The media has been replete with commentary lately about the bottom in housing and the coming recovery in 2012. Of course, this is the same siren's song that we heard in 2010 and 2011 and many a soul were dashed against the rocks of further declines. In this past weekend's missive we talked about the 5 reasons why the bottom in housing is not in and why further declines are likely coming from the massive overhang, and ultimate liquidation, of foreclosures.

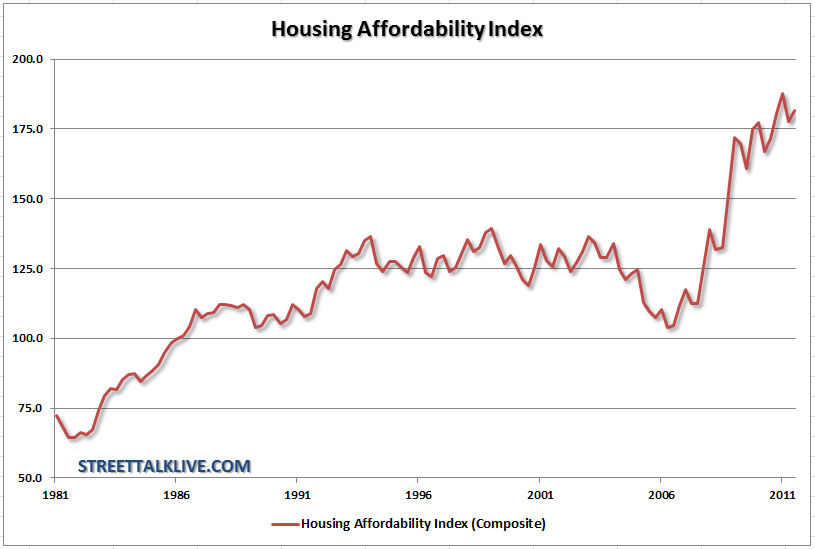

One of the points that has really gnawed at me as of late is the National Association of Realtor's (NAR) Housing Affordability Index.This index has been pointed to many times by the mainstream media as evidence that a recovery was at hand as "affordability" has never been higher.Nothing could be further from the truth. Before I get into the "why" let me explain the index.

According to the NAR the index: "Measures the degree to which a typical family can afford the monthly mortgage payments on a typical home. Value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment."

Looking at the index today, as it hovers near 180, would obviously support the case of individuals having more than sufficient income to afford a home. If that is the case, with 30-year mortgage rates at historic lows, why would there NOT be another boom in housing? After all, with the historic low mortgage rates coupled with deflated home values surely imply that this is the time to buy, right? Not so fast.

The problem with the index is that it assumes two things: 1) that a family with the median income (roughly $55,000) can QUALIFY for a mortgage of a median priced home; and 2) that they have SAVED the required 20% down. In today's credit constrained environment due to the financial crisis which has left the major banks saddled with millions of homes that are delinquent or in foreclosure, there is little reason to lend money to borrowers who can't meet very stringent qualification requirements.

