Natural gas is making a big comeback. I don't mean the price, but its use as a vital fuel in the economy. Natural gas is right now the only fuel we have that can be used as a substitute for oil in transportation energy. Hydrogen is but a dream and electric cars are failing because they lack the features people are used to in gas engines. Those options are still on the table, but they're in the future, not the here and now. Natural gas will be the complementary transportation energy to oil for now and in the near future until a we find a better technology that doesn't require enormous trade-offs to implement.

Natural gas in the U.S. is so cheap it has become a substitute for coal in grid power. And coal is still really cheap. The advances in fracking gas have increased supplies and production rates to the point that it is the cheapest and cleanest of the fossil fuels, which comes at a good time. As I wrote in Beyond Thunderdome, oil is getting harder to extract and, therefore, more expensive. We have enough left for the short term, but it is high time we identify serious alternatives if we don't want to go back to the horse and bugy.

Huge Supply

The CIA estimates we have over 6 quadrillion cubic feet of proved natural gas reserves worldwide. Quoted:

Proved reserves are those quantities of natural gas, which, by analysis of geological and engineering data, can be estimated with a high degree of confidence to be commercially recoverable from a given date forward, from known reservoirs and under current economic conditions.

A quadrillion is a lot of something. The number is hard to imagine, even in the era of 'a trillion this-and-that'. A quadrillion is 1000 times a trillion. Here is a quadrillion dollars on pallets stacked against the tallest building in the world, Burj Dubai. Now think of every dollar bill as a cubic foot of natural gas and the resource image gets several iterations larger.

Natural gas is in abundance at the moment and it may help address our most pressing current energy dilemma, transportation fuel. If we didn't have this cheap and clean fuel, our entire life quality paradigm would change much more quickly than it already has.

Natural gas reserves are distributed fairly well globally with some denser concentrations in Russia and the middle east.

world.bymap.org

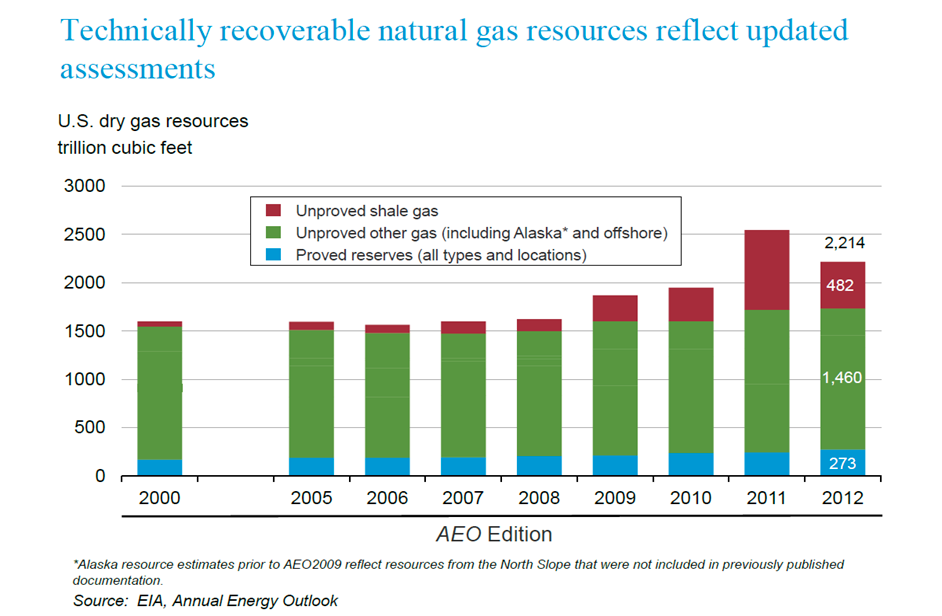

The U.S. has quite a large store by itself. See the following chart provided by the Energy Information Administration in its Annual Energy Outlook presentation.

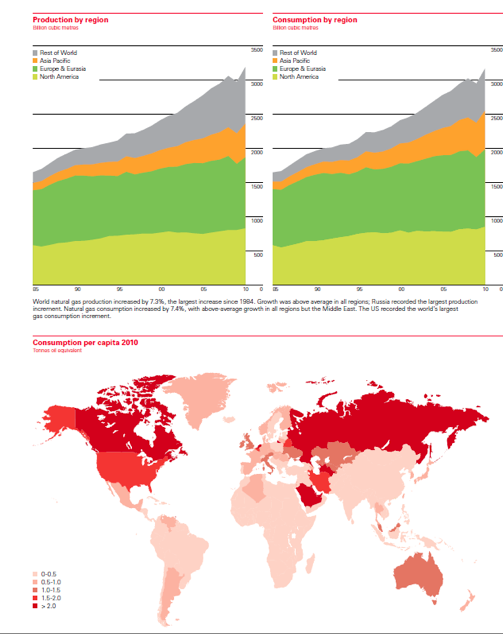

BP has done the work for us on global gas demand and supply.

