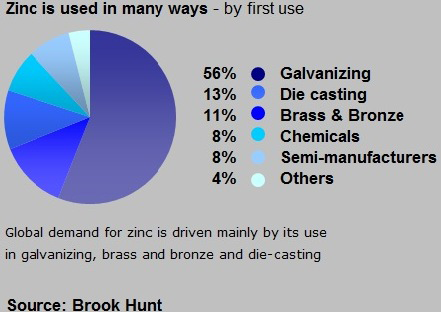

After aluminum and copper, zinc is the most-used nonferrous metal in the world thanks to its capacity to protect ferrous metals against corrosion/rusting. Hence, the “infrastructure metal” zinc is mainly used to galvanize/coat iron and steel products, such as vehicles, buildings, bridges, railways and other structures.

“Although many elements can be used as a substitute for zinc in chemical, electronic and pigment applications, the demand for zinc-galvanized products remains strong, especially in regions where significant infrastructure projects are being developed. The dramatic increase in the world's production (supply) and consumption (demand) of zinc in the past 35 years reflects demand in the transportation and communications sectors for such things as automobile bodies, highway barriers, and galvanized iron structures,” according to geology.com.

Strong Demand Regardless Of Economy

If the global economic recovery progresses in the next years, demand for zinc will increase accordingly. However, even if global economics worsens in the future, demand for zinc is set to be strong due to massive infrastructure projects in industrialized and emerging countries. Additionally, natural disasters such as earthquakes or tsunamis require reconstruction activities that can significantly change demand.

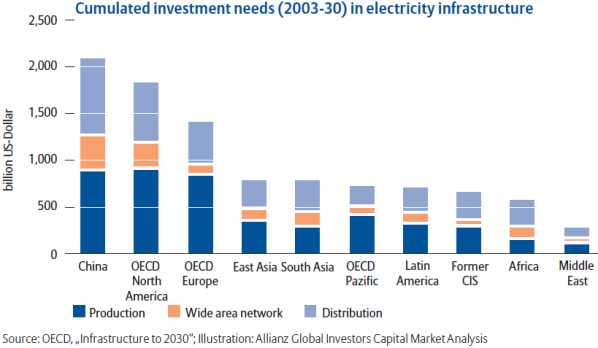

The OECD estimates a yearly investment requirement for worldwide infrastructure projects in the area of $600 billion for the next 20 years -- only to guarantee the provision of water. Additionally, the OECD expects China to spend some $2,000 billion through 2030 on infrastructure only to produce and distribute energy. And such cost-intensive infrastructure developments are not only limited to undeveloped countries. As per the OECD, the USA and Canada must invest around $1,800 billion in its electricity facilities, which is almost as much as China. “The Government of India plans to invest over 1 trillion dollar over the next 5 years to meet the countrys huge infrastructure demands. Over 50% of these funds will come from the private sector.” Any development of infrastructure is highly zinc intensive.

The urban development trend, especially in undeveloped countries, is set to additionally escalate the demand dynamics for zinc. New markets and industries, as well as emerging countries, demand buildings, structures and transportation routes such as streets, rails, waterways and airports, not to mention all kinds of new facilities that, for example, provide water and electricity.

Urbanization is also driving demand. In cities, the per capita consumption of zinc is significantly higher than in the countryside. Calculations forecast that in 2050, some 6.5 billion people will live in cities -- today it's just 3.5 billion. The additional 3 billion, or 86% more than today, represents, on average, 1.5 million people more per week living in cities. The enlargement of all cities in the world until 2050 is expected to equal the combined areas of Germany, France and Spain.

