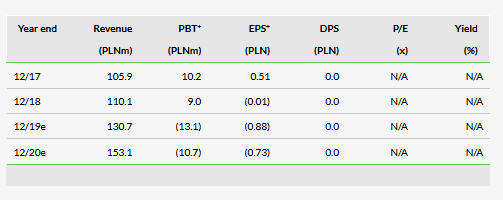

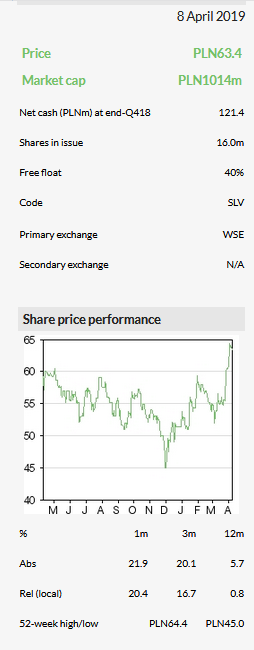

Selvita's (WA:SLVP) announcement of an intention to split into two separate companies was the hallmark event in the Q418 results presentation. By end of 2019, the drug discovery services and oncology R&D will be split into separate listed entities (subject to financial authorities and shareholders' approvals. We believe both businesses have sufficient momentum to sustain such a split. The profitable Services segment again delivered substantial sales growth of 34% in 2018. The R&D pipeline is progressing according to plan and two clinical trials with SEL24 and SEL120 could deliver data over 2019–2020. Our valuation is slightly higher than before at PLN1.34bn or PLN83.9/share.

A significant step in corporate history

With its Q418 results Selvita released a major announcement about its plans to split into two distinct companies. One company will provide drug discovery services while the other will focus on developing the innovative oncology compound portfolio, which roughly correspond to the current Services (including Ardigen) and Innovations business segments. Both companies will be listed on the Warsaw Stock Exchange. Selvita stated the rationale for the split is primarily related to the different risk and cash-flow profiles of the businesses. Because both parts of the company are mature enough to continue as separate entities, Selvita believes the timing for the split is right.

Services segment backlog indicates good 2019

Selvita’s reported total 2018 revenues of PLN110.1m (up 4% y-o-y) were largely in line with our expectations. Operating loss of PLN13.6m was slightly better than our expected PLN16.3m loss, as total operating expenses came in at PLN123.7m compared to our forecast PLN121.0m. As usual, Selvita released its first 2019 backlog with its Q418 results. The Services segment had already contracted revenues of PLN41.7m for 2019, up from PLN29.1m a year ago over the same period, which indicates another good year for this segment.

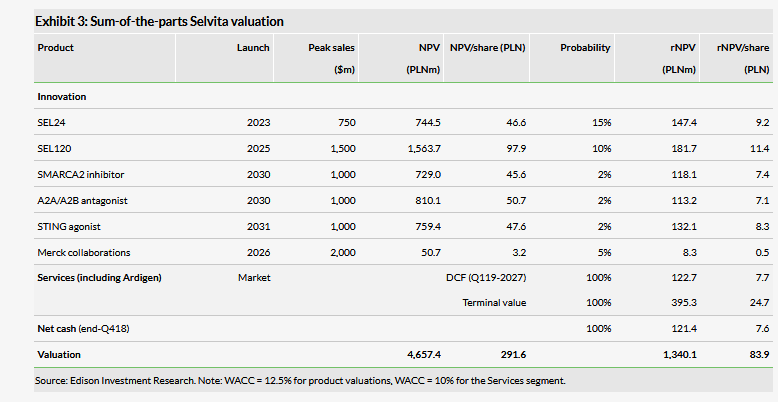

Valuation: Slightly up to PLN1.34bn or PLN83.9/share

Our valuation of Selvita is slightly higher at PLN1.34bn or PLN83.9/share versus PLN1.24bn or PLN77.6/share previously. Both the revision of the operating estimates and rolling the model forward had a small positive effect on the rNPV values of the R&D projects and the DCF. Data readouts from ongoing clinical trials with SEL24 and SEL120 should be released over 2019–2020.

Business description

Selvita is an R&D and drug discovery services company. It operates three business segments: Innovations Platform (internal R&D pipeline), Research Services (medicinal chemistry/biology, biochemistry) and Ardigen (a spin-out bioinformatics company, 52% owned). The lead asset is wholly owned SEL120, currently Phase I-ready after the FDA approved an IND application in March 2019. Selvita is focusing on its other projects in a broad pipeline dedicated to oncology.