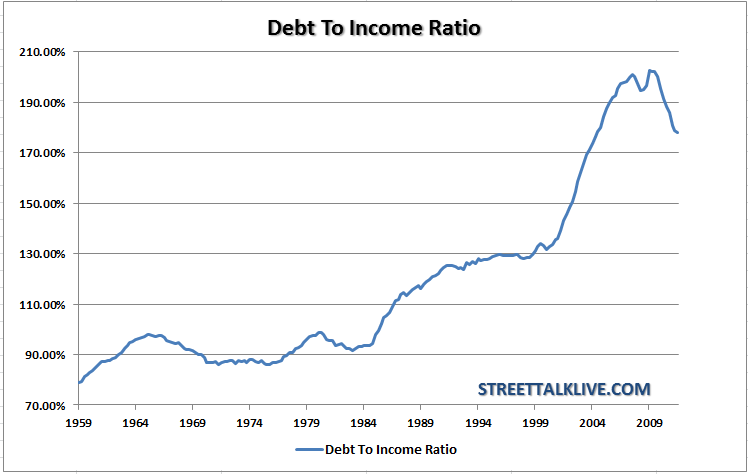

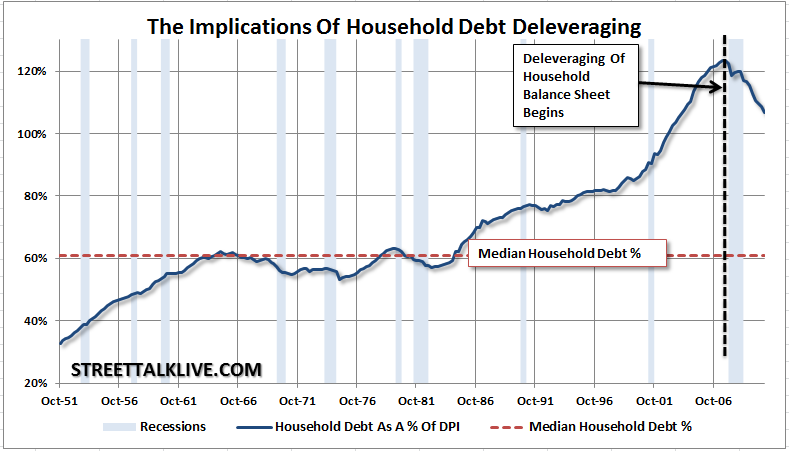

This is what the Housing Affordability Index misses entirely. The issue isn't whether or not individuals want to buy a home - the reality is that they simply can not afford it. This realization that debt to income ratios for the average American are at levels that strain budgetary capabilities; the reality of home affordability begins to set in.

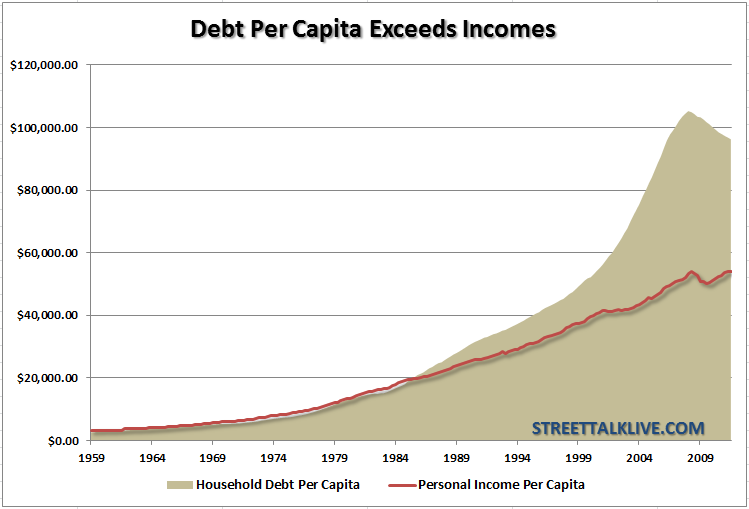

The ability for a potential buyer to qualify for a mortgage in today's post bubble environment is exceedingly difficult. While lending standards have tightened significantly over the past couple of years; the real issue is the level of current indebtedness that is keeping buyers from qualifying for loans. If we take the level of household debt and divide it between every single American over the age of 16 it comes to $96,229 per person. This versus income of $54,110 before taxes. With a debt to income ratio of 177.8% on average just making ends meet becomes more difficult - much less qualifying for a mortgage.

Secondly, assuming that the median sales price of a home is currently $214,000 (according to the Census Bureau) then a 20% down payment of $42,800 would be required. The problem is that with a personal savings rate of currently 3.5% it would take an individual roughly 20 years to save up for the down payment on a home. This is why the last housing boom required a rash of programs that required no money down, few credit checks and a lot of "hope". The majority of loans were made to individuals that really couldn't afford the home in the first place.

However, with little or no money down, 2nd liens and lax lending standards the seeds to the financial crisis were sown. Today, the reality is that houses are NOT affordable by the average American and will not be for quite some time until the debt to income ratios come back to realistic and manageable levels.

With "real" unemployment still very high, incomes stagnant and costs of living rising, the inherent pressures on disposable income continue to rise. With a low savings rate and little money in the bank for most Americans, the allure of low interest rates and lower home prices won't solve the problem of affordability.That is going to just take a lot more time.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Why Housing Is Actually Not Affordable

Published 01/21/2012, 01:53 AM

Updated 02/15/2024, 03:10 AM

Why Housing Is Actually Not Affordable

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.