Over the past few weeks, the market has shifted its attention from Europe’s sovereign debt crisis to the U.S. fiscal cliff. Since we are beginning to hear people in the financial markets use the words “fiscal cliff,” it is important for us to explain exactly what it is and why it is such a major concern.

In our education center, we always try to explain concepts in as easy to understand a manner as possible so we start with breaking the two words down:

“Fiscal Cliff”

The word “fiscal” refers to the financial health of a country, which is determined by subtracting the amount of revenue that a country takes in through taxes and other activities minus the amount that the country spends. If the sum is negative, the country ends up with a fiscal deficit and if it is positive, the country has a fiscal surplus. The difference between what a country spends and what it collects is generally made up through the sale of government bonds. A country that runs a large deficit will need to sell a lot more bonds than a country that runs a small deficit.

A “cliff” is basically a steep rock face. The “fiscal cliff” is a ticking time bomb that the U.S. government needs to deal with by the end of the year. Tax cuts and mandatory discretionary spending plans enacted by former President George W. Bush are set to expire at exactly the same time in January 2013. If Congress does not extend these cuts before they go into effect at the beginning of 2013, Americans could be hit with a hefty increase in taxes and reduction in government spending that could lead to a sharp pullback in growth.

At more than $600 billion or the equivalent of 5% of GDP, the fiscal cliff of currently legislated spending and tax cuts could push the U.S. economy back into recession. It is estimated that in states such as New York, New Jersey and Connecticut, the average taxpayer could be forced to shell out another $5,000 in taxes next year, which is no small sum.

Just imagine how you would feel and act as a consumer if you knew that you would have to pay another $5,000 in taxes next year.

