Since the US auto industry had its best sales quarter in 4 years in Jan-March, and overall world sales are also expected to increase in 2012, you’d think that auto parts companies would be fairly valued already. But, that’s not the case, even with standout growth apparent in some firms. We found 2 solid dividend paying stocks within this sub-industry that are undervalued on many metrics: Magna International, (MGA), a Canadian firm, and Standard Motor Products, (SMP), a US firm. Magna sells its parts to Original Equipment Manufacturers, and Standard sells its parts in both the aftermarket segment and also to Original Equipment Manufacturers. (More detailed profiles are at the end of this article.)

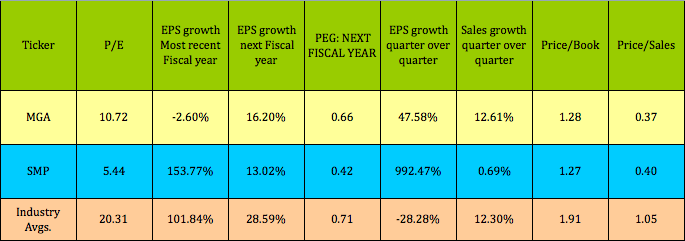

Both of these dividend stocks had strong growth in their most recent quarter, and have good growth forecasts for their next fiscal year. However, their P/E’s are way below industry avgs., making them look undervalued on a PEG ratio basis. MGA’s current 10.72 P/E is approx. in the middle of its historic P/E range of 7.93 – 14.03, while SMP’s 5.44 P/E is actually below its historic range of 7.24 – 27.97. Both stocks are also cheap on a Price/Book and Price/Sales basis:

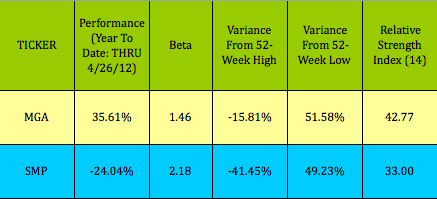

Even though it’s up over 35% in 2012, MGA still looks undervalued. SMP is down over -24% this year:

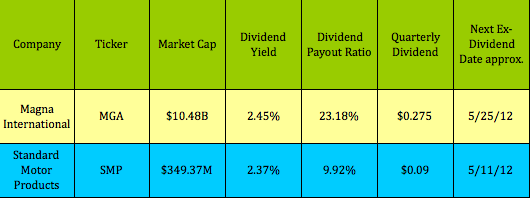

Dividends: MGA and SMP both increased their quarterly dividends in 2011 and 2012 – MGA went from $.18 in 2009, to $.25 in 2011, and raised it again, to $.275, in 2012. SMP raised its dividend from $.05 to $.07 in 2011, and again to $.09 in 2012:

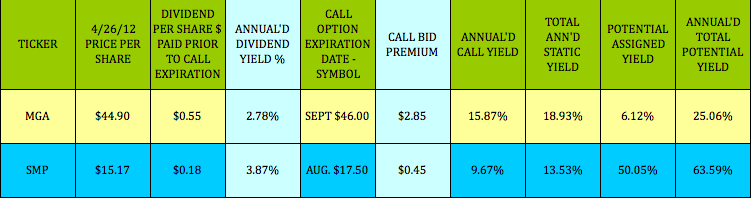

Covered Calls: Want to rev up the dividend yield on these stocks? You can do it via selling covered call options: Both stocks have relatively high options yields which you can use to turn them into short term high dividend stocks. MGA’s call options yields outpay its next 2 quarterly dividends by over 5 to 1. Click here for a blow-by-blow outline of selling covered calls.

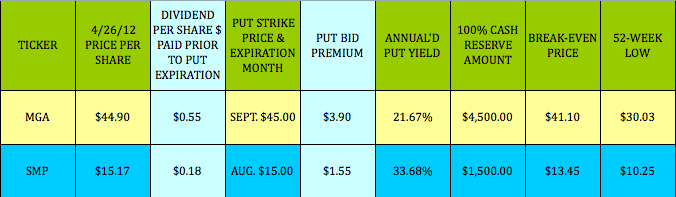

Cash Secured Puts: This is a strategy to use if you want to earn some option income now, with the potential of having a stock put, (sold), to you in the future.

