Are the gold bubble prognosticators right? Is the run in gold and silver over as they fall to a three month low? Nothing could be further from the truth. The reason gold and silver prices have fallen of late is because, as I have been saying, the Dollar Index is rising. This is a 40 year pattern that was last repeated in 2008 when the Dollar Index broke above the 80 mark. Yesterday, the Dollar Index broke above the 80 mark again.

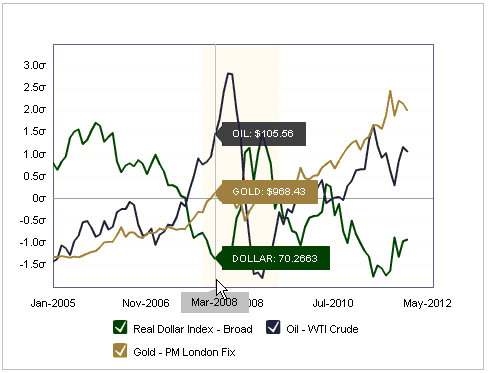

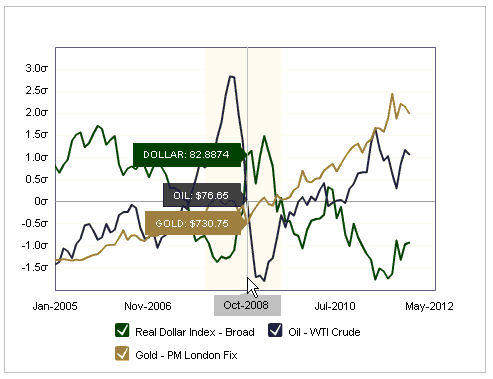

The charts below show what things looked like when the Dollar Index rose sharply and gold fell in 2008 from March to October where we saw the Dollar Index go from 70.27 to 82.89 and gold fall from $968 to $731.

So where are we today with the Dollar Index? The chart below shows we bounced off the low 70′s and are now heading back above 80. The question to answer is, where will it stop?

The high for the Dollar Index during the last two run ups was 89.62 in March of 2009 and 88.70 in June of 2010. These are the two areas where I would keep an eye on to see if they are breached. What would cause the surpassing of these marks? To answer this one needs to understand what makes up the Dollar Index to begin with. Why does the Dollar Index go higher or lower? It is what the Dollar Index is priced in that matters.

From the above chart you can see that the Euro makes up 57.6% of the Dollar Index. Needless to say, Europe has been struggling of late causing the Euro to fall to the 1.30 level against the dollar. The chart below shows how quickly the Euro has fallen.

The problem for Europe as a whole is that the individual countries that are causing the problems, Greece, Portugal, Italy, Spain, Ireland, etc., can’t print themselves out of this mess. So their only hope, outside of France and Germany along with outside investors, is to rely on the only one’s who can possibly help them, the ECB, the Fed and the IMF. We already know the IMF has been selling gold to raise cash to help Greece and other European countries. I pointed this out in IMF Gold Sales and Credit Expansion Maneuvers Show How Desperate Situation in Europe Is – Central Banks Step In. European Central Banks have been selling gold the last 10 years at a time when if they would have held the gold, they would have been better off today. Switzerland was forced to sell much of its gold and I’m sure the Swiss today aren’t too happy about that.

But to understand how far the dollar can go higher, and thus possibly have a further downward effect on gold and silver prices, we need to see how far the Euro could move lower.

How Far Can the Euro Sink?

There are two key areas in the charts below that we need to keep an eye on, the 6/10 low of 1.19 and the 11/05 low of 1.16. If these are breached, could it be game over for the Euro? How much money will Central Banks and the IMF throw at the Euro to keep the game going? What will France and Germany do? We already know their citizens don’t want to throw money at countries that can’t handle their own affairs through austerity.

Where Does This Leave Gold and Silver?

One has to realize that those in Europe are buying gold. Those here in the U.S. are somewhat confused as to what to do. They hear on one hand about all this inflation coming, but can’t understand how Treasuries have been so strong. This is all about perception. People still believe Treasuries to be safe, so foreign money is flowing into Treasuries. You can also bet that the OPEC countries have been getting out of the Euro and buying the dollar. They sold the dollar and bought the Euro when the Dollar Index was in the upper 80′s. We’ll find out soon enough, in my opinion, that they have been buying the dollar since the low 70′s.

One also has to realize that gold is still up double digits for the year. It is still viewed as a safe haven the world over, despite what CNBC might have you think. I’ve never seen a group of people so adamantly against gold.