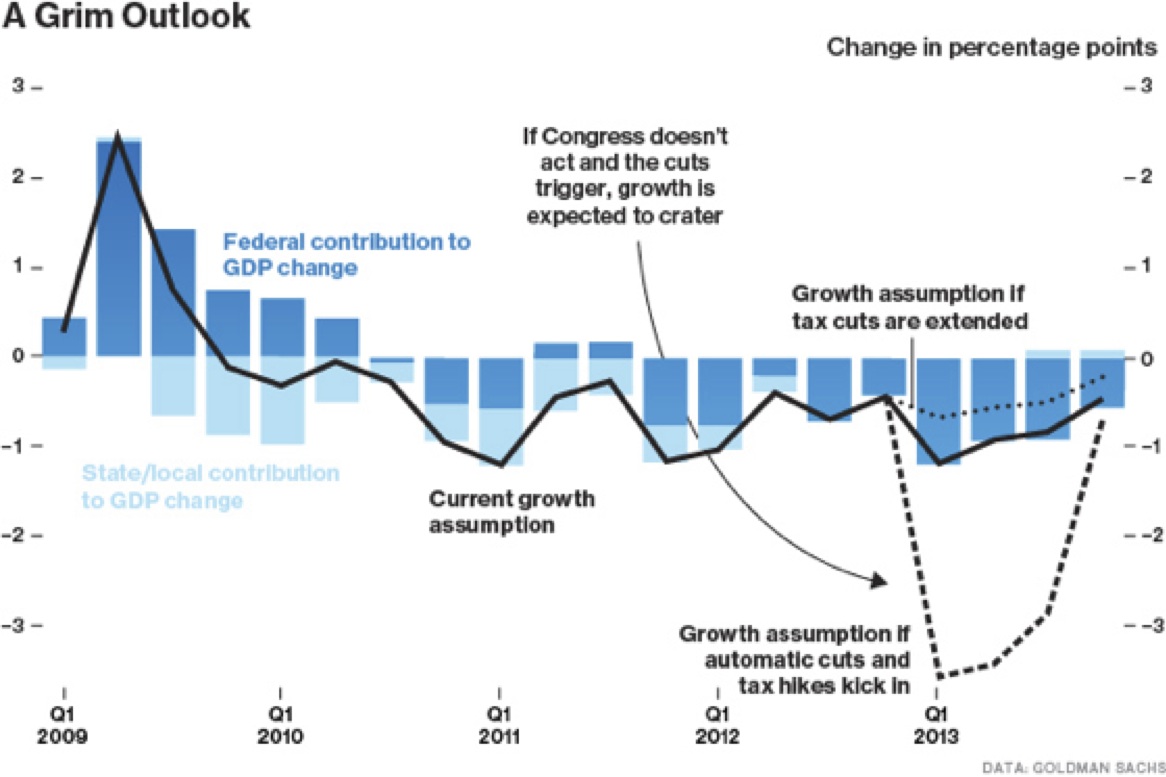

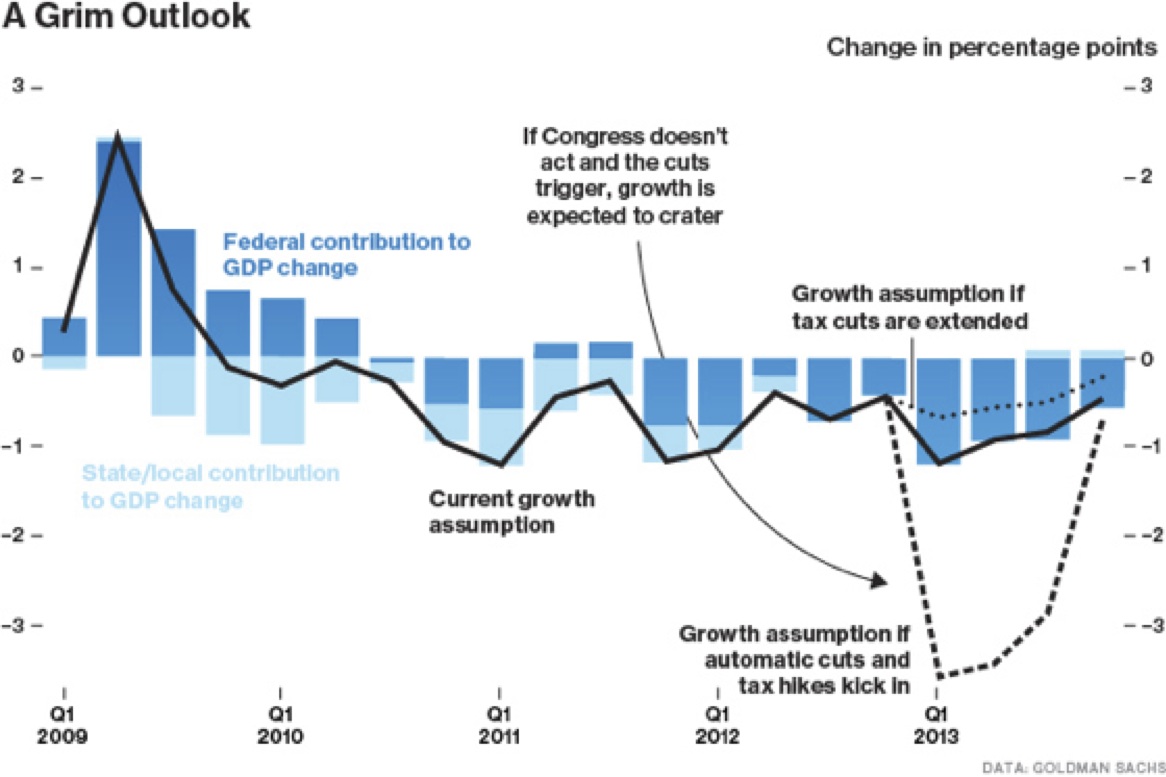

The people at Bloomberg using Goldman Sachs data has put together a fantastic graphic illustrating how the U.S. economy would perform if the tax cuts are extended and if they are expired. As you can see, if the tax cuts are extended, the economy would continue to recover at a faster pace in 2013. If the automatic cuts and tax reductions expire, it is widely believed that the U.S. would fall into recession early next year with growth contracting as much as 4% in the first half of 2013. According to a report commissioned by the Aerospace industry, federal budget cuts could cost the country more than 2 million jobs and raise the unemployment rate by 1.5%.