SMP has higher put options yields in the 2 trades listed below. SMP’s August $15.00 put currently pays just over 10%, on a 4-month term, for a very high annualized yield of over 33%.

You’re basically getting paid to wait, with the possiblity of having SMP put/sold to you at the $15.00 strike price, if SMP goes below $15.00 at or near expiration. However, your break-even cost would be $13.45, due to the $1.55 put premium you received when you made the put sale. As with the calls, these put options pay a lot more than the dividends do over the next 4-5 months. (Note: Put sellers don’t receive any dividends.)

Unlike selling covered calls, when selling cash secured put options, you don’t buy the underlying stock first. Instead, your broker will “secure”, i.e. hold, an amount equal to 100 times the strike price of the put option you sell. In the SMP example below, you’d sell 1 $15.00 put option.

Since each option corresponds to 100 shares of the underlying stock, your broker would hold $1500.00 for every $15.00 put option that you sell. At expiration time in August, you’ll either end up with 100 shares of SMP being sold to you, or the $15.00 put will expire worthless.

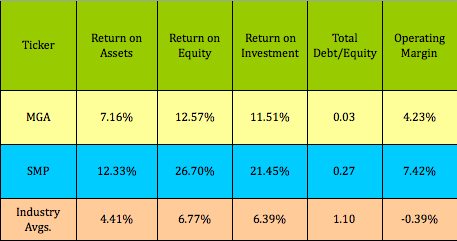

Financials: Both firms have better Mgt., debt, and margin metrics than industry avgs., but SMP is the winner in all categories, except for debt. SMP has a very impressive Interest Coverage ratio of 17.9:

Profiles:

Magna International: With 286 manufacturing operations and 88 product development, engineering and sales centers in 26 countries on five continents as of Q4 2011, Magna is the most diversified automotive supplier in the world. We design, develop and manufacture automotive systems, assemblies, modules and components, and engineer and assemble complete vehicles, primarily for sale to original equipment manufacturers (OEMs) of cars and light trucks in our three geographic segments – North America, Europe, and Rest of World (primarily Asia, South America and Africa).

Magna’s capabilities include the design, engineering, testing and manufacture of automotive interior systems; seating systems; closure systems; metal body & chassis systems; mirror systems; exterior systems; roof systems; electronic systems; powertrain systems as well as complete vehicle engineering and assembly. (Source: MGA website)

Standard Motor Products: SMP is a leading independent manufacturer, distributor and marketer of replacement parts for motor vehicles in the automotive aftermarket industry, with an increasing focus on the original equipment and original equipment service markets. The company is organized into two major operating segments, each of which focuses on a specific line of replacement parts. The Engine Management Segment manufactures ignition and emission parts, ignition wires, battery cables and fuel system parts. The Temperature Control Segment manufactures and remanufactures air conditioning compressors, air conditioning and heating parts, engine cooling system parts, power window accessories, and windshield washer system parts. We also sell our products in Europe through our European Segment.

SMP sells primarily to warehouse distributors, large retail chains, original equipment manufacturers and original equipment service part operations in the United States, Canada and Latin America. Our customers consist of many of the leading auto parts retail chains, such as Advance Auto Parts, AutoZone, O’Reilly Automotive/CSK Auto and Pep Boys. (Source: SMP website)

Disclosure: Author had no positions at time of writing this article.

Disclaimer: This article is written for informational purposes only and isn’t intended as investment advice.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Two Auto Parts Dividend Stocks With Undervalued Growth

Published 04/29/2012, 12:11 AM

Updated 07/09/2023, 06:31 AM

Two Auto Parts Dividend Stocks With Undervalued Growth

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.