Details of transaction and the two new companies

According to the initial details released by Selvita, the innovative oncology company will control the current R&D pipeline of small molecules and the platform technology (targeted therapeutics, cancer metabolism/immunometabolism and immunooncology platforms). The Selvita branding will be retained by the services company. Around 170 employees will be part of the innovative oncology company and the remaining 325 will join the services company. The separation is expected to be complete by end of 2019. Subject to approval by shareholders and the supervisory board, current Selvita CEO Pawel Przewiezlikowski will be CEO of the oncology company and COO Boguslaw Sieczkowski will become CEO of the contract research company (both are co-founders of Selvita). The current shareholding structure of Selvita should be maintained by both new companies. For each existing share in Selvita, the shareholders will receive one share in the innovative R&D company and one share in the services company. All Ardigen (Bioinformatics spin off) shares owned by Selvita will be allocated to the services company and all NodThera’s shares owned by Selvita will be allocated to the new R&D company.

Between 2014 and 2018 Selvita’s research Services grew by more than 30% per year to a total of PLN59m in 2018. The services company will seek to maximise its sales and profitability via organic growth and acquisition of complementary drugs discovery service providers. Of note is that the latter strategic option will become available as debt funding will be more accessible to the profitable services company.

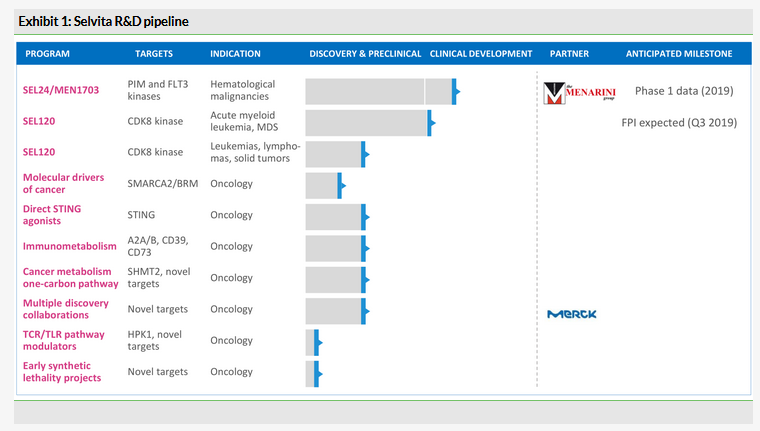

We provided a detailed overview of Selvita’s R&D pipeline in our recent outlook report, including the two most advanced assets in clinical development, SEL24, a dual PIM/FLT3 inhibitor, and wholly owned SEL120, a selective CDK8 inhibitor. SEL24 is out-licensed to Menarini Group (and is now known as MEN1703), therefore we expect the new oncology company will focus on SEL120 and on advancing the broad preclinical pipeline. Selvita indicated that the existing pipeline of R&D projects would allow it to progress one new drug candidate into the clinic every year.

Our take

We believe such a split will be beneficial for investors as it will offer investors an investment option to match their risk/return profile. The Services segment is fast growing and profitable. As a standalone entity it will be able to diversify its capital structure, lower overall costs of capital and complement organic growth with acquisitions. The innovative R&D company will likely resemble a classic drug developer, which tends to be a high-risk but high-reward type of business. In Selvita’s case, the R&D pipeline is broad and the company has the same business goals it described in its 2017–2021 development strategy, which are to:

sign a partnership contract for further development and commercialisation of SEL120 in Phase II on significantly better terms than for SEL24; and

independently develop and partner one R&D project a year.

If these goals are met, the newsflow should be sufficient to support the share price. Therefore, both businesses appear to have enough momentum to continue as standalone entities. Data readouts could be released from both ongoing clinical trials with SEL24 and SEL120 this year, which are key catalysts for the share price as Selvita splits.

R&D progress

According to the Q418 update, Selvita made progress across its R&D pipeline and is on track with the plans announced in conjunction with the 2018 share issue.

Targeted therapeutics platform

The Phase I/II trial with SEL24/MEN1703 in acute myeloid leukaemia (AML) patients is progressing according to plan and now is run solely by Menarini, which should provide trial updates at scientific and medical conferences in 2019. Selvita anticipates the first clinical data could be released in 2020.