Pricing Outlook

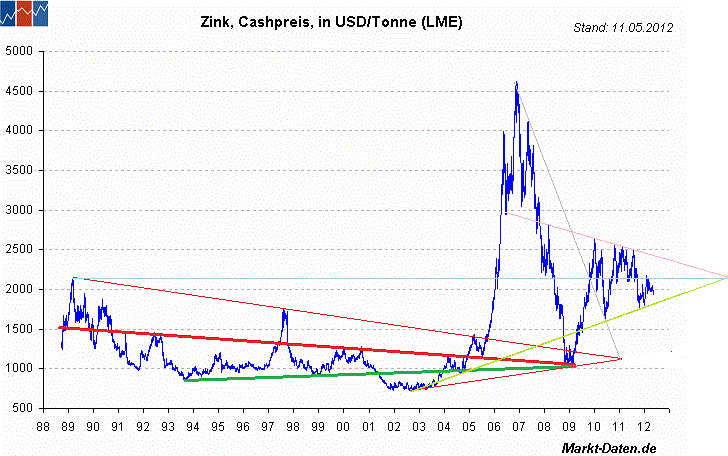

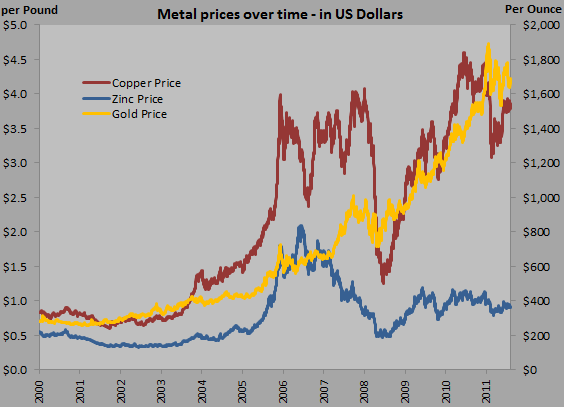

The price of zinc is set to escalate over the next years -- not only because of sound demand dynamics on a global scale -- but also due to a looming chronic shortage of supply. The coincidental closure of large zinc mines (e.g. Brunswick, Century, Lisheen, Skorpion) due to depletion coupled with only a few new mines being developed these days leads to a regressive supply. As we expect demand to remain strong over the next decades (regardless of whether global economics recover or not) and supply to be in a slump, we anticipate much higher zinc prices, especially considering that zinc today sells for around the same price as in the late 1980s and early 1990s.

More than 50 countries around the world mine zinc ore, with Australia, Canada, China, Peru and the USA being the largest producers. About 80% of the world’s zinc is mined underground, while 8% is mined via open pits with the rest using a combination of both methods.

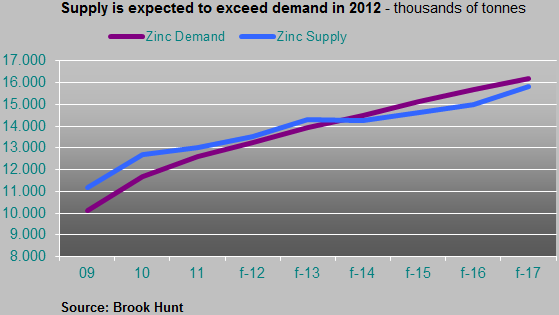

The following graph shows the change in supply and demand since 2000 with estimations by Brook Hunt for 2012-2017. It is estimated that demand will grow 2-3% per year, especially in industries such as construction, automotive and transport due to zinc's long and useful life-cycle. In the years 2013-2014, demand is expected to exceed supply and a chronic deficit to arise.

Scotia Bank (Toronto, Canada; March 2012):

“Zinc may represent the next big base metal play. Zinc will shift into "deficit" (at latest by 2014) due to ongoing demand growth in the face of significant global mine depletion in mid-decade. In 2013, the closure of the Brunswick mine in Canada, Century in Australia and Vedantas Lisheen mine in Ireland will shift sentiment towards zinc, with prices rallying in anticipation of tightening supplies. In the second half of this decade, zinc demand will be boosted by a recovery in G7 construction activity, particularly in the USA.”

Brook Hunt (Wood Mackenzie; April 2012):

“Zinc has the most promising fundamental outlook among the metals… The zinc price is expected to be rangebound for the most part of this year before starting its ascent towards the end of 2012 in anticipation of a tight market. Brook Hunt expects the zinc price to average US$1.24/lb in 2014 and steadily climb thereafter, possibly challenging the previous high of US$2.08/lb that was reached in late 2006.”

Similar comments about the upcoming shortage of zinc supply and inventories being drawn down below critical levels have been made by Credit Suisse, RBC Capital Markets and Goldman Sachs. Salman Partners (Vancouver, Canada; April 2012) advice how investors may profit from the imminent shortage of zinc and list Canada Zinc Metals Corp. (TSX: CZX) as one of the few alternatives for the development of zinc resources. Recently, Salman Partners commented:

“We believe that, beginning next year, the world faces an increasing shortage of zinc mines. The opening up of the

Akie district could help Canada make an important contribution to alleviating such a shortage.”

