Another sideways overnight session on currencies and indices as traders look forward to the return of the Chinese market from holiday today.

The New York session fizzled out across most asset classes with stock indices broadly flat and currencies for the most part trading within their defined ranges. The market has a definite waiting for Godot look about it as we look forward to tonight’s ADP Employment and FOMC Minutes to spark some life into things. Locally the China bloc returns from holiday today which may spark some life into USD/CNH and commodities.

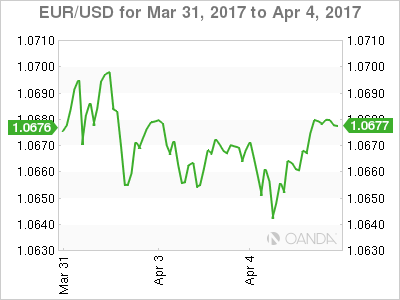

Euro

Draghi was a fizzer overnight, but we will get another bite of the cherry tomorrow when he speaks again. We will see a frenzy of Eurozone PMI’s released around 4 pm Singapore this afternoon, with traders looking for signals that the QE driven recovery remains on track. Euro itself continues to mark time in the 1.0630/1.07000 range of the last week. A break of either level most likely bringing some stop-loss action out of the woodwork. In the bigger picture, the key level remains 1.0500.

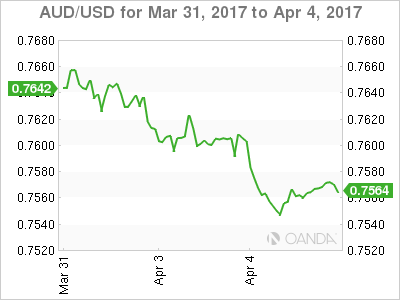

Australian Dollar

The AUD picked itself up off the floor from 7545 to 7575 in New York trading, following yesterday’s tepid trade data and a dovish RBA. With China back today, it will be interesting to see if the AUD can pick up a tailwind from commodities as China reacts to Cyclone Debbie induced supply disruptions in iron ore and especially coal. The breakdown level at 7590 forms resistance this morning with key support around the 7500 area.

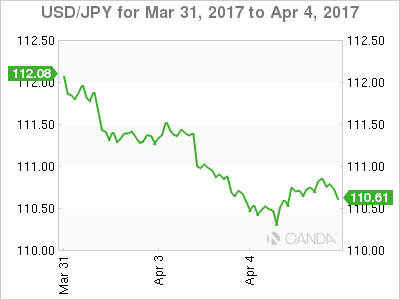

Japanese Yen

Like the AUD, USD/JPY picked itself up off the floor as the Cross/yen selling noted in Asia yesterday seemed to have run its course. U.S. yields also ticked up in New York giving support to USD/JPY. We will probably have to wait until Friday’s non-farm payrolls to gain more clarity on yen’s direction if this week’s price action is anything to go by. 110 remains the pivotal support level with the 112.00 area resistance. Expect choppy trading in this range in the meantime.

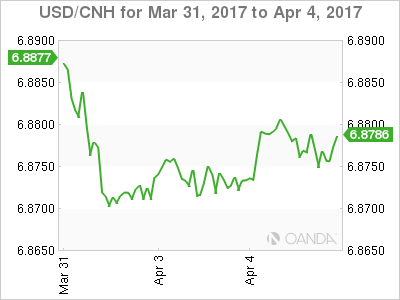

China offshore CNH

China comes back from two days holiday today, and we may see USD/CNH tick higher to reflect USD strength over the last two days. All eyes will be on President’s Trump and Xi’s meeting in Florida. Having said that, EM flows have been quite strong this week, and any topside in USD/CNH should run into plenty of offers above 6.9000. The chances of CNY/CNH being allowed to trade materially weaker while Mr XI is visiting the U.S. will be almost zero I would think. USD/CNH has well-defined support at 6.8400 with resistance at 6.9000. The action will more likely be in the commodity space today with all eyes on the China iron ore futures.