The second lead drug candidate, SEL120, is now ready to enter the Phase I trial after the FDA approved an IND application in March 2019 in patients with AML or high-risk myelodysplastic syndrome. The open-label, dose-escalation study is designed to evaluate safety, tolerability and recommended dose of SEL120. Selvita indicated that the activation of clinical centres in the US started in Q219 and administering SEL120 to the first patients could start in Q319 and, if all goes to plan, the data readout is planned for 2020. This focus on haematological malignancies is supported by the Leukemia and Lymphoma Society and Selvita has received US$1.1m in research funding in total since the collaboration was established in August 2017. However, the company believes the potential of SEL120 is much wider and could be used in various solid tumours, including in combinations with checkpoint inhibitors.

The targeted therapeutics platform also includes an ongoing project exploring the BRM/SMARCA2 target in the so-called synthetic lethality space and other projects with undisclosed epigenetic modulators. We reviewed all available preclinical data released by Selvita in our recent outlook report.

Immunooncology platform

The STING agonist project is at the most advanced discovery stage in this platform. One of the key potential competitive advantages of Selvita’s compounds is that they are small molecules suitable for systemic administration, rather than several other technologies that are in a clinical stage and based on cyclic dinucleotides scaffolds that are mostly administered intratumorally. In 2018, Selvita continued optimising the compounds and aims to identify the drug candidate for late-stage preclinical development by the end of 2019.

Another project in an earlier preclinical stage focuses on regulating the T-cell dependent immune response. It involves the target HPK1 (MAP4K1), which is one of the major proteins in the signalling cascade triggered by TCR activation. Inhibition of this kinase leads to prolonged activation of T-cells and stimulates dendritic cells’ antigen presentation, which eventually leads to improved mounting of the immune response directed against the cancerous cells.

Cancer metabolism and immunometabolism platform

In this platform Selvita has its own projects and a longstanding collaboration with Merck (compounds undisclosed). Of the internally run projects, the most advanced are focused on the adenosine pathway, more specifically on the modulation of the production of adenosine by tumour cells (CD39/CD73 enzymes) and its effects on immune cells (A2A/B receptors).

Selvita is focusing on best-in-class dual A2A/A2B receptor antagonists and expects to nominate the drug candidate for IND-enabling studies in 2019. Compounds are differentiated versus competitors and showed excellent anti-tumour efficacy in combination with immuno- and chemotherapies in preclinical studies. Entering the Phase I clinical trial is planned in 2020. Another project in this platform involves SHMT2 inhibitors in early discovery stages of preclinical development.

NodThera NLRP3 inflammasome technology

In June 2018 Selvita’s spin-out, NodThera, announced a £28m fundraise from a consortium of investors co-led by Sofinnova Partners and 5AM Ventures. Selvita’s last reported ownership of NodThera is 14% on a fully diluted basis. NodThera was created around Selvita’s NLRP3 inflammasome inhibitor technology with first-in-class compounds. Inflammasomes have been identified as the molecular mechanism behind the activation cascade of interleukin (IL)-1. IL-1 is a family of pro-inflammatory cytokines that have been widely implicated in pain, inflammation and autoimmune conditions and more recently in cancer.

We note that inflammasome inhibitors continue to draw the pharma industry’s attention. The most recent example is the deal announced on 1 April 2019 by Novartis and IFM Tre. Novartis paid $310m upfront and up to $1.265bn in potential milestones to acquire IFM Tre. Novartis gained access to a portfolio of two preclinical and one clinical NLPR3 antagonist for an array of chronic inflammatory disorders including atherosclerosis and non-alcoholic steatohepatitis. IFM Tre was a spin out from IFM Therapeutics, which sold STING and NLRP3 assets targeting oncological indications to Bristol-Myers Squibb (NYSE:BMY) in August 2017 for $300m upfront and potential milestones of up to $1.01bn. IFM Therapeutics was seeded with just $2m in October 2015, so a combined upfront of $610m and potential milestones $2.28bn in less than five years represent a very attractive reward.

