While we are taking the brunt of Europe's bad news, and gold and silver are taking a beating, expect some good news at some point between now and November as we gear up for the coming election.

As long as the stock market continues to falter, Obama will indeed play the QE3 card. Since the general public doesn’t even know what QE3 is, it’s an easy card to play. It’s like having two extra aces stuck up your sleeve that you can use at any time. No one will notice there are six aces being played. Advantage cheaters. The third ace is coming, and the Fed has unlimited aces….but sooner or later, the cheater is called out. You can only play that extra card so many times before the other players in the game realize you have an uncanny ability to always get aces. Then, it’s game over.

I wanted to remind everyone what I wrote on January 11th, 2012 for my predictions on gold and silver for this election year in saying I think we get one more push down in the price of gold and silver.

Gold And Silver Predictions

There will be an eventual rise in the price of gold with all currencies. All currencies are on a ship with the U.S. dollar on one side and the Euro, Pound and Yen on the other. They run from one side of the ship to the other where sometimes the dollar is higher and sometimes the other currencies, all trying to stay afloat. Unfortunately the ship is called the Titanic. When compared to gold,all of those currencies will be chasing the gold and silver lifeboats at some point.

I have been saying that while the U.S. dollar gains strength, primarily against the Euro, it could have some pressure on gold and silver. The dollar index is now past 81 and moving toward the 88,89 level while the Euro moves down to its lows of around 117,118.

But there will come a point in time where gold and silver will bottom out and the dollar should continue to rise. This will break a near 40-year pattern that has the dollar and gold reacting inverse to one another. When will occur? I believe we get one more push down in gold and silver. This will catch all those who recently bought off guard, especially those on leverage. It will challenge them to keep their investment during the downturn and have second thoughts as to why they bought gold or silver to begin with. The financial media will say “the gold bubble has popped” like they tried to do last year and the year before. They will. of course, be wrong.

Thoughts For Today

$1,600 has been the line in the sand for quite some time for gold. It was breached today. Silver has it’s December lows in the $26 range. $26.16 is the price I would watch to see if it is breached. A stronger dollar stemming from a weaker Euro could just do the trick.

Naturally, I would prefer we bounce from where we are today, but the market makers know these levels and know they can squeeze the longs out of their positions if they can just push past these prices of old. The market is always right. It is only the trader who is wrong.

I don’t have any clients who are selling their gold or silver. This is the nature of those who understand the purpose of gold and silver as “insurance.” If everyone is dumping a currency, where is the place they want to immediately go? Will it be treasuries that pay virtually nothing in interest and present a liquidity problem? Or will it be the complete liquidity of gold and silver?

Treasuries -- The Next Great Bubble -- But When?

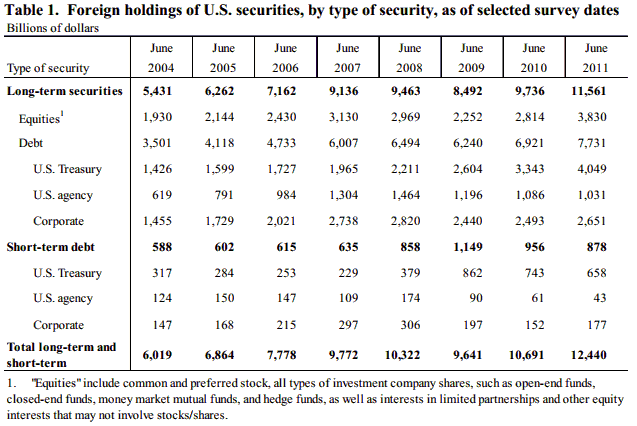

According to the latest Department of Treasury Foreign Portfolio Holding of U.S. Securities Survey released in April 2012, “measured foreign holdings of U.S. securities as of June 30, 2011 at $12,440 billion, a$1,749 billion rise from the previous survey as of June 30, 2010. Of these foreign holdings of U.S. securities, $11,561 billion were U.S. long-term securities (equities or debt securities with original term-to-maturity greater than one year) and $878 billion were U.S. short-term securities.”

You can see by the table below how the rush to treasuries has occurred.

So why is it that people rush to treasuries and other U.S. securities the world over when interest rates are at historic lows as seen in the data below? The answer is, “perceived” safety. While gold and silver are also historically known the world over as safe havens, the general public is still influenced by financial advisors who don’t recommend them. Yet gold has moved higher in price for the last 11 years straight. Silver has come close to that mark. A 1964 Roosevelt dime could buy you a loaf of bread in 1964, while that same dime today, because of its silver content, can still buy you a loaf of bread at $2.14. Any questions on maintaining purchasing power?

The media would have you forget about gold and silver and their place in history as a store of value. All currencies throughout history have eventually imploded. Why? Because governments screw them up by abusing the power to print money at will. Has the Federal Reserve and our beloved Congress been doing this for years? Yes. They ramped things up once Nixon took our monetary system away from its ties to gold.

Questions To Ponder

Are we fighting wars that never end with money printed to pay for them? Are we currently over $16 trillion in debt with no real solutions to cut anything but the amount of future deficits rather than tackle the programs we can no longer afford to pay for? Are we starting government sponsored projects to stimulate the economy that once the government backing ends the jobs will disappear? Is the FDIC still in debt? Is the Pension Guaranty Association still in debt? How can the Tea Party be taken seriously when they approve of funding wars that we can’t afford? Same goes for the democrats who don’t hold Obama accountable for his promise to end the wars his first thing in office. But I am sure under the definition of “politician” are the words “broker promises.”

