Investing.com – U.S. stock futures pointed to a higher open on Wednesday, boosted by robust corporate earnings and as markets awaited the conclusion of a key policy setting meeting by the Federal Reserve later in the day.

Dow Jones Industrial Average futures pointed a gain of 0.2%, the S&P 500 futures climbed 0.35%, while Nasdaq 100 futures indicated an increase of 0.55%.

The Fed’s Open Market Committee was widely expected to continue its policy of targeting a federal-funds rate between 0% and 0.25% and its plan to purchase USD600 billion of government debt by the end of June.

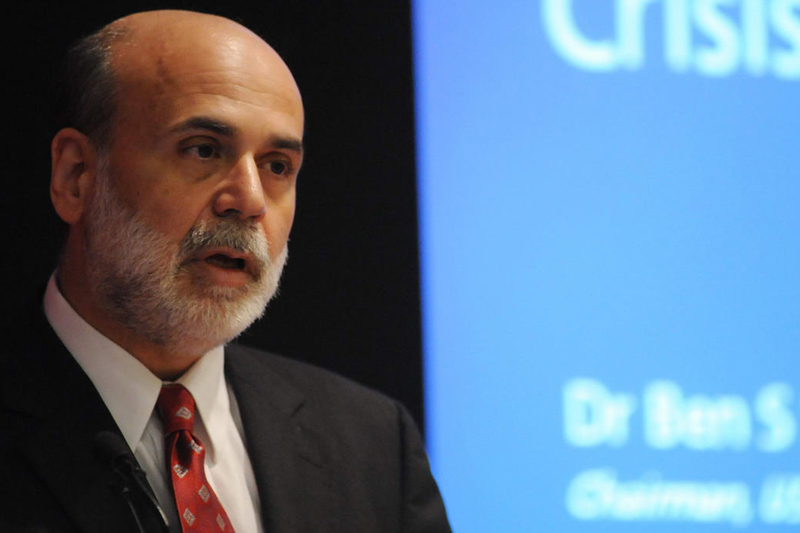

The two-day FOMC meeting was to be followed by the first-ever post-meeting press conference by Fed chief Ben Bernanke in the central bank’s 97-year history.

Meanwhile, the world’s largest aircraft manufacturer Boeing saw shares climb 1.1% to hit a 52-week high in pre-market trade after it reported a 13% increase in first quarter earnings, helped by a significantly lower tax rate. The company affirmed its full-year earnings outlook and said it expected to start deliveries of its new 787 Dreamliner during the third quarter.

The world’s largest appliance maker Whirlpool saw shares jump 4.2% after it said first quarter revenue rose 3% to USD4.4 billion, surpassing expectations for revenue of USD4.26 billion. The company reaffirmed its full-year earnings outlook, citing increased demand in emerging markets as well as a modest improvement in the key North American region.

Pharmaceutical giant GlaxoSmithKline rose 1.35% after it posted a 14% increase in first quarter profit. The firm lifted its dividend payout and said that it expected to generate sustainable reported sales growth in 2012.

Oil and gas major British Petroleum saw shares add 1.3% after it said first quarter net profit rose 17% to USD7.12 billion, boosted by higher oil prices.

On the downside, wireless microchip manufacturer Broadcom saw shares plunge 8% after it cut its second quarter earnings forecast, as leading customers such as Nokia and Samsung Electronics struggled to boost sales.

Amazon.com saw shares slide 1.2% after it reported a 33% drop in first quarter earnings. The world’s largest online retailer lowered its full-year earnings outlook due to large amounts of investments in new products and technologies, such as the Kindle electronic-book reader.

Other stocks in focus included online auctioneer eBay and the world’s largest coffeehouse chain Starbucks, which were both expected to release earnings after Wednesday’s closing bell.

Across the Atlantic, European stock markets advanced, as upbeat earnings from Ericsson and Volkswagen boosted technology and auto shares. The EURO STOXX 50 climbed 0.78%, France’s CAC 40 rose 0.65%, Germany's DAX gained 0.75%, while Britain's FTSE 100 edged 0.2% higher.

During the Asian trading session, Japan’s Nikkei 225 Index closed 1.4% higher, as shares in Canon surged after reporting first quarter results.

Earlier in the day, official data showed that U.S. core durable goods orders rose less-than-expected in March, while durable goods orders, which include transportation items, rose more-than-expected.

Dow Jones Industrial Average futures pointed a gain of 0.2%, the S&P 500 futures climbed 0.35%, while Nasdaq 100 futures indicated an increase of 0.55%.

The Fed’s Open Market Committee was widely expected to continue its policy of targeting a federal-funds rate between 0% and 0.25% and its plan to purchase USD600 billion of government debt by the end of June.

The two-day FOMC meeting was to be followed by the first-ever post-meeting press conference by Fed chief Ben Bernanke in the central bank’s 97-year history.

Meanwhile, the world’s largest aircraft manufacturer Boeing saw shares climb 1.1% to hit a 52-week high in pre-market trade after it reported a 13% increase in first quarter earnings, helped by a significantly lower tax rate. The company affirmed its full-year earnings outlook and said it expected to start deliveries of its new 787 Dreamliner during the third quarter.

The world’s largest appliance maker Whirlpool saw shares jump 4.2% after it said first quarter revenue rose 3% to USD4.4 billion, surpassing expectations for revenue of USD4.26 billion. The company reaffirmed its full-year earnings outlook, citing increased demand in emerging markets as well as a modest improvement in the key North American region.

Pharmaceutical giant GlaxoSmithKline rose 1.35% after it posted a 14% increase in first quarter profit. The firm lifted its dividend payout and said that it expected to generate sustainable reported sales growth in 2012.

Oil and gas major British Petroleum saw shares add 1.3% after it said first quarter net profit rose 17% to USD7.12 billion, boosted by higher oil prices.

On the downside, wireless microchip manufacturer Broadcom saw shares plunge 8% after it cut its second quarter earnings forecast, as leading customers such as Nokia and Samsung Electronics struggled to boost sales.

Amazon.com saw shares slide 1.2% after it reported a 33% drop in first quarter earnings. The world’s largest online retailer lowered its full-year earnings outlook due to large amounts of investments in new products and technologies, such as the Kindle electronic-book reader.

Other stocks in focus included online auctioneer eBay and the world’s largest coffeehouse chain Starbucks, which were both expected to release earnings after Wednesday’s closing bell.

Across the Atlantic, European stock markets advanced, as upbeat earnings from Ericsson and Volkswagen boosted technology and auto shares. The EURO STOXX 50 climbed 0.78%, France’s CAC 40 rose 0.65%, Germany's DAX gained 0.75%, while Britain's FTSE 100 edged 0.2% higher.

During the Asian trading session, Japan’s Nikkei 225 Index closed 1.4% higher, as shares in Canon surged after reporting first quarter results.

Earlier in the day, official data showed that U.S. core durable goods orders rose less-than-expected in March, while durable goods orders, which include transportation items, rose more-than-expected.