“If you limit your choices only to what seems possible or reasonable, you disconnect yourself from what you truly want, and all that is left is compromise.” - Robert Fritz

On March 21 here on Investing.com, I wrote an article titled “The Curious Disconnect between Gold And Gold Miners” in which I noted that Gold had been significantly outperforming Gold Miners despite the stock side of the equation supposedly acting as a “leveraged” play to rising precious metal prices. Equities had had their best first quarter in years then, and yet gold stocks failed to outpace Gold itself. I ended the article by asking the question: “Could Miners be warning of further weakness in Gold prices to come?”

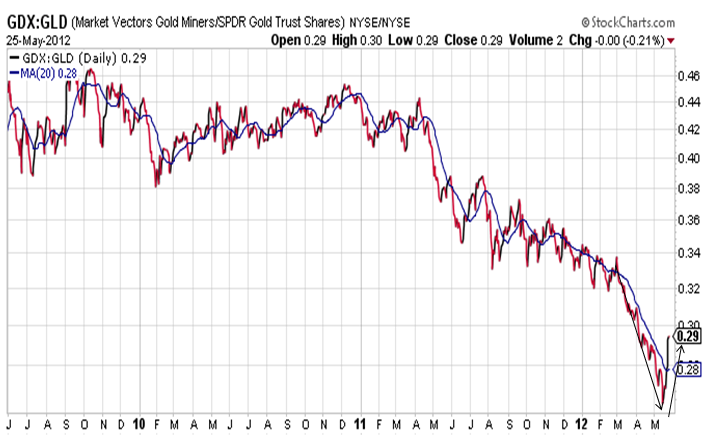

Gold did indeed fall, particularly as the May correction post European elections in worldwide stock and commodity indices picked up speed on the downside. Gold Miners, however, fell quite a bit more as broad “risk-off” sentiment took hold. Interestingly enough, the last few days seem to suggest a reversal may be at hand. Take a look below at the price ratio of the Market Vectors Gold Miners ETF (GDX) relative to the SPDR Gold Trust ETF (GLD). As a reminder, a rising price ratio means the numerator/GDX is outperforming (up more/down less) the denominator/GLD.

First, notice how Gold Miners began underperforming Gold in early 2011, with a severe decline occurring from March to early May of this year. It can be argued that the decline had exhausted itself in a capitulation-like move, given that the far right of the chart shows a stunning period of relative price strength has occurred in the past several days. The formation could be an early stage “V” of strength.

What could be the catalyst for such a move? Given the growing possibility of Greece leaving the Euro (FXE), it could very well be that bets are growing that Gold prices will recover on a “flight to safety” trade as the European financial crisis potentially worsens. Either way, Gold Miners seem to be reconnecting with the underlying Gold price.

Disclosure: This writing is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction, or as an offer to provide advisory or other services by Pension Partners, LLC in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Pension Partners, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Curious Reconnect Between Gold And Gold Miners

Published 05/28/2012, 12:44 AM

Updated 07/09/2023, 06:31 AM

The Curious Reconnect Between Gold And Gold Miners

Michael A. Gayed

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.