If you missed the notes from Niall Ferguson's presentation it also contains the complete lineup of the 9th Annual Strategic Investment Conference. I encourage you to read each of the sets of presentation notes as they contain a diverse set of opinions on everything from the markets to economics to politics both the U.S. and abroad.

The second speaker was one I have wanted to hear for quite sometime. Dr. Woody Brock, who is an economist and head of Strategic Economic Decisions. He holds 5 degrees in Math and Economics and the author of "American Gridlock" which is a MUST READ in my opinion. With that said - here are the notes from his presentation.

Greatadvances have been made possible by Game Theory.

There is a huge debate over "Austerity" versus "Spending" which leads to increases in debt. High debt to GDP ratios must ultimately be reduced. There is no question of that. Rising debt levels erode economic prosperity over time. However, the word, "deficit", has no real meaning – let me explain.

Let's take two different countries.

Country A spends $4 Trillion with receipts of $3 Trillion. This leaves Country A with a $1 Trillion deficit. In order to make up the difference between the spending and the income the Treasury must issue $1 Trillion in new debt. That new debt is simply used to cover spending but generates no income leaving a future hole that must be filled.

Country B spends $4 Trillion and receives $3 Trillion income. However, the $1 Trillion of excess which was financed by debt was invested into projects, infrastructure, that produced a positive rate of return. There is no deficit as the rate of return fills the hole.

There is no disagreement about the need for government spending. The disagreement is with the abuse and waste of it.

Keynes' theory is that when private spending is low it should then be stimulated with public spending. The problem with this theory, while correct, is that it was badly abused. When the economy is strong and growing the public spending should be sharply reduced. This was never the case.

The problem today is that government spending is primarily unproductive (roughly 70%) in relation to productive investments. This is according to Arrow-Kurtz principles. Today we are borrowing our children's future with debt. "We are witnessing the 'hosing' of the young" he stated.

The U.S. has the labor, resources and capital for a resurgence of a "Marshall Plan". The development of infrastructure has high rates of return on each dollar spent. However, instead, the government spent trillions bailing out banks and supporting Wall Street which has virtually no rate of return.

When it comes to the healthcare system and the aging of the population the problem with Medicare and Medicaid is a problem. Social Security is fixable by simply raising the retirement age to 71 or even 73 as suggested by Oprah Winfrey. Medicare is the problem and it is simply a function of math.

"Mathematics and Sex create performance anxiety in men - because you can't fake the outcome of either" he stated.

The future expenditure on health care will be so great that it will break the economy. The demand on the healthcare system itself, Medicaid and Medicare is increasing at a rate faster than the supply. This is a massive problem with the Obama healthcare plan. It focuses on increasing the demand on the system but absolutely no mechanism to increase the supply. The shift of demand without an equal shift in supply ensures that the entire system eventually bankrupts itself.

5 Take Aways In Comparing Models

- In judging different systems - it is social systems that matter, not just economic systems.

- You cannot judge, or critically compare, systems without norms for doing so. There must be a magnetic north on the compass

- Politics is about multi-lateral bargaining between interest groups. Good government achieves good bargaining.

- The dynamics of the two models based on "incentive structure logic" is what matters. Both models contain the seeds of their own destruction.

- Incentives Structures matter the most.

Politics is about optimal compromises. We maximize the welfare of people by good compromises.

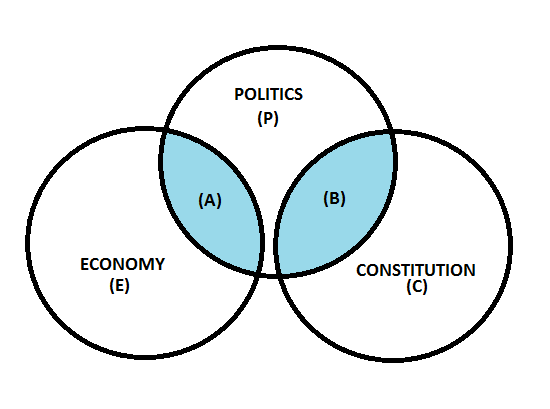

The chart shows the overlap between Economics (E) and Politics (P), Politics and the Constitution (C). (A) is the government regulated portion of (E) and (B) is the interference by government into the constitution. If you think about where we are today we see clear evidence of this such as the current debate of the "constitutionality" of Obamacare.

The moral: In an optimal society the activities and relative size of the entities must balance.

The Norms for an Ideal Economy = E

- Efficiency or "Non-Wastefulness"

- Stability

- Freedom

- Privacy

- Justice (Fairness)

- Incentive Structure Compatibility " with norms of 1-5

Therom: True "capitalism" can satisfy all the economic norms 1-6.

A "Fair Share" society, as promoted by the current administration, has absolutely NOTHING to do with Capitalism. It is an absurd hypothesis which is why Dr. Brock stated that "He (Obama) is a mental midget"

Norms Of An Ideal Constitution = C

- Equal protections and Treatment – Symmetries.

- Distributive Justice – "To each according to his contribution."

The idea of distributive justice is why a "flat" or "fair" tax should never be implemented into the economic system. The only proper way to pay for public goods is through a progressive tax system. It is the only fair system. Implementation of "Fair" or "Flat" tax systems will to pay for public goods will ultimately result in "Torches and Pitchforks". It is a function of math.

Liberal Capitalism is the real problem in the U.S. The decline in economic prosperity is NOT due to the capitalistic backdrop of the economy but from the politics. The constitution is vital to the long term prosperity of the economy in the U.S. and in the next few years the current environment will reinforce and force positive changes to the current constitution.

Government must be reduced. The performance of the economy suffers whenever the overlap between economy and politics becomes too large. Innovation and a strong constitution are crucial for long term growth. The current path is destroying both.