Financials

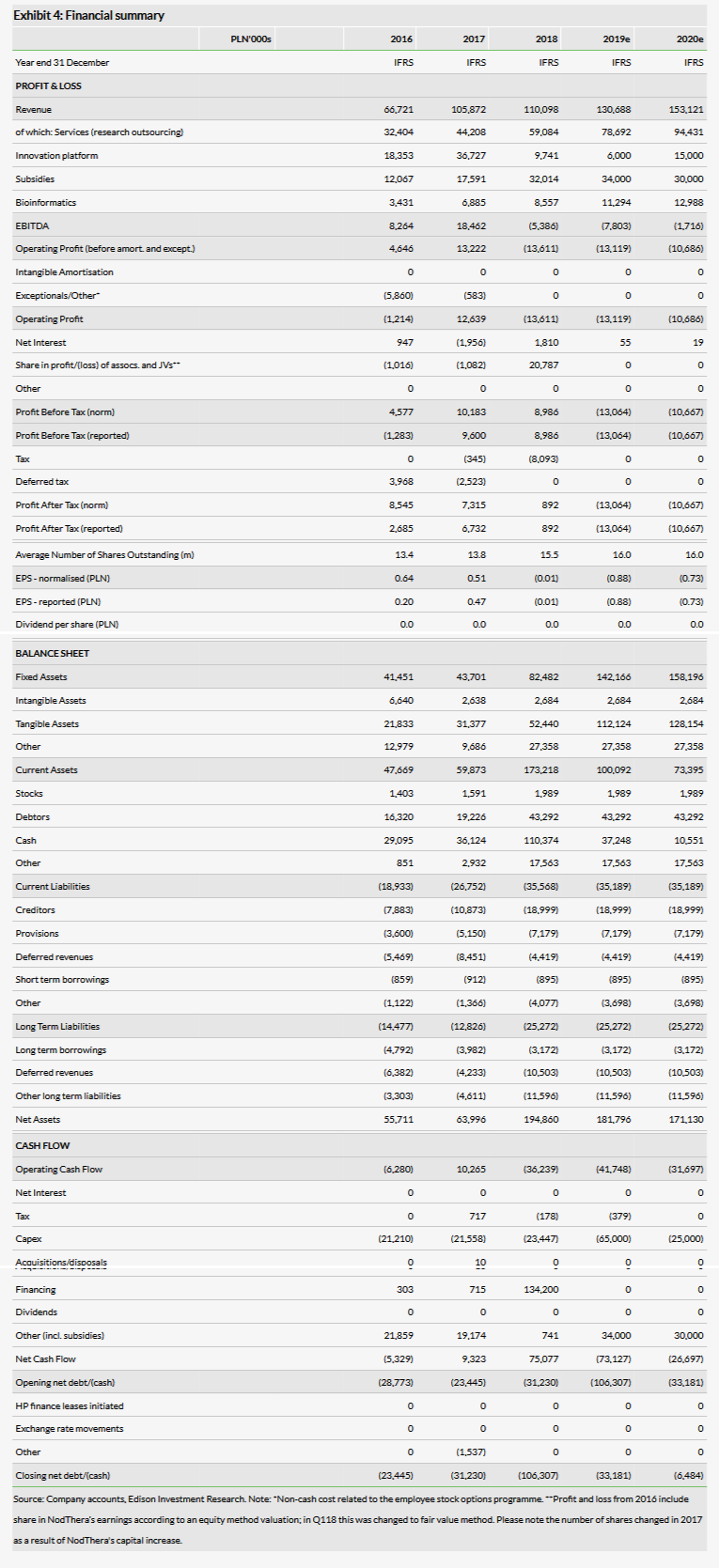

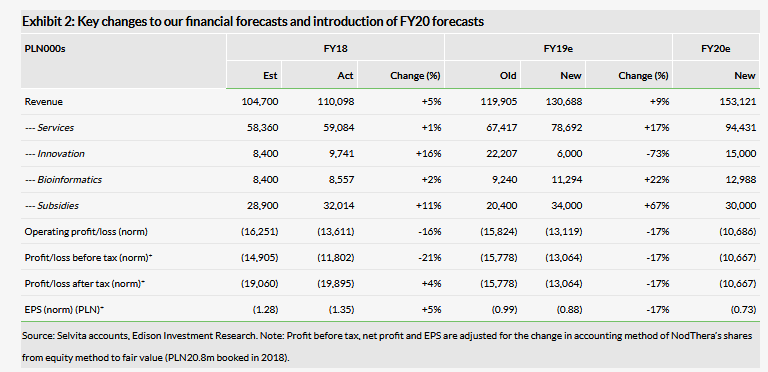

Selvita’s reported total 2018 revenues of PLN110.1m (4% y-o-y) were largely in line with our expectations. The total top-line y-o-y growth was achieved despite strong Q117, when a large income of PLN20.3m was recognised after the company out-licensed SEL24 to Menarini Group. Selvita reports in three business segments: Services, Innovation (income from SEL24 was included in this segment) and Bioinformatics.

The Services segment generated sales of PLN59.1m (excluding subsidies) in 2018, an increase of 34% y-o-y, reflecting continuing solid organic growth. Subsidies in this segment were PLN3.2m, while operating profit was PLN8.8m versus PLN5.3m a year ago, improving the operating margin from 10.8% to 13.5%.

