FedEx Corporation (NYSE:FDX)Industrials - Air Freight and Logistics | Reports June 21, After Market Closes

Key Takeaways

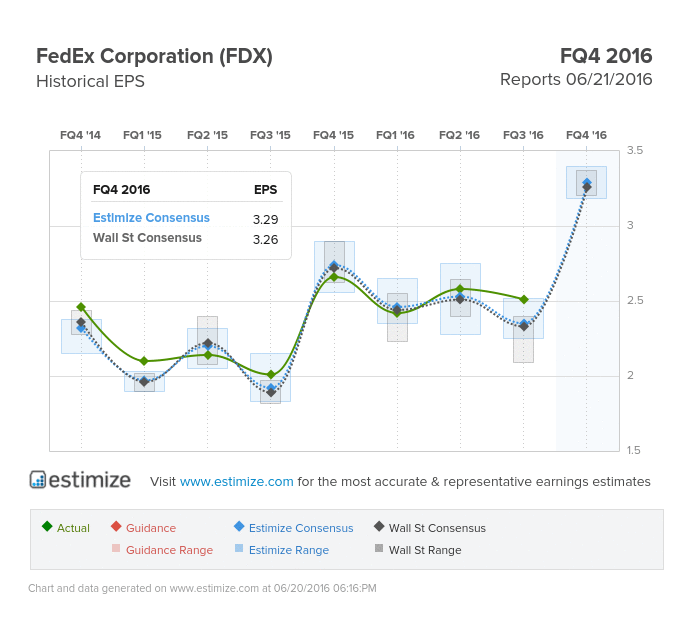

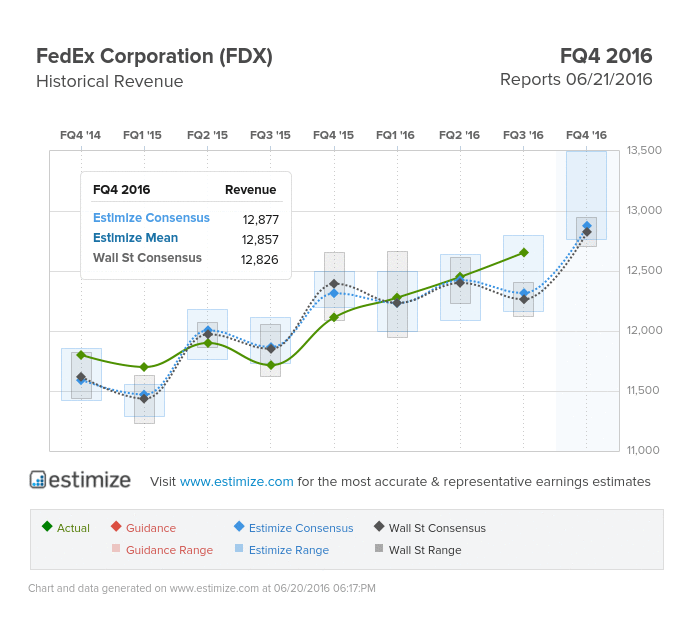

- The Estimize consensus is calling for earnings per share of $3.29 on $12.87 billion in revenue, 3 cents higher than Wall Street on the bottom line and over $50 million on the top

- At the moment, the Express division has been the standout performer, accounting for 40% of the company’s operating income followed by Ground and Freight

- FedEx’s acquisition of TNT Express, the FedEx of Europe, positions them to expand and grow their global air network

- What are you expecting for FDX?

The increasing popularity in ecommerce shopping has not only benefited online retailers like Amazon (NASDAQ:AMZN) but delivery services as well. FedEx and United Parcel Service Inc (NYSE:UPS) have seen margins and revenue expand given the recent influx of opportunities.

Despite some slowdown in the global economy, expectations are high that they will stay on track or exceed earnings expectations. FedEx, which is scheduled to report fiscal fourth quarter 2016 earnings tomorrow afternoon, is seeing strong momentum heading into its report.

The Estimize consensus is calling for earnings per share of $3.29 on $12.87 billion in revenue, 3 cents higher than Wall Street on the bottom line and over $50 million on the top. Compared to a year earlier this represents a 24% increase in earnings with sales expected to grow by as much as 6%.

Despite strong earnings growth of late, the stock typically doesn’t move during earnings season. In fact, shares of the logistics company are down nearly 6% in the past 12 months.

FedEx currently reports thee core financial segments; Express, Ground and Freight. At the moment, Express has been the standout performer accounting for 40% of the company’s operating income followed by Ground and Freight.

FedEx Express is the fastest and most expensive mode of delivery which makes the biggest contributions to income and margins. This has unfortunately started to slow down as customers are shifting towards slower less expensive deliveries. Turning to Ground, FedEx is seeing strong business to consumer demand with ecommerce creating the most opportunities.

The company continues to make strategic investments to position itself as a worldwide leader in delivery services. Earlier this month FedEx acquired TNT Express (AS:TNTE), in a move that aligns them to grow its extensive global air network.

TNT is essentially FedEx of Europe, so the merger should have strong synergies moving forward. New initiatives are important for maximizing profitability especially with the rapid growth in ecommerce.

Do you think FDX can beat estimates?