For those of you who are in love with Goldman Sachs advice, I refer you to what I wrote about their comments on gold just one month ago via CNBC;

"Just heard CNBC say that Goldman Sachs is reiterating their call for gold through 2012. Personally, I don’t trust anything Goldman Sachs says. They are a holding bank and a puppet of the Federal Reserve. The same goes for J.P. Morgan. Why exactly are they both holding banks? Why have they involved themselves heavily into the gold and silver markets? Again…stay tuned… Reference spot price of gold right now $1,780.90 and silver $34.28 with the U.S. dollar index sitting at 77.53."

While one can give Goldman Sachs the benefit of the doubt about holding through 2012, I found their timing rather odd to announce this “reiteration” of their point of view at a time when the dollar was moving higher because of the mess in Europe. Anytime I hear things that don’t make sense like this, I immediately think market manipulation. My brain is trained to hear the opposite. In this case, I was right. Gold is down $180 from that point in time and silver fell 24% since that call hitting a low of around $28.90 this week. Meanwhile, the Dollar Index has continued to climb past the 80 mark. They didn’t see this coming?

No One Is Selling Their Gold and Silver

I have been writing articles on the potential of a gold and silver decline with the rise of the dollar. This is what’s occurring. I don’t have any clients or anyone else calling me to sell their gold and silver. They understand what a mess our banks are in. They understand the Fed just gave the banks and other countries $7.7 trillion, accounting for over $120,000 per man, woman and child in the U.S. They understand there are eventual consequences to this.

Dollar Cost Averaging in on these pullbacks is the way to play this market. You buy and actually hope it goes lower to get an overall better price. I expect we get one more washout in gold and silver, possibly coming at the end of this year when you’ll see some mutual funds and hedge funds that were late to the gold and silver game (especially silver) sell their metals and take advantage of the fact they can write off the losses. This could definitely put some pressure on gold and silver prices into the beginning of 2012 along with the dollar index pushing towards the upper 80′s mark. I continually remind investors this is the tortoise versus the hare one should take with investing in gold and silver. We’re not going to fall apart as a nation overnight, but I do keep a close eye on the Treasuries for keys as to what’s going on. One can’t ignore perception. But once this perception dynamic changes, hold on to your hat.

Political Talk

I have to get political here for a moment…and for good reason. My goal is simply to bring awareness and help one decipher what they are really hearing on television versus what’s really going on in the real world.

There is no doubt in my mind that Obama will pull out all stops to get reelected in November of 2012. He still has another bout of quantitative easing as a card to play should the stock market stumble. The economy will be the key issue of the 2012 election. On the Republican side, no candidate but Ron Paul and Gary Johnson have any sense about what’s really going on with the economy and the cuts that need to be made. Gary Johnson isn’t even allowed to debate and Ron Paul is constantly criticized by the media because he wants to save money by not being the policemen of the world. He understands that these wars are unsustainable and he can do simple math. Sean Hannity, Rush Limbaugh, Bill O’Reilly, Dick Morris, all think Paul would lose to Obama. They critique his foreign policy because they love the Fed and wars.

Obama doesn’t have a clue as to what to do either, except spend, spend, spend. Even in this last Trillion dollar budget that just passed, he is hurting those who want to buy real estate by raising the fees by thousands of dollar for loans made through Fannie and Freddie. How is this going to help the housing market when you make it more difficult to buy? But it is under Obama’s watch that we have the Fed doing two rounds of Quantitative easing that have done nothing but dig us deeper into debt and only put band-aid’s on the banks real problems. No cuts have been made or promised.

The national debt currently sits at over $15.12 trillion. The interest alone on that is $220 billion. The budget deficit we are presently running under Obama is $1.3 trillion. You can’t blame all this on Bush. Both parties are driving this country into the proverbial toilet. Don’t listen to what the media tells you. Do your own homework on the candidates and their economic plans. Only one candidate wants to cut $1 trillion immediately and that is Ron Paul. We either cut now or take the consequences of what’s to come through higher inflation and a reduced quality of life here in America. We are the world’s largest debtor nation and can’t afford the policies our government is putting on us. This is supposed to be a country run by We the People, but more and more we are all becoming We the Serfs, the title of my forthcoming book.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Confused About Falling Prices Of Gold and Silver?

Published 12/19/2011, 03:50 AM

Updated 07/09/2023, 06:31 AM

Confused About Falling Prices Of Gold and Silver?

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.