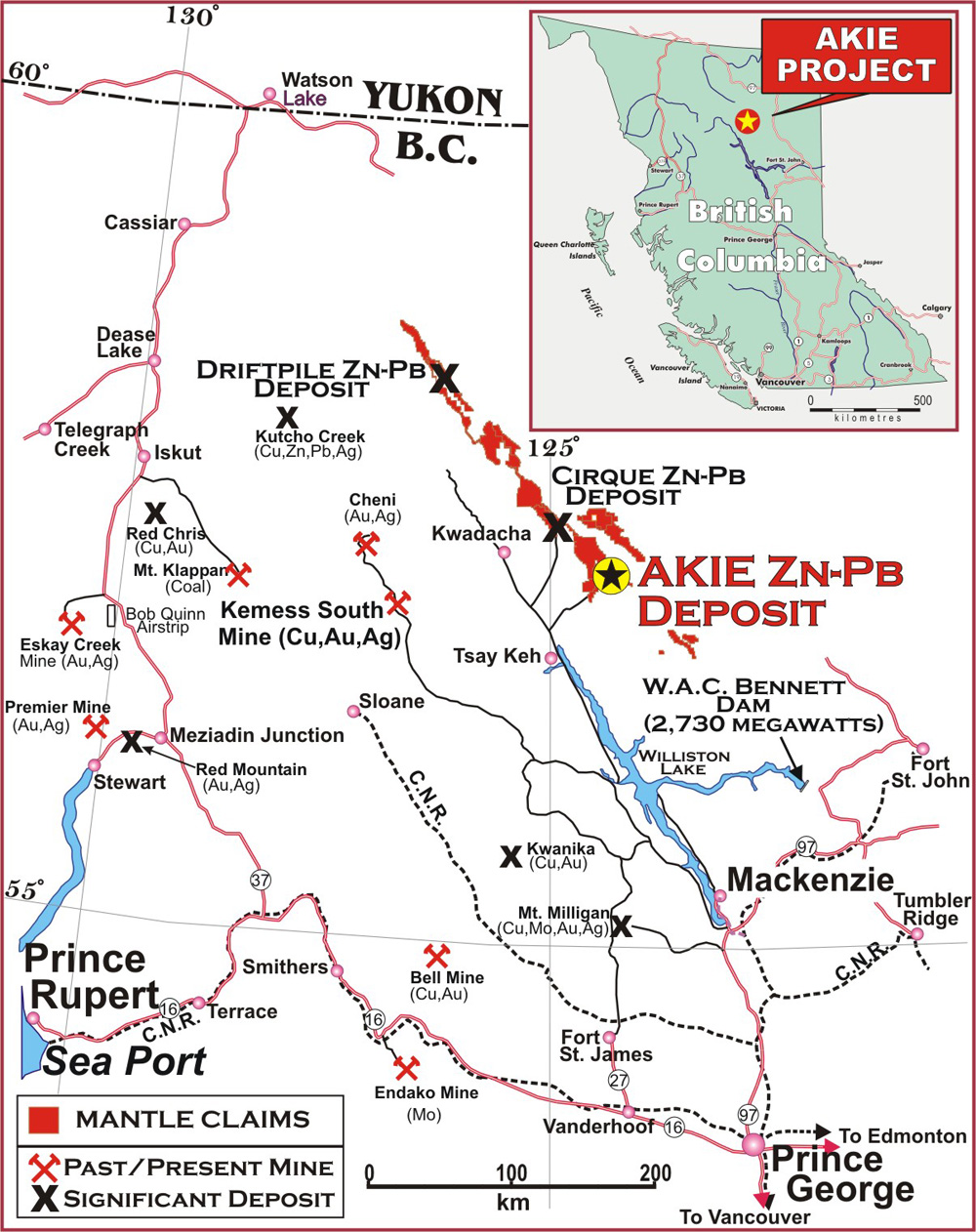

The development of the Akie zinc-lead-silver district in north-east British Columbia is actively supported by the Canadian government, whereas BC's largest hydroelectric power source is located 160 km south-east. The 125 km2 Akie district is 100% owned by Canada Zinc Metals Corp.

