Market movers today

- Key focus today will be the Fed meeting tonight, where we look for another rate cut of 25bp but no pre-commitment to further cuts, see FOMC Preview , 13 September 2019. Another 'mid-cycle adjustment' cut is warranted by weak global growth and high uncertainty, while a still strong US consumer puts the Fed on a 'meeting-by-meeting path' to gauge the need for how much further support the economy needs. We see a risk that markets will be disappointed from what might be perceived as a hawkish rate cut. We still expect the Fed to ultimately cut five times in total until March 2020 as we look for weak global growth and high uncertainty to prevail for some time. The tensions in the Middle East have only added to the uncertainty.

- Saudi state television said the Saudi Defense Ministry will hold a media conference on Wednesday that will show evidence of Iran's involvement in the Aramco attacks, including the use of Iranian weapons, see Reuters .

- On the economic front we get UK inflation and final euro area inflation for August and US housing starts.

- In Scandi markets focus will be on the Swedish budget proposition for 2020 at 8.00 CEST, see page 2.

Selected market news

Saudi Arabia yesterday indicated that its crude oil output will be ready to return to normal levels within two to three weeks. The news triggered a sharp fall in the crude oil price from USD68 to USD65 per barrel, as the market was concerned it would take longer. The crude oil price is still much higher compared to last Friday, as the market will continue to demand a premium on oil until the situation is fully normalised.

Stock markets were slightly higher yesterday on the Saudi news but otherwise markets are in wait-and-see mode ahead of the Fed decision tonight.

The effective Fed Funds fixing jumped to 2.25% on Monday (published yesterday), which was an increase of 11bp compared to Friday, hitting the ceiling of the Fed's target range. Short-term USD funding has been under pressure due to tighter USD liquidity conditions also seen in elevated US repo rates. Consequently, New York Fed announced a repo operation of up to USD75bn to support the market, the first one since the financial crisis in 2008/09. Another repo operation is scheduled for Wednesday.

The first day of three days of hearings in the UK Supreme Court started yesterday . The court will decide on the legality of Prime Minister Boris Johnson's suspension of the parliament. The day ended with Johnson on the back-foot judging from the questions asked by the judges, see Bloomberg .

US industrial production for August was better than expected, rising 0.6% m/m (consensus 0.2% m/m). Japanese exports overnight also surprised slightly to the upside at -8.2% y/y (consensus -10.0% y/y). It is within the range it has been throughout 2019.

Scandi markets

Main thing to look out for today is Sweden’s budget proposition for 2020, which is to be presented at 08.00 CEST. Although the details of the proposed reforms totalling approximately SEK25bn could prove to be interesting, the market impact should be limited, as the fiscal policy is set to remain ‘neutral’ and most of the proposed reforms have already been presented.

Fixed income markets

Political uncertainty in Spain and Italy. Italian government bonds came under pressure yesterday as former Italian Prime Minister Renzi resigned from PD, one of the coalition parties in the new government. Renzi is a supporter of the new government, but the timing is unfortunate as the government is looking to agree on a budget for 2020.

In Spain we are looking for another general election as the Socialist Prime Minister Sanchez cannot find a majority in Parliament. This would be the fourth general election in four years. The Socialists are ahead in the polls, but whether Sanchez will get enough votes to have a majority is uncertain. Market impact on the Spanish government bonds should be modest as there is significant consensus regarding the economic policy in Spain. We are already long Spain and Italy, but would use a widening of both spreads to core-EU to buy more in both Spain and Italy.

The main event today is the FOMC meeting, where the Federal Reserve is expected to cut rates. Furthermore, given the reverse repo auction yesterday in US Treasuries, the expectations of another round of QE are increasing. US Treasuries rallied from the long end of the curve yesterday and we expect more downward pressure on treasury yields to continue as the FOMC lowers policy rates.

We have bond auctions in both Denmark and Germany today. Germany is tapping in the new 30Y benchmark, while Denmark is selling in the 2Y and 10Y. In Denmark, too much cash continues to chase too few assets. See more here.

FX markets

In FX markets, today’s key event will be the Fed meeting. Markets have been ‘risk-on’ as no-deal Brexit risk has faded, trade talks have resumed and US data has been decent. Today, the risk is how the Fed will be perceived and how it will communicate around a fairly strong US domestic situation but a still fragile and weak global situation - as the market is well positioned for a 25bp cut. So rather, the battleground will be in the updated dot plot and forward guidance, where we see a risk of the Fed disappointing market expectations (of further rate cuts). That would bring the Fed in line with the ‘mid-cycle adjustment’ story but surely disappoint markets, which would push EUR/USD back down. We could see a drop in the magnitude of 50pips. We see the risk as being largely that Fed will talk up broad USD. If that is the case, EUR/SEK and EUR/NOK could also go higher (notably SEK, see below). In the past one to two days, markets have moved slightly but still notably towards such a ‘hawkish Fed’ scenario.

Tuesday proved an eventful day in the USD money market. Early on, the upward pressure on short-term USD funding rates from Monday persisted amid tighter USD liquidity conditions. In FX markets, this was translated into downward pressure on EUR/USD to around the 1.10 level. When the Fed funds fixing for Monday came out at 2.25% (an 11bp rise on the day and right at the top of Fed’s upper target band) the market quickly started speculating that New York Fed would need to take action and provide liquidity to the market. NY Fed promptly responded by announcing an overnight repo operation of up to USD75bn (in the end dealers took USD53bn). The move quickly eased upward pressure on short-term USD rates and triggered a move higher in EUR/USD up to around 1.1060.

In our view, the events today will prove a game changer for the short-term USD money market including EUR/USD FX forwards. The Fed’s hand was forced yesterday and we should expect it to play an active role in providing liquidity to the market, in turn making it less likely that we will see tight USD liquidity conditions in the coming months. This could otherwise have resulted in wider 3M (NYSE:MMM) LIBOR-OIS and/or 3M EURUSD XCCY basis, which we now view as less likely. In this regard, we would be surprised if the Fed does not roll over Tuesday’s repo operation (next week it might even need to raise the limit). The Fed may also need to fast track plans of a standing repo facility and/or open market operations to gradually increase the balance sheet as it lowers its key policy rate.

EUR/SEK moved higher yesterday as Swedish unemployment continued to rise. The Riksbank minutes were somewhat hawkish and in our view the market seems to doubt that message - and rightly so. We would not be surprised to see EUR/SEK firmly established above 10.70, which coincides with our 1M forecast.

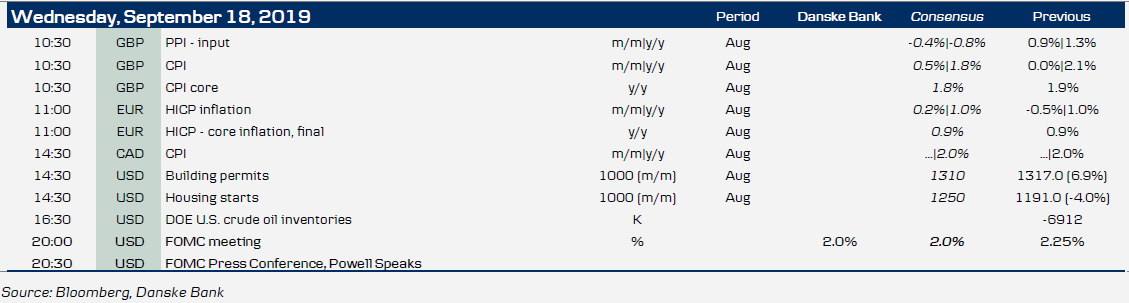

Key figures and events