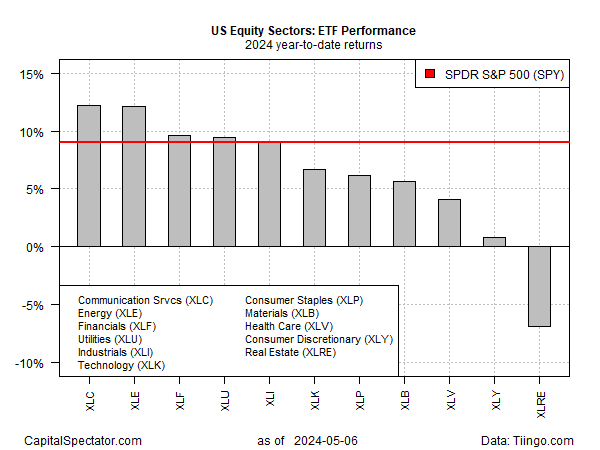

The upside momentum in the US stock market so far this year continues to be led by rallies in communications services and energy shares, based on a set of ETFs through Monday’s close (May 6). Both sectors are outperforming the broad market and their counterparts.

Communication Services Select Sector SPDR Fund (NYSE:XLC) and Energy Select Sector SPDR Fund (NYSE:XLE) are tied for first place in 2024’s performance run. Each fund is posting a 12.2% year-to-date return. The gains reflect moderate premiums over the broad market’s 9.0% increase this year, based on SPDR S&P 500 ETF (NYSE:SPY).

All but one of the primary equity sectors are sitting on year-to-gain gains — increases either match the broad market’s rally via SPY or fall short. The downside outlier for sector performance: real estate, which continues to post a steep year-to-date loss.

Property shares, which are prized for their relatively high payouts, have been hurt by the rise in Treasury yields. The stronger competition in risk-free government bonds is considered a factor in the slide for real estate investment trusts.

Real Estate Select Sector SPDR Fund (NYSE:XLRE), which has fallen 6.9% year to date, currently yields 3.69% on a trailing 12-month basis, according to Mornignstar.com. By comparison, the 10-year US Treasury yield is substantially higher at 4.49%, as of May 6.

For some analysts, the slide in property shares represents a buying opportunity, despite recent delays in expectations for rate cuts by the Federal Reserve.

“From where listed REITs are currently priced, I don’t believe the market needs to expect rate cuts for REITs to deliver solid performance,” says Janus Henderson Investors’ Gregory Kuhl.

“If the market reaches a solid consensus that rate hikes are off the table, that may be enough to get REITs going. It did seem like Powell took rate hikes off the table [at last week’s Fed meeting], which I think is a positive for REITs.”

Yield differentials may be a factor in REITs’ weak performance, but it’s notable that the utilities sector (XLU), which is also interest-rate sensitive, has rallied lately while XLRE has barely moved. XLU is up 9.5% year to date, a gap that suggests sentiment for property shares suffers from more than concerns about competitive Treasury yields.