The Emergency Liquidity Assistance (ELA) are temporary loans provided by the Eurozone's National Central Banks (NCBs) to banks in their jurisdiction. These loans are outside of those provided by the ECB, such as the LTRO program. The idea was to allow for some discretion for the NCBs to help their domestic institutions in a crisis situation that is specific to that nation, as opposed to a Eurozone-wide issue managed by the ECB. Unlike the ECB's lending programs where the risk is shared by the Euro-system, the NCBs bear the risk on ELA loans. The ECB can in fact stop the NCBs from providing specific ELA assistance if it is deemed to interfere with the ECB's overall policy actions.

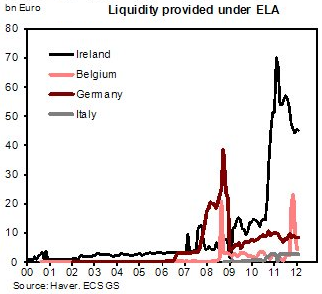

With the massive LTRO lending program by the ECB, one would expect that the Eurozone banks would repay their ELA loans and roll them into the ECB's 3-year loans. That seems to be what in fact happened for some nations such as Belgium, but the roll was only partial for Ireland. The Central Bank of Ireland still has some €45 bn of ELA loans outstanding.

So why would Irish banks not roll their ELA into the 3-year 1% LTRO? There is only one explanation. In spite of the much looser collateral requirements under the latest LTRO program, the collateral posted by the Irish banks under the ELA loans just doesn't qualify for LTRO. These Irish banks still need the liquidity but simply don't have the collateral the ECB would find palatable.

This is an important development to watch because it indicates continuing stress in the Irish banking system - with some banks so tapped out, they don't have enough ECB-eligible collateral. It also poses a risk to the Central Bank of Ireland that is not shared by the Eurozone (for now), particularly given that Ireland is in no position to bail out its central bank.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Some Irish Banks Unable To Qualify For LTRO Are Tapping Bank Of Ireland's ELA

Published 03/28/2012, 06:53 AM

Updated 07/09/2023, 06:31 AM

Some Irish Banks Unable To Qualify For LTRO Are Tapping Bank Of Ireland's ELA

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.