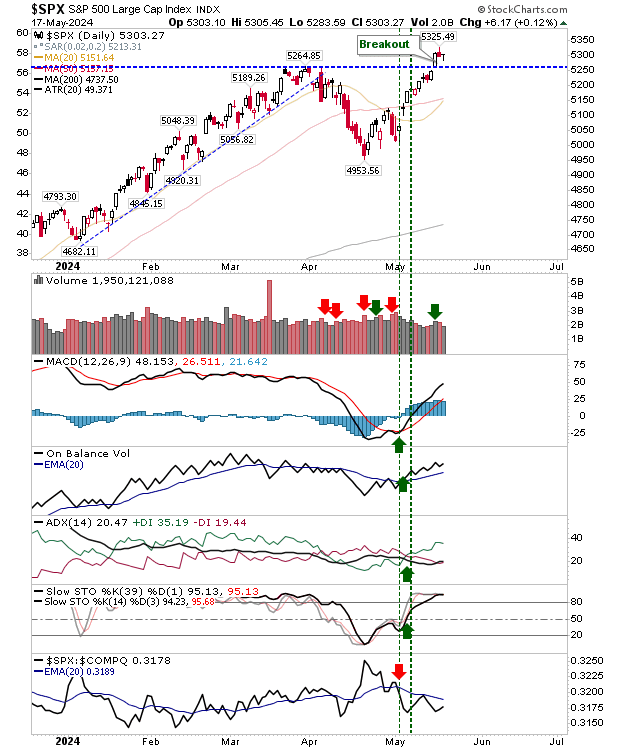

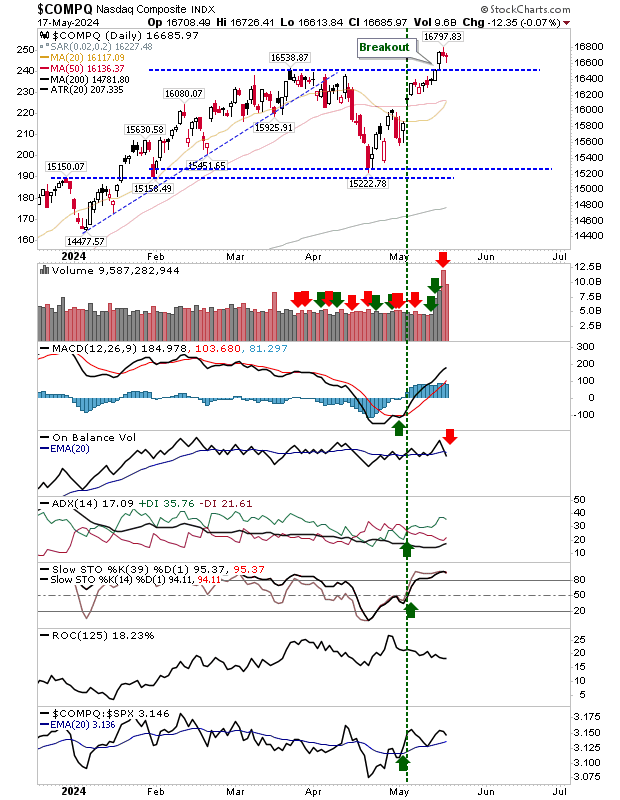

There wasn't a whole lot of drama to Friday's action but it was telling that there was no undercut or 'bull trap' left to linger into the weekend for either breakout in the S&P 500 or Nasdaq.

On Thursday, we did see potential reversal candlesticks in these indices, but there was no return on them by Friday's close. However, I was disappointed with the number of penny stocks that were picked up by my breakout scan on Friday, suggesting there may yet be trouble ahead for the indices.

There is a tonne of support for traders to lean on, even if it takes a 10% loss to get there.

The S&P 500 may be underperforming relative to the Nasdaq, and the last couple of days have seen buying volume fall, but the breakout is very much intact and technicals are solidly bullish.

The Nasdaq saw some huge selling volume on Thursday (distribution) that carried into Friday's trading. The selling over these two days was enough to deliver a 'sell' trigger in On-Balance-Volume.

But, it's the more bullish doji from Friday that may yet deliver upside for next week. The index is outperforming both the S&P 500 and Russell 2000 (IWM), so is doing most of the heavy lifting.

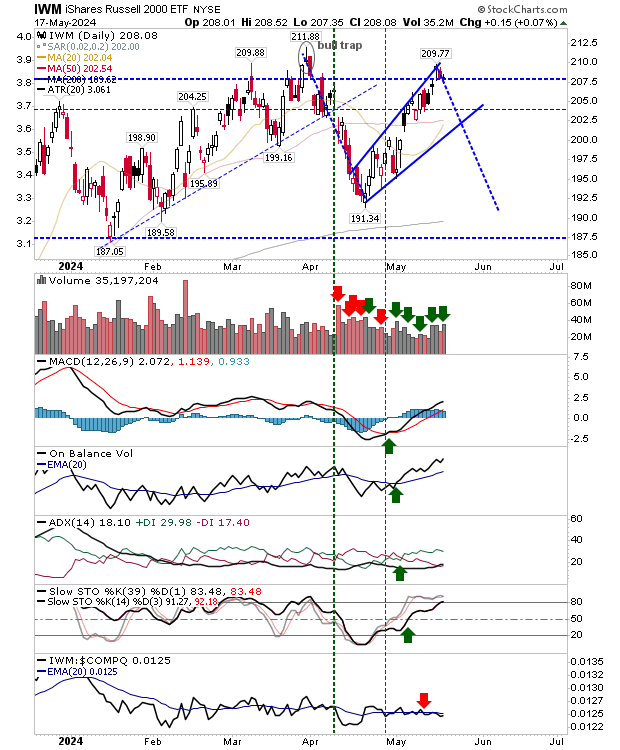

The Russell 2000 (IWM) has proven to be a harder index to read.

The rally had started to form what - at the time - looked to be a 'bear flag', only for the rally to accelerate to take the index beyond 'bear flag' resistance into a possible bearish wedge; although, even this looks a stretch.

What hasn't changed is that the March 'bull trap' remains intact, even as recent volume spikes have sided more with bullish accumulation than bearish distribution. With the breakouts in the S&P and Nasdaq, I expect the Russell 2000 to eventually follow suit, but it hasn't done so yet.

For this week, I will be looking for Friday's positive doji to deliver the Nasdaq and S&P 500 to new highs. This should help drag the Russell 2000 ($IWM) to new highs of its own, and help spread the load as this new bull market takes shape.