Two weeks ago, we looked at the possibility of a Canadian housing bubble, and saw that Vancouver looked particularly bubble-icious in terms of new inventory. This is often a good indicator, as builders in a free, capitalist society should only overbuild if they are getting a strong price signal to do so. But of course, it is possible that builders are just irrationally overbuilding for some reason (e.g. government stimulus, tax credits, expectations of price increases etc.), so it does make sense to look at more metrics than just new home inventory before concluding that there is a price bubble.

The ratio of house prices to income levels is another useful metric for judging how expensive houses are relative to a historical standard. Canada-wide, this ratio is elevated, but perhaps not dramatically so. Recall from last week, however, that there is considerable variability with respect to housing data within the country. It, therefore, makes sense to look at this ratio for specific regions in order to identify trouble spots.

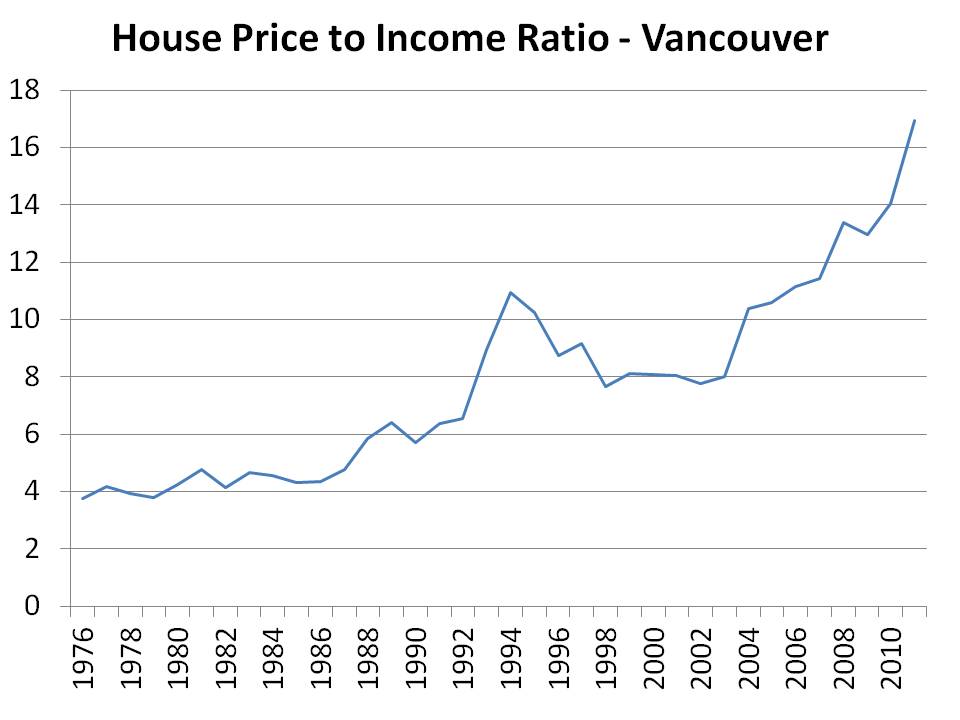

Considering Vancouver has the highest house prices in the country, it makes sense to start there. Consider the house price to income ratio* in Vancouver over the last 35 years:

That is a scary chart. For this ratio to be back in line with its levels of just 10 years ago, prices will have to fall by 50% or incomes rise by 100%...which of those is most likely? The former. Though this ratio can continue to rise for a while, with cheap money funding further asset purchases, it can't go on forever. At some point, it seems very likely that some heavy pain will be felt in this region.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Vancouver Housing Bubble: Part 2

Published 02/29/2012, 02:06 AM

Updated 07/09/2023, 06:31 AM

Vancouver Housing Bubble: Part 2

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.