Adventrx has revealed the design of its pivotal Phase III study of ANX-188 in sickle cell disease, on which its investment case effectively rests. From an operational and statistical perspective, the design appears to give the product an excellent chance of demonstrating a reduction in the duration of severely painful ‘crisis’ episodes. The study, which should start enrolment and dosing by the end of 2012, has a seemingly better defined endpoint than was used in a previous Phase III study and a 90% power to detect a clinically meaningful treatment benefit. As a result, we have upgraded our valuation to $137m or $2.50 per share.

Drawing on experience

Adventrx canvassed the opinion of physicians, key opinion leaders, patients and the FDA to come up with a trial design that plays to the strengths of ANX-188 (purified poloxamer 188). It also drew on experience from a prior Phase III study, which missed a poorly-defined primary endpoint for crisis resolution across all patients, but showed an effect in paediatric patients. The study will enrol 388 children aged eight to 17 years experiencing acute pain from vaso-occlusive crisis.

Cleaner endpoints

Defining the point at which a patient’s ‘crisis’ resolves is inherently tricky and subject to huge variability, so Adventrx has selected a much simpler measure than that used in the previous study. The duration of crisis will be defined as the time from randomisation to the time of the last dose of parenteral opioid analgesic, prior to hospital discharge. In the prior Phase III study a patient had to meet four varied criteria, including notoriously subjective pain rating scales. The new endpoint should also help reduce the potential problem of patient drop-outs from the trial.

Defining clinically meaningful

Adventrx’s discussions with various stakeholders have led to the selection of a 16- hour difference (with 90% power) between treatment arms as clinically meaningful. Crisis episodes typically last for five to six days and in the prior Phase III study a 22- hour reduction in duration was observed in children ≤15 years. A relatively conservative but still meaningful efficacy hurdle boosts ANX-188’s chances of success in the study.

Valuation: Upgrade to $137m

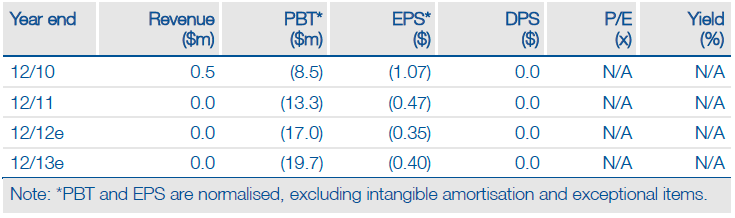

We have upgraded our valuation of Adventrx to $137m or $2.50 per share (previously $80m or $1.46 per share), largely due to increasing ANX-188’s probability of success to 70% from 50%. Adventryx’s Q312 net cash of $40m is sufficient for 18 months and should allow it to make significant progress with the pivotal ANX-188 trials.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Adventrx Pharmaceuticals

Published 10/29/2012, 09:57 AM

Updated 07/09/2023, 06:31 AM

Adventrx Pharmaceuticals

Neat design for ANX-188

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.