As we can see, production keeps up with demand quite nicely without a huge spike in the price. There was a short-term demand spike in natural gas a few years ago, but production ramped so fast that the spike is now a trough.

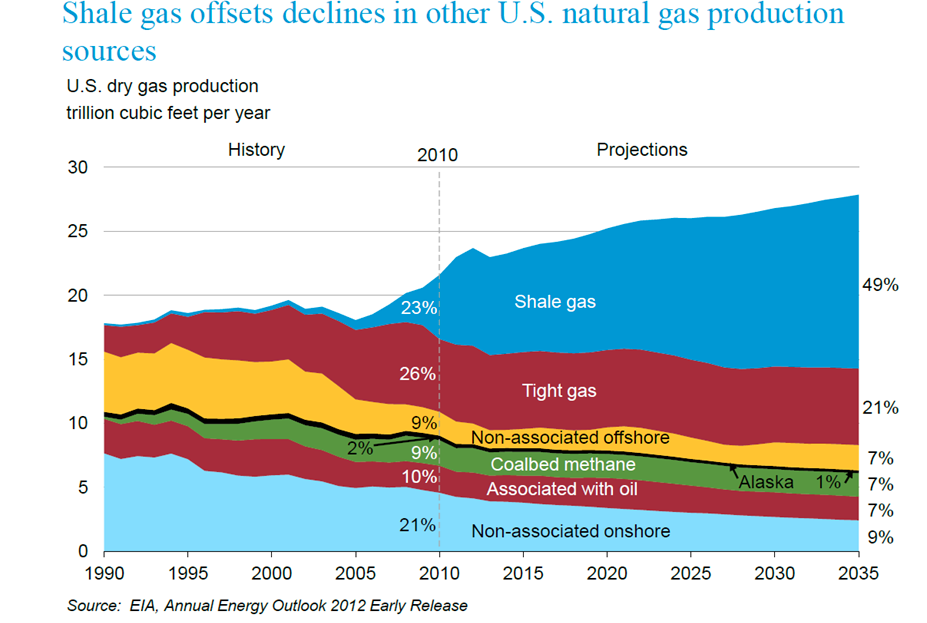

And now for another chart from the EIA showing that U.S. production is humming right along.

The argument is clear: Natural gas is our best current alternative transportation fuel. But how much of an impact can natural gas have on the energy space?

We have to start with some assumptions to answer the question. One, that my hypothesis about thorium is correct and that a cheaper, cleaner grid energy is on the way in a relatively short time frame (5-7 years), meaning coal and natural gas eventually get edged out as primary grid power. We have to also assume that there are no infrastructure and conversion costs to a natural-gas switchover in cars and trucks. We'll get to those costs in a bit, but for now I want to ignore them to give the best-case scenario for natural gas adoption as a transportation fuel source.

Usage And Growth Rates

At current global oil usage and growth rates over the last 25 years (1.6% growth annually), we double our use of fuels every 45 years. That doesn't seem significant at first until you realize we have already been through the first couple of doubling periods and are closing on another.

Note that while some economies in the emerging world are increasing rates of fuel usage faster, at the end of the day, the global needle hasn't moved much in the past few decades.

So how long can natural gas last? We have to figure out how much oil is used for transportation, then compare that with what our Gasoline Gallons Equivalent (GGE) available in natural gas.

