China outlook

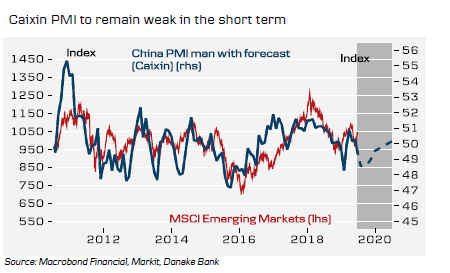

Our view. PMIs are set to remain weak in the short term, but there is no sign of a hard landing. On the other side of a trade deal, the economy should recover again.

Leading indicators are a bit mixed

#1. Lower yields still point to a lift to home sales ( p.4 ). Construction also supported by low inventories.

#2. Metal prices have softened but not collapsed. Points to weakness but not a sharp slowdown( p.6 ).

#3. Credit impulse stable but not yet recovered( p.8 ).

#4. PMI exports have weakened again. Global slowdown and trade war cause strong headwind ( p. 10 ).

Policy outlook

The re-escalation of the trade war caused new headwinds. Despite a ceasefire, we expect talks to be difficult leaving uncertainty in place for some time. We expect a deal to be struck at some point in H2.

We expect a cut in the Reserve Requirement Ratio, more targeted lending and more consumer stimulus.

Chinese market outlook

Chinese stocks are capped for now by trade war uncertainty. Long term, we are positive.

We expect USD/CNY to move higher before turning lower when a trade deal is in sight.

Global financial implications

- Equities. Chinese weakness weighs on global profit growth and equities. Stimulus adds support, though.

- Emerging markets. A weaker Chinese cycle is a headwind for EM assets, but Fed cuts and weaker USD will be a cushion.

- Global bonds. Lower Chinese growth weighs on global activity and inflation pressure and thus underpins bond markets.

- Commodities.Weakness but not a hard landing should keep commodity prices moving sideways or moderately lower. A trade deal will be positive for commodity prices as it will give a lift to Chinese growth.

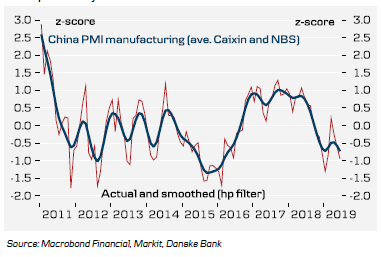

Following the recovery in Q1, our PMI indicator turned lower again in May and June. The renewed weakness is likely a reflection of the trade war escalation and to some extent that the increase in Q1 was probably a bit overdone.

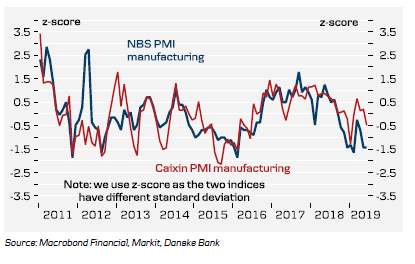

Both NBS and Caixin PMI have fallen back, although the NBS version is the weakest of the two. Both indices are still above the lows in 2018.

To read the entire report Please click on the pdf File Below..