wrote last week that his measures of gold timer sentiment was very washed out, which indicated the possibility of a bottom for gold and gold stocks soon:

Consider the average recommended gold market exposure among a subset of the shortest-term gold market timers tracked by the Hulbert Financial Digest (as measured by the Hulbert Gold Newsletter Sentiment Index, or HGNSI).

When I wrote about gold sentiment two months ago, this average stood at 16.7%. Today, in contrast, it is at minus 14.8%, which means that the average gold timer is now allocating about a seventh of his gold-oriented portfolio to shorting the market.

Hulbert wrote that he hadn't seen these kinds of sentiment readings since March 2009:

In fact, except for a couple of days in late March when the HGNSI dropped marginally lower to minus 15.7%, its current level is the lowest it’s been since March 2009, more than three years ago.

And that’s really quite amazing, given that gold at that time was trading only slightly above $900 an ounce.

Does this mean that gold and gold stocks are set to bottom? Not yet, according to my long-term measures of greed and fear.

Consider, for example, the silver-to-gold ratio. Silver has long been regarded as a high-beta play on gold. The chart below of this ratio shows that while sentiment has descended from levels indicating excessive bullishness, they are not at levels consistent with a long-term bottom yet.

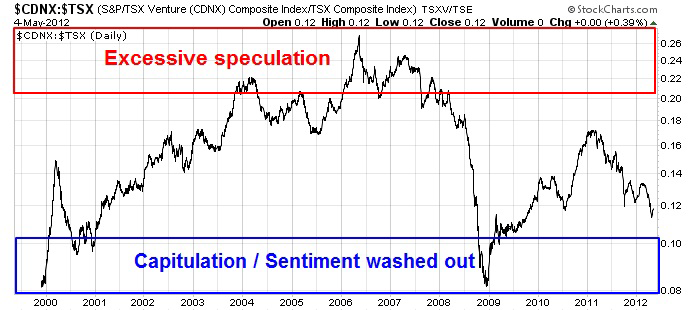

Here in Canada, we also have a good measure of speculation levels in resource and junior resource stocks. The chart below shows the ratio of the TSX Venture Index, which is comprised mainly of junior resource companies, against the more senior and established TSX Composite.

This relative return ratio also tells the story of falling speculative fever, but readings are not at levels consistent with capitulation bottoms. (Note that the scale of this chart is 13 years, which is the amount of history available, compared to the silver/gold ratio above that has a 20 year history.)

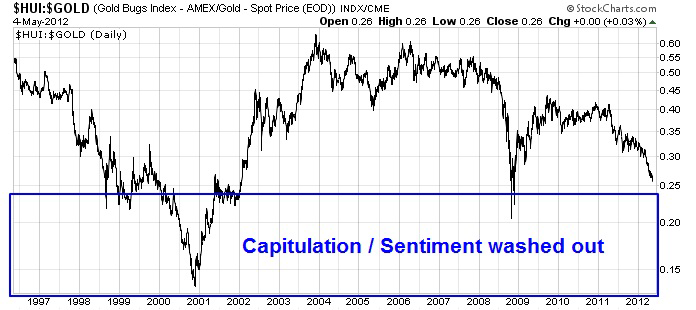

What about the ratio of gold stocks to gold? The chart below shows the HUI to gold bullion ratio. While we are nearing levels where a meaningful bottom can be established, readings are not at screaming buy levels yet.

Mark Hulbert qualified his analysis with the following caveat [emphasis added]:

How long must traders wait for gold to begin to respond to these positive sentiment conditions? Assuming the market responds the way it typically has done in the past, the wait could be as much as several more weeks.

I say that because of econometric tests I have run on the HGNSI over the last three decades. Its greatest explanatory power in predicting the market’s subsequent direction existed at the three-month horizon.

These readings are suggestive of a tradable, short-term bottom in gold and gold stocks is coming up, but a long or even intermediate term bottom may have to wait. Given that gold prices are deflating in the wake of the French and Greek elections, that short-term bottom may be fast approaching.

My inner trader tells me that I could buy here, but I need to carefully define how much risk I am willing to take. My inner investor tells me that there is value at current levels and I can accumulate positions, but there may be better entry points down the road.

Disclosure and Disclaimer: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

A Bottom For Gold And Gold Stocks?

Published 05/07/2012, 04:24 AM

Updated 07/09/2023, 06:31 AM

A Bottom For Gold And Gold Stocks?

Mark Hulbert

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.