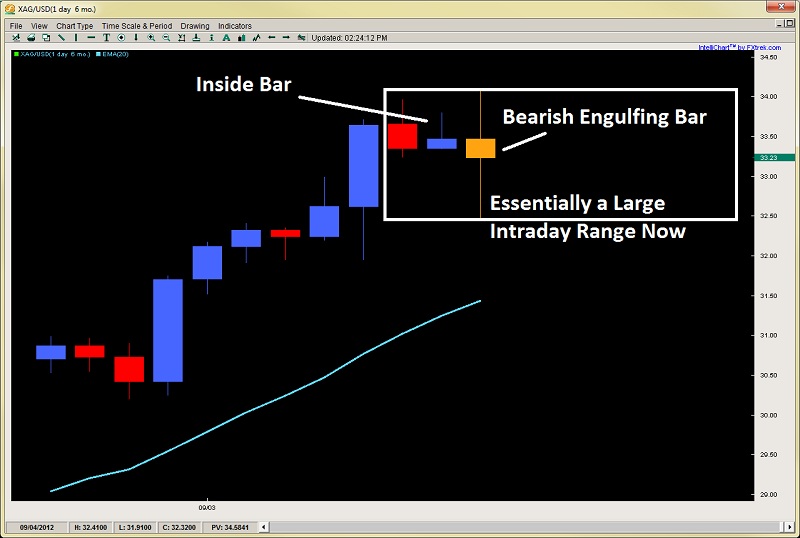

After closing last week strong, silver has been rather muted lately, forming a false breakout and then an inside bar. Today however is a little more interesting as the metal formed a large bearish engulfing bar, but more of what I would describe as a 2-way bar. Generally, bearish engulfing bars look a little more menacing and close towards the lows if the selling pressure is strong.

Not this bar. This one closed right in the middle, but this was after making an intraday high above the prior days highs, then selling off from $34-$32.45. So the initial breakout to the upside was a fake breakout and sellers took over while current longs dumped positions. But then, after hitting the intraday low at $32.45, the buyers came back in and bought the metal on the cheap, suggesting they were willing to pick some up at lower prices.

End result? It closed almost where it started, suggesting strong 2-way price action (hence the name).

An engulfing bar following a small inside bar is less impressive than usual, so we have to discount it a bit. Best to look at it as more of a large one day range. This gives us the intraday options of playing fades of both sides prior to the FOMC meeting where liquidity will likely decrease leading up to the announcement. But try to be flat going into it until Ben and his beard speak. And expect volatility after.

XAG/USD" title="XAG/USD" width="600" height="336">

XAG/USD" title="XAG/USD" width="600" height="336">Global Market Commentary:

The main thing on the day was German Court’s ruling approving the EZ’s new rescue fund which alleviated sentiment and pressure on the zone.

Stocks and the euro gained on the day, with the EUR/USD closing just a nick below 1.2900, while the Dow gained 10pts and the DAX gaining 33pts on the day.

The big announcement comes tomorrow with the FOMC decision.

Original post