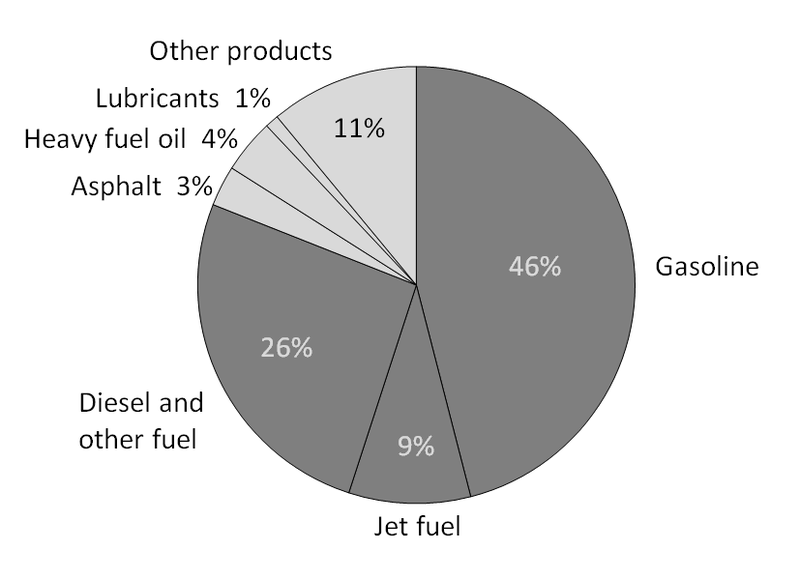

Here's a chart showing the typical breakdown in U.S. crude oil products for every barrel of oil produced.

About 72% is used in diesel and gas products for cars and trucks. We'll ignore jet fuel for now as the conversion of jets to natural gas is not immediately likely.

Usage By The Numbers

We know the world uses about 88 million barrels of oil a day, so about 63 million barrels per day go to car and truck transportation. Each barrel has 42 gallons, which comes to 2.6 billion gallons of gasoline/diesel per day, or roughly 960 billion gallons of gasoline/diesel per year.

The GGE of natural gas for one gallon of gasoline is 126.7 cubic feet. Given that we have 6.5 quadrillion cubic feet of gas reserves, that equates to 51 trillion GGE (6.5 quadrillion/126.7 GGE ).

With 51 trillion GGE, the world could transport itself at current usage, plus current growth of 1.6% per year, for 250 years. That's quite a reservoir of energy to draw from. I think that's what changes the debate on oil as our primary source of energy.

Conversion Costs

Now back to costs. Popular Mechanics estimated that a gas station would spend about $750,000 on conversion costs to a natural gas system. We have about 130,000 gas stations in the U.S. So, it would cost around $97 billion to convert every station. Of course, the costs would be spread out over a number of years, perhaps even a decade.

How much does it cost to convert a vehicle? People have done it for about $1000 themselves for a two-gallon unit allowing 50 miles per fill-up. For about $1600, a person can convert to a 5.5 gallon system that would more than take care of daily driving needs for the vast majority of people. Installed professionally, $2500 would be the most anyone would pay to convert their car to a gasoline/natural-gas hybrid.

It has also been reported that prices are much cheaper in third world countries, which have higher rates of natural gas cars already on the road, meaning costs fall pretty quickly as more units are installed.

Savings Time frame

The average savings of natural gas per GGE, based on gasoline and natural-gas pump rates, is currently sitting at around $1.00 ,or so, per gallon. Depending on the system and options used to install the conversion, the payoff could be between two-to-four years on a car getting 25mpg at 15,000 miles per year. I could think of worse investments.

The world has over 1 billion cars, according to the Huffington Post. Assuming all cars have to be converted using a $1500 system, that is a price tag of about $1.5 trillion for the entire world's fleet.

New CNG cars cost anywhere from $3500 to $5000 more than their gas counterparts, but given economies of scale, that number should come done substantially given a large move to CNG vehicles.

