Europe is on the ropes, U.S. businesses remain cautious and U.S. consumers are ill-inclined to spend money. Meanwhile, crude oil has been in triple-digit territory.

That should spell deep trouble for the nation's airlines.

Instead, they just posted a superb quarter. According to data compiled by Deutsche Bank, the seven top U.S. airlines just bagged a collective $247 million operating profit. That compares with a modest loss for the industry a year ago, and comes at a time when the collective bill for jet fuel is $1.8 billion higher than last year's first quarter.

The fact that decent profits were generated in the slowest quarter of the year says something. The current quarter, and the third, are typically the most profitable, thanks to increased travel. For all of 2012, Deutsche Bank now thinks the top seven domestic carriers can earn a collective $3.8 billion, well ahead of the $2.3 billion earned in 2011.

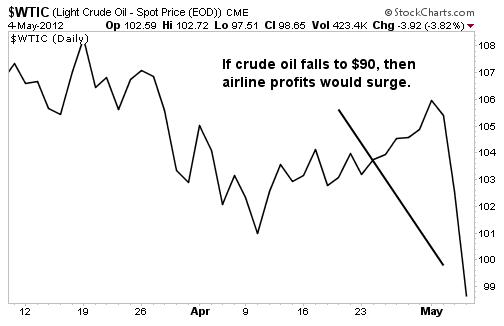

Frankly, that forecast could be off the mark. The analysts assume oil prices will stay range-bound, but they are starting to weaken, recently crossing well below $100 a barrel. Might we be looking at $4 billion or even $5 billion in industry profits? It's possible -- and investors who recognize this early on could profit handsomely once others catch on.

Industry Drivers

The robust industry profits are the result of one simple factor -- airline executives are no longer concerned with market share at any cost. Instead, they're solely focused on ensuring that every flight earns its keep. Almost any route that is unprofitable gets nixed, and the resulting scarcity of available seats leads to firmer prices. The fact that airlines now charge for many things such as checked luggage also helps.

I could single out a specific carrier as an example of the new-found wisdom of expense control and revenue maximization, but virtually every carrier (except for beleaguered AMR) has gotten religion.

Yet Delta Airlines (NYSE: DAL) serves as good an example as any. This past summer, I pointed out how management was making all the right moves, and shares have already made roughly half of the 100% upward move I predicted back then. Delta is on track to generate $2.50 or even $3 a share in free cash flow this year, which is quite impressive for an $11 stock, but the income and cash flow statements aren't even the most important story here.

Roughly two-third's of Delta's free cash flow goes toward paying down debt, which means the next time the sector stumbles in the face of economic headwinds, Delta's risk profile will be a lot lower. And as investors start to perceive less risk, they'll be more willing to let the price-to-earnings (P/E) multiple expand. This stock trades for around five times projected 2013 profits, but that multiple could expand by 50% once investors appreciate Delta's ever-stronger balance sheet. Notably, further drops in oil prices will boost profits, making that P/E ratio even lower.

The M&A angle

Delta's decision to acquire Northwest Airlines was, in hindsight, a master stroke. The ability to combine flight routes and remove redundant overhead has fueled tangible gains in terms of margins. United Airlines (NYSE: UAL) and its merger with Continental, has borne similar fruit. Now it's U.S. Airways' (NYSE: LCC) turn.

That carrier recently won the support of key AMR unions and is said to be preparing a bid to acquire AMR while that company remains in bankruptcy. If such a deal comes to pass, then watch out for hundreds of millions in identified synergies, plus serially rising profit forecasts. UBS has done the preliminary math and figures U.S. Airways' stock should rise from $11 to $18 if the two carriers join forces. "The whole U.S. airline industry is likely to benefit from further industry consolidation, should it happen," it notes. That's because the combined entity would take more routes offline, which, due to reduced capacity, is why pricing is so firm these days.

Risks to Consider: If fuel prices shift course and move back up, then industry profits may come down.

Action to Take --> Right now, the bias is toward ever-lower oil prices. If oil moves below $95, then look for analysts to boost their profit forecasts for almost every airline carrier. These stocks are already quite cheap, and even higher earnings forecasts would lead to stunningly low P/E ratios that won't last long before share prices rise.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

As Oil Falls, Airlines Soar

Published 05/09/2012, 08:50 AM

Updated 07/09/2023, 06:31 AM

As Oil Falls, Airlines Soar

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.