Yet people still plow money into treasuries that pay for all these broken promises.

“Perception” is still such that treasuries that pay virtually no interest and an illiquid piece of paper saying you own something backed by the government is somehow preferable to gold and silver that is 100% liquid in almost every city in America. You mean to tell me that today you will buy a 10 year treasury that pays you 1.83% interest over the next 10 years will outperform silver at $29 an ounce? Really? You actually believe a government that can’t balance a checkbook and a Federal Reserve that is manipulating interest rates to save the banking system they and Congress allowed to get out of control is going to somehow return the U.S. to the glory years when they are relying on our own citizens spending to get us out of the mess they created? You trust them? You trust Congress that year after year after year just raises the debt ceiling in a bipartisan vote to pay for their spending is going to somehow stop spending? Really?

I think you get my point. Treasuries are in a bubble. They just don’t know it yet, and neither do their owners.

I had a conversation with a real estate investor from Wisconsin in 2005. The above reference to treasuries becoming worth less in the future reminds me of that conversation. I was trying to convince him to invest in gold. I have dealt with real estate investors before in my over 20 years as a financial advisor. There is no telling a real estate investor, especially in California, that “I have a better investment for you.” They have a one track mind. Or at least had a one track mind. This guy was no different. I remember him distinctly making this statement; “You mean to tell me that you think gold is a better investment than real estate?” I of course said yes. I had a multitude of reasons as to why, the same reasons I have today, but he wouldn’t listen. Real estate today is still not near it’s bottom despite the low interest rate environment. The investor from Wisconsin learned a lesson that I am sure many others learned as well.

What's Ahead

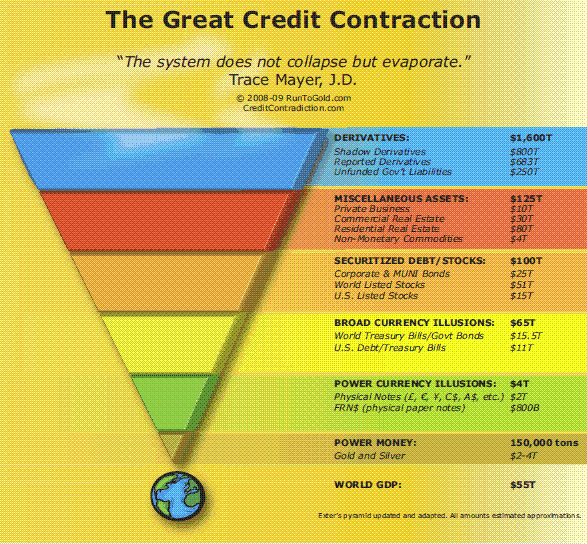

As you can see from the chart below, money has been running from risk to safety since the market top for real estate in 2006 and the eventual implosion of the financial markets in 2008. This money has been flowing into treasuries, gold and silver. But eventually, you'll see that third to last stop or “perceived” safety area called treasuries make a mad dash for cash and what’s left of the world’s gold and silver. As Trace Armstrong J.D. has said, these treasuries are “illusions” of wealth. Even currencies he calls "illusions of wealth" because some become worth less and less, or eventually worthless.

There is only one last great bastion of safety and the only proven place that over time maintains one’s purchasing power. It is found in physical gold and silver. It is not found in paper illusions of gold and silver like the Exchange Traded Funds (ETFs) that are controlled by bank custodians like J.P. Morgan or HSBC, who are the leaders in owning sub-investment grade derivatives you see at the top of the pyramid. Do you really want these folks in charge of your gold and silver? No. You want physical gold and silver in your hand. Everything else, like the ETFs, are an illusion of real wealth.

Where's Your Faith?

The question is, where do you put your faith in maintaining your wealth? Do you see today’s prices in gold and silver as a good time to dollar cost average into a position? I do. I have been giving this advice for over a year now. When silver was higher, I didn’t just say, you have to get in now, the dollar is going to crash like so many others. I have been in the deflation camp as you can see by my writings (although all of us agree that eventual inflation will rear its ugly head). I have said many times it is the tortoise vs. the hare approach that one should take and the Fed is still relevant, but running out of solutions to distract the general public (QE1, QE2, Operation Twist). But it is from the banks that I see all hell breaking lose. 2008 will have nothing on what’s to come. Just look at what happened to MF Global with one of their wrong bets on Europe. It caused the company to go bankrupt. Don’t think that the nation's top banks aren’t playing the same game. They are.

I have told clients to dollar-cost average in, hoping the price goes lower so they get an overall better price. This has been the case. The next Fed meeting is at the end of June. The stock market is faltering and maybe due for a bounce. Obama though, will do anything to get elected again, which means QE3 is on the table when needed. Treasuries' days are numbered. We are not Japan where we can keep interest rates low indefinitely. Japan has been a net exporter. But they have their own issues these days. The U.S. has half of its treasuries owned by foreigners and we are a net importer. If the treasury ship is sinking, these foreigners will sell en mass, and they will be jumping into the life boats that only gold and silver offer.

Lastly, if you are in Europe right now, are you sitting by waiting for the Euro to implode with the weight of Greece, Spain, Italy etc. bringing it down? If you are in Germany and your country is doing well, are you investing in the insurance that buoys your portfolio’s purchasing power? Europe is only a precursor of what is coming to America. How many U.S. banks are connected to European banks?

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Are We At Gold's Bottom?

Published 05/08/2012, 03:51 PM

Updated 07/09/2023, 06:31 AM

Are We At Gold's Bottom?

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.