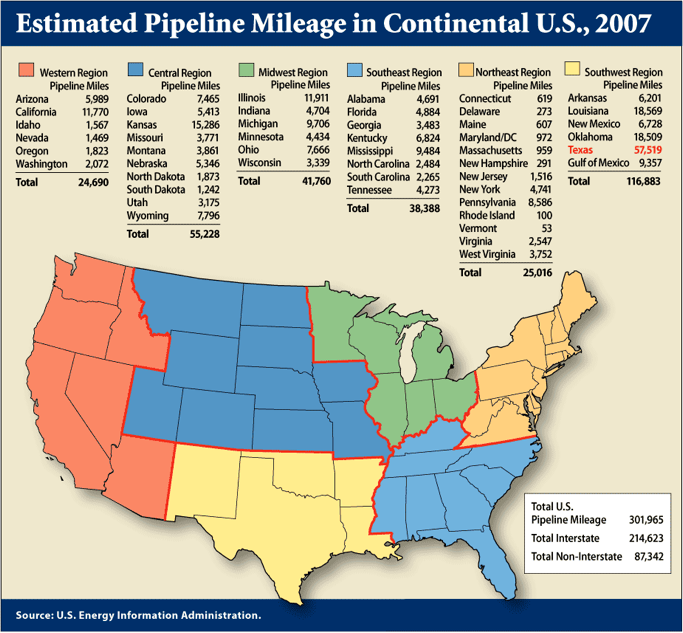

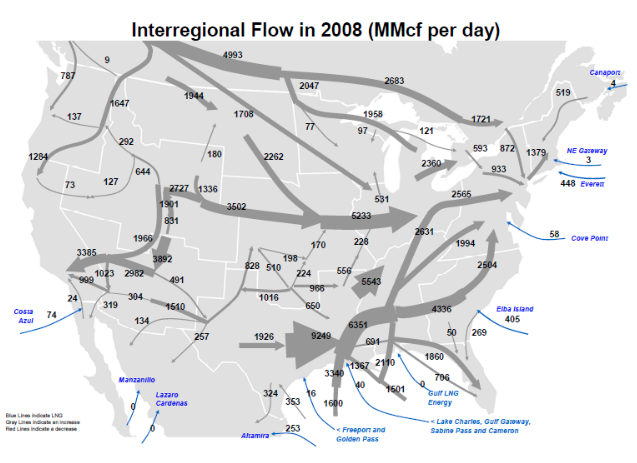

Then we have the infrastructure. Natural-gas pipelines are not cheap. But, 64% of the world's pipelines are already pumping natural gas compared to 17% for oil. The U.S. has an extensive pipeline network.

Natural-gas pipeline construction costs are about $60k per inch mile, according to the Intrastate Natural Gas Association of America (INGAA).

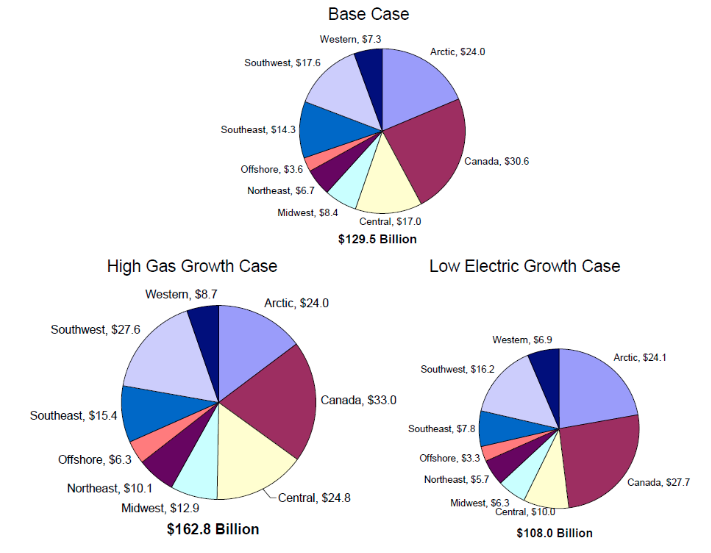

At current rates, between 1000 and 1,500 miles of new pipe are expected to be built between the U.S. and Canada through 2030, given current rates. At least $160 billion in pipeline expenditures are expected annually until 2030 including those needed in the arctic.

If the nation converts it's fleet of cars and trucks, that will increase significantly. Pipelines are by far the safest way to transport natural gas, though trucking it regionally shouldn't be ruled out.

The INGAA estimates current pipeline costs in three scenarios.

It's impossible to tell what the total pipeline expenditures would be for a conversion process of the world's fleet of cars to natural gas from oil, but it would conservatively be in the hundreds of billions of dollars.

If we estimate a $2 trillion total, all-in cost of oil to NG conversion, we are probably in the right ballpark. If we compare that to the $1.2 trillion the U.S. alone has spent on war in the Middle East, then about 60% of that world conversion cost could have been paid for already. We could have been well on our way.

The numbers are big, but so are the payoffs. Natural gas is cleaner and very abundant. We have enough oil to see us through a transition to natural gas. Inotherwords, we have enough of both fuels to use for transportation for the foreseeable future. That is not a bad situation and it is certainly not as apocalyptic as many analysts make it seem.

If our anticipated grid solutions in thorium nuclear work out, we will have plenty of safer and cheaper energy options for us and a few succeeding generations to come.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Answer To Oil's Dilemma? Natural Gas

Published 08/08/2012, 11:49 AM

Updated 07/09/2023, 06:31 AM

The Answer To Oil's Dilemma? Natural Gas

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.