Commercial revenues from the Innovations segment were PLN9.7m in 2018 vs PLN36.7m in 2017, with the out-licensing of SEL24 to the Menarini Group in March 2017 the main reason behind the strong performance in 2017. In addition, Selvita stopped capitalising the R&D costs in early 2018. Commercial revenues from this segment came from payments related to different partnerships, such as milestone payments from drug discovery collaborations, and therefore tend to be volatile from quarter to quarter but offer potentially higher margins. Subsidies in this segment were PLN26.2m (versus PLN15.9m a year ago), while the operating loss was PLN24.6m.

The Bioinformatics (Ardigen) segment recorded revenues of PLN8.6m versus PLN6.9m a year ago. This business was spun out from Selvita (which holds 52% of the shares) in October 2015 and in 2018 the sales grew by 24.3% to PLN8.6m. So while still a small operation for Selvita, the growth rate is very high. Revenues from subsidies in this segment were PLN2.6m and operating profit was PLN2.2m.

Selvita’s 2018 net income was also affected by Selvita’s spin out NodThera raising new funds from a consortium. Selvita changed the accounting of NodThera’s shares from the equity method to fair value and booked PLN16.6m in profit.

We have made some revisions to our revenue estimates in each segment. Overall 2018 revenues slightly surpassed our expectations. As usual, Selvita released its first 2019 order backlog:

Services PLN41.7m, up from PLN29.1m over the same period a year ago.

Innovation PLN2.5m, down from PLN6.9m y-o-y.

Bioinformatics PLN6.7m, up from PLN4.7m y-o-y.

Subsidies PLN31.1m, up from PLN27.8m y-o-y.

The Services segment again appears to be poised for substantial growth in 2019, as does Bioinformatics. Subsidies should also increase as Selvita advances its R&D pipeline. Contracted revenues for the Innovations segment could decrease this year, but as we describe above, the value in this segment is created via R&D and actual revenues can fluctuate substantially. Operating loss of PLN13.6m was slightly better than our expected PLN16.3m. Total operating expenses were PLN123.7m compared to our expected PLN121.0m. Exhibit 2 summarises our estimate changes post Q418 results. Selvita reported cash of PLN125m at end-Q418 (PLN114m as of 22 March 2019) and PLN4.1m in debt.

Valuation

Our valuation of Selvita is slightly higher at PLN1.34bn or PLN83.9/share versus PLN1.24bn or PLN77.6/share previously. The revision of the operating estimates and rolling the model forward had a small positive effect on the rNPV values of the R&D projects and the DCF. We maintain our valuation approach and assumptions discussed in detail in our last outlook report. We use risk-adjusted NPV models with a discount rate of 12.5% for Selvita’s R&D projects at various stages. Separately, we use DCF-based calculations with a discount rate of 10% to value the core drug discovery services business and research collaborations.

We have made one substantial update to our rNPV calculation by replacing the SHMT2 inhibitor project with STING. While both projects are active, we see the STING agonist making rapid progress towards clinical development. According to the latest update, Selvita aims to identify the drug candidate in this project for late-stage preclinical development by the end of 2019. We use the following assumptions for this project:

Market potential. STING agonists have broad potential to be used in combinations with other chemotherapeutic agents and immunoncology drugs, such as checkpoint inhibitors (CPIs). The strong rationale for combinations with CPIs is based on the fact that they act late in the immunity cycle (which makes the tumour ‘visible’ to T-cells), while the STING pathway appears to prime cancer-specific T-cells, so both technologies are potentially synergistic (see the overview in our last outlook report). Because of the early stage of development and lack of clarity on specific indications, but to reflect the broad potential, we use $1bn as our peak sales assumption, in line with our other preclinical projects.

R&D costs and timelines. We assume that a clinical candidate will be identified in 2019 and partnered in 2021. We assume the R&D cost for Selvita to develop the asset to a partnership deal is $2.5m. Phase I will start in 2022, and the partner continues the development and launches in 2031 with peak sales reached in six years.

Licensing terms. We use the terms of the recent deal between Aduro and Eli Lilly (NYSE:LLY) involving the preclinical-stage STING asset. Lilly paid $12m upfront and $620m in milestone payments. We assume 7–10% royalty rates. An earlier deal between Aduro and Novartis was even more impressive, where Novartis paid $200m up front, invested $25m in Aduro, while up to $500m are due in milestones. We use the deal with Lilly to err on the conservative side and due to the fact that it is the most recent one. We assume market protection until late 2030.