The US housing's bubble and its spectacular end left a indelible mark on people's view of residential property markets. Sadly the idea of a "permanent" US housing market decline has been drummed into the heads of numerous, often well educated and otherwise open-minded people. Hoards of angry bloggers keep spewing the same line over and over again - housing prices will fall "forever" because of the shadow inventory, etc., etc. People, including many in academia, would deny a housing market improvement even if it stared them in the face. Positive housing news cause many to experience what psychologists call "cognitive dissonance", as they desperately attempt to rationalize away the data that doesn't conform to their views.

The housing market bottom has to come some time, and as predicted at the beginning of the year (which really angered some of the folks described above), 2012 seems to be that year. Nobody is talking about a recovery of prices to the bubble years or even a robust growth in housing. We all know the issues. But on average across the US, home price declines have stopped.

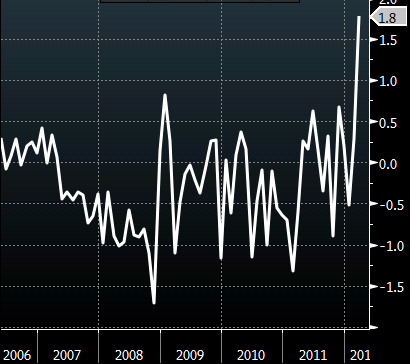

Multiple data points are now suggesting that is indeed the case. A sudden spike in the FHFA housing price index is one of those points. A 1.8% monthly increase in March is the largest monthly move in recent years.

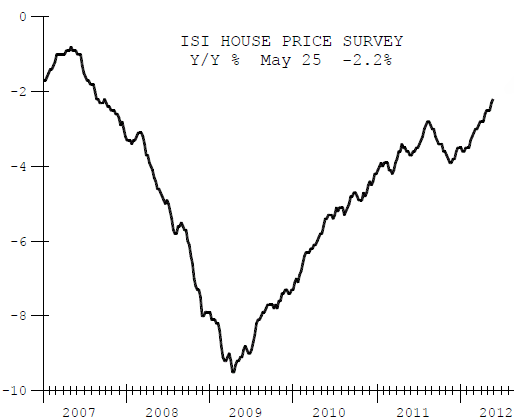

Our friends at ISI Group are continuing to see more recent improvements in April and May in their house price survey. That is in spite of otherwise jittery economic conditions in the US and the mess in Europe. Of course year over year the index is still down - we are not expecting any miracles here. But on a month-over month basis, the trend is unmistakable. This and other housing indices will be up from current levels this time next year.

ISI Group: - House prices are continuing to improve in may. ISI's house price survey, which covers over 40 residential real estate agents around the country, continued to improve this week, suggesting existing house prices, which surged in April, improved further in May.

There are other indicators pointing to improvements, such as the stabilization in lumber prices in spite of the recent sharp drop in commodity prices.

Perhaps the best data point would be to hear it from the people on the ground - the realtors. The National Association of Realtors maintains a tremendous database and has done a thorough job in monitoring the health of the housing market. Their latest results indicate that distressed sales are beginning to taper off, the number of first time buyers is increasing, and prices are stabilizing.

NAR: - Lawrence Yun, NAR chief economist, said the housing recovery is underway. “It is no longer just the investors who are taking advantage of high affordability conditions. A return of normal home buying for occupancy is helping home sales across all price points, and now the recovery appears to be extending to home prices,” he said. “The general downtrend in both listed and shadow inventory has shifted from a buyers’ market to one that is much more balanced, but in some areas it has become a seller’s market.”

Here is the video

http://link.brightcove.com/services/player/bcpid1465406675?bctid=1650963263001

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Us Housing Market Is Beginning To Recover

Published 05/28/2012, 03:19 AM

Updated 07/09/2023, 06:31 AM

The Us Housing Market Is Beginning To Recover

Latest comments

When You plan to move from your home in the next few years dont refinance your mortgage, use tools from 123 Refinance they make it easy to check your current loan and provide you the solution

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.