Congress can disarm the time bomb and they have had years to do so but unfortunately the highly partisan nature of the current political environment has led to very little progress. The election is less than 3 months away in November, which means reaching a compromise could be even more difficult. Everyone knows that the fiscal cliff poses a major risk to the U.S. economy but Republicans want to cut spending and avoid raising taxes while the Democrats want to combine spending cuts with higher taxes on the wealthy.

Don’t expect any solutions until after the November elections, when we know which political party will lead the country. By that time however it may be too late to act, leaving Congress with no option but to elect for stopgap measures. On August 2nd, Senate Majority Leader Harry Reid and the Speaker of the House John Boehner said they have reached an agreement with President Obama on a 6 month stop-gap spending bill for the 2013 fiscal year.

They said that lawmakers will write up the deal in August so Congress can pass the bill in September. At the end of this week, lawmakers depart for a 5-week recess. When they return, they will be in session for only 3 weeks before the November 6 election and must pass a stop-gap funding measure to avoid a government shutdown after the September 30 end of the fiscal year.

In our education center, we always try to explain concepts in as easy to understand a manner as possible so we start with breaking the two words down:

“Fiscal Cliff”

The word “fiscal” refers to the financial health of a country, which is determined by subtracting the amount of revenue that a country takes in through taxes and other activities minus the amount that the country spends. If the sum is negative, the country ends up with a fiscal deficit and if it is positive, the country has a fiscal surplus. The difference between what a country spends and what it collects is generally made up through the sale of government bonds. A country that runs a large deficit will need to sell a lot more bonds than a country that runs a small deficit.

A “cliff” is basically a steep rock face. The “fiscal cliff” is a ticking time bomb that the U.S. government needs to deal with by the end of the year. Tax cuts and mandatory discretionary spending plans enacted by former President George W. Bush are set to expire at exactly the same time in January 2013. If Congress does not extend these cuts before they go into effect at the beginning of 2013, Americans could be hit with a hefty increase in taxes and reduction in government spending that could lead to a sharp pullback in growth.

At more than $600 billion or the equivalent of 5% of GDP, the fiscal cliff of currently legislated spending and tax cuts could push the U.S. economy back into recession. It is estimated that in states such as New York, New Jersey and Connecticut, the average taxpayer could be forced to shell out another $5,000 in taxes next year, which is no small sum.

Just imagine how you would feel and act as a consumer if you knew that you would have to pay another $5,000 in taxes next year.

The people at Bloomberg using Goldman Sachs data has put together a fantastic graphic illustrating how the U.S. economy would perform if the tax cuts are extended and if they are expired. As you can see, if the tax cuts are extended, the economy would continue to recover at a faster pace in 2013. If the automatic cuts and tax reductions expire, it is widely believed that the U.S. would fall into recession early next year with growth contracting as much as 4% in the first half of 2013. According to a report commissioned by the Aerospace industry, federal budget cuts could cost the country more than 2 million jobs and raise the unemployment rate by 1.5%.

Congress can disarm the time bomb and they have had years to do so but unfortunately the highly partisan nature of the current political environment has led to very little progress. The election is less than 3 months away in November, which means reaching a compromise could be even more difficult. Everyone knows that the fiscal cliff poses a major risk to the U.S. economy but Republicans want to cut spending and avoid raising taxes while the Democrats want to combine spending cuts with higher taxes on the wealthy.

Don’t expect any solutions until after the November elections, when we know which political party will lead the country. By that time however it may be too late to act, leaving Congress with no option but to elect for stopgap measures. On August 2nd, Senate Majority Leader Harry Reid and the Speaker of the House John Boehner said they have reached an agreement with President Obama on a 6 month stop-gap spending bill for the 2013 fiscal year.

They said that lawmakers will write up the deal in August so Congress can pass the bill in September. At the end of this week, lawmakers depart for a 5-week recess. When they return, they will be in session for only 3 weeks before the November 6 election and must pass a stop-gap funding measure to avoid a government shutdown after the September 30 end of the fiscal year.