On April 7, FedEx Corporation (NYSE:FDX) announced a deal to buy Dutch delivery firm TNT Express NV (AMS:TNTE) for $4.8 billion, or 4.4 billion euros. The deal is an all-cash public offer of 8 euros per share, which represents a 33% premium over TNT’s closing price on April 2. TNT’s board unanimously recommended the transaction, though it is contingent upon approval by U.S. regulators.

In January 2013, U.S. regulators denied UPS’s (NYSE: UPS) bid to acquire TNT. The nullified United Parcel Service (NYSE:UPS) deal valued TNT at $7 billion, or 9.5 euros per share, which is significantly more than FedEx’s bid. At the time, regulators claimed the UPS/TNT acquisition would impede competition in the delivery sector. However, TNT and FedEx executives are confident that their deal will be approved due to its simplicity and the different nature of the companies. FedEx has a much smaller presence in Europe than UPS, thus there will be little overlap between the two existing models.

FedEx (NYSE: FDX) has a considerable air-delivery service in Europe, but a much smaller ground-delivery footprint than competitors. The TNT acquisition will be highly beneficial as it will give FedEx access to TNT’s existing delivery blueprint throughout Europe, as opposed to creating one from scratch. Home delivery can pose a challenge in some European neighborhoods as apartment buildings are often hard to access and streets are difficult to navigate.

FedEx CEO Frederik W. Smith commented:

“This transaction allows us to quickly broaden our portfolio of international transportation solutions to take advantage of market trends – especially the continuing growth of global e-commerce – and positions FedEx for greater long-term profitable growth.” Likewise, TNT Express CEO Tex Gunning noted that though the acquisition was unsolicited, it is “good news for all stakeholders.”

On April 7, analyst Helane Becker of Cowen & Co. reiterated an Outperform rating on FedEx with a price target of $210. Becker noted the “impeccable” timing of the TNT acquisition announcement due to “cheap debt financing, the euro tanking and UPS going through its own restructuring.” She added that FedEx had been expanding in Europe via “small tuck-in acquisitions that steadily increased market share,” but the deal with TNT catapults FedEx “into a dominant player in Europe.”

Helane Becker has rated FedEx 10 times since April 2009, earning a 67% success rate recommending the stock with a +23.1% average return per FedEx recommendation. Overall, Becker has an 80% success rate recommending stocks with a +33% average return per rating.

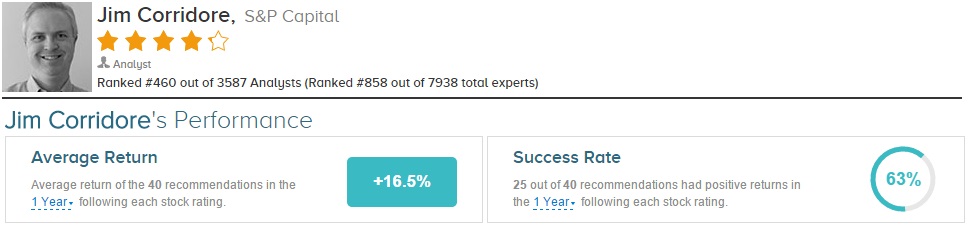

Separately on April 7, analyst Jim Corridore of S&P Capital reiterated a Strong Buy on FedEx with a $240 price target. Corridore is “very positive” on the deal, noting that it will “greatly expand FDX’s presence in Europe.” Though FedEx says that it is “confident it can get the deal past regulators,” referring to UPS’s denied deal two years ago. Corridore does not think U.S. regulators will pose a problem.

Jim Corridore has rated FedEx 14 times since March 2009, earning a 62% success rate recommending the stock with a +18.5% average return per FedEx rating. Overall, Corridore has a 63% success rate recommending stocks with a +16.5% average return per recommendation.

On average, the top analyst consensus for FedEx on TipRanks is Strong Buy.

Disclosure: All recommendations for FedEx sourced from TipRanks.