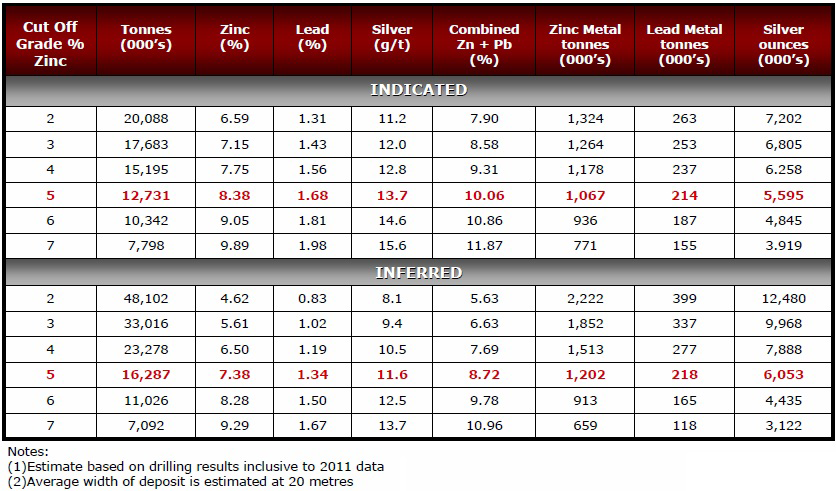

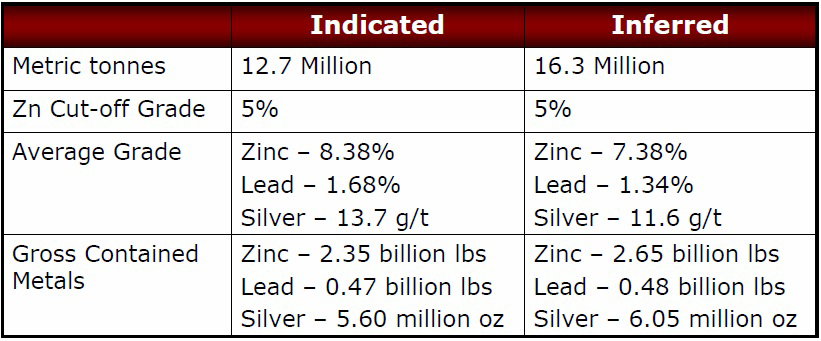

Currently, the NI43-101 resource calculation is based on 31,000 m of diamond drilling between 2005-2011:

Akie is one of the largest undeveloped zinc-lead deposits in the world and is attracting the interest of several investors such as Tongling Nonferrous Metals Group Holdings from Peking (a Chinese state-owned enterprise) and Lundin Mining -- both companies are among the largest shareholders of CZX (likely why the stock performed better than most other resource stocks during the last months of a broad market correction).

Infrastructure in the Akie area is already relatively advanced, whereas CZX is well funded with $15 million in working capital -- yet market values CZX with solely $60 million at the moment. An extensive exploration and development program is being planned and includes underground development and drilling to move toward completion of feasibility-level studies.

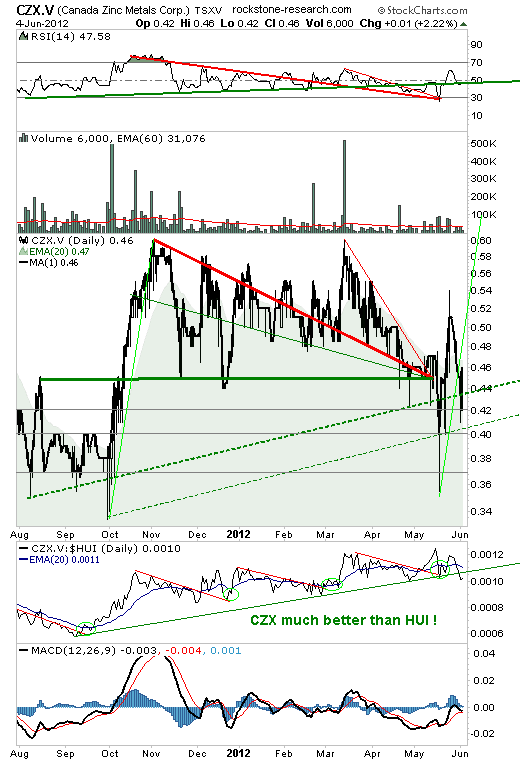

Technically, the stock price has been consolidating sideways within the red-green triangle since November 2011, whereas the apex of the triangle was reached in May 2012. After short “fake breakouts” to the downside, the price managed to start thrusting to the upside recently, yet again another pullback to the apex at approx. $0.45 occurred most recently. Thus, a buy-signal à la thrust-to-the-upside is active when trading above the $0.45 level, whereas a sell-signal à la thrust-to-the-downside is generated below that apex level. Relative to the HUI mining index, CZX has been performing much better since September 2011, especially after rising above the red resistances. The above chart can be followed with daily price updates with the following link: http://scharts.co/IS2425

Disclaimer: Please read the full disclaimer at www.rockstone-research.com

The above editorial is not to be construed as an investment advice, consultation, or even recommendation to buy, sell or even hold any kind of securities or financial instruments of the above mentioned companies, any other company, market or physical commodity. The author was not paid or remunerated in any way by the above mentioned companies. The author does not hold any securities of the above mentioned companies, but may initiate purchases after 72 h of the above publication.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

A Long Look At Zinc

Published 06/06/2012, 09:25 AM

Updated 07/09/2023, 06:31 AM

A Long Look At Zinc

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.