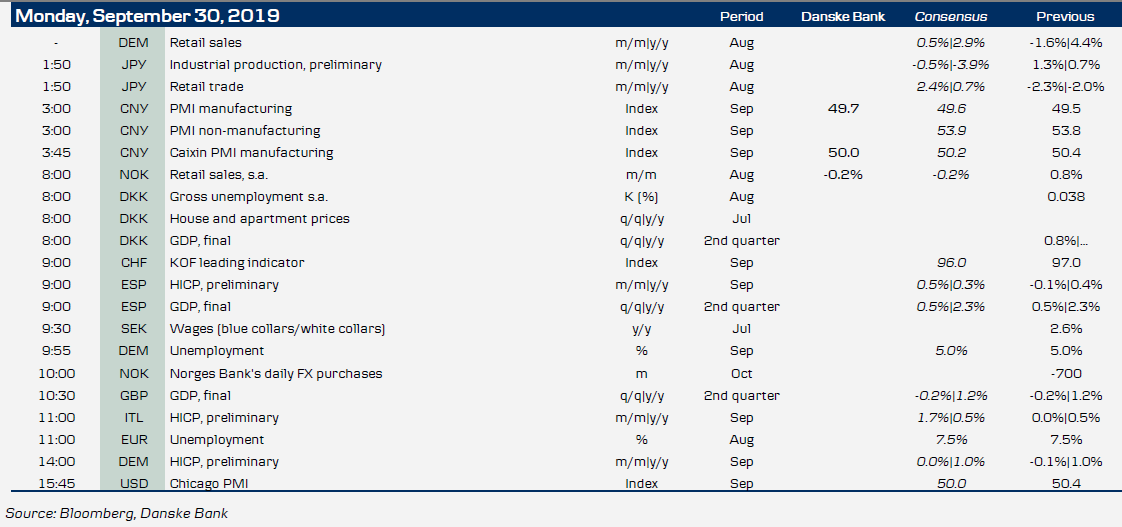

Market movers today

- Today, we only have a few data releases. We get retail sales out of Norway and unemployment data for the euro area and Germany. The latter in particular will be interesting given the weakness we have seen in some parts of the German economy.

- In terms of economic data releases this week, we look for a small rebound in ISM manufacturing and a further moderation in employment growth to around 100,000. We expect the flash release for euro area inflation to have fallen to 0.9% in September from 1.0% in August. We also get PMI manufacturing and service sector indicators from most countries this week.

- The focus is also on politics with the UK Conservative Party Conference taking place and the impeachment process of US President Trump. Also look out for any announcement on trade ahead of the trade negotiations next week.

Selected market news

In an interview with the Financial Times published on Sunday, ECB President Mario Draghi backed Emmanuel Macron's proposal from earlier in the year of a more highly integrated fiscal regime in the Eurozone that includes, among others, a common Eurozone budget and fiscal transfers between member states. Although Draghi acknowledged that the debate still has a long way to go, he was 'optimistic' following the recent austerity measures taking place in many countries in the Euro Area, further signalling the need for more coordinated fiscal measures to the general public. Draghi also reiterated the latest ECB communication on a need for fiscal expansion to play a larger role in order to relieve pressure on monetary policy, with the alternative being non-standard policy measures having to play a large role for an extended period of time despite generating adverse income effects (i.e. larger savings) and asset price inflation. Lastly, with regards to the recent stimulus package, Draghi acknowledged the downside of further monetary stimulus, but added that the positive consequences still outweighed the negative ones.

In Austria, Sebastian Kurz, the leader of the conservative ÖVP, is set to return as chancellor for the alpine state following Sunday's Nationalratswahl (National Council election). The preliminary results show ÖVP obtaining 37% of the popular vote, up from 31% in 2017 (34% expected). This comes largely at the cost of coalition partner FPÖ, with ORF.at reporting that a fifth of the party's voters from 2017 chose to vote for ÖVP on Sunday (and another one out of five chose not to vote at all). The right-wing party thus only obtained 16%, down from 26% in 2017. Although the majority obtained by Kurz and ÖVP was greater than expected, forming a coalition could prove difficult following comments from FPÖ stating that they did not see the results as a mandate to resume in government, meaning that the social democrats (SPÖ), registering the worst election result to date, or GRÜNE would be the only alternative. Only a single minority government has ruled since 1945.

The Fed funds effectively fell to 1.85% on Friday, from 1.90% on Thursday as both of the Fed's liquidity providing operations (O/N and 2W term repos) came in undersubscribed.

Scandi markets

In the Scandies, the disconnection between relative rates and the NOK is set to persist in the coming months. While the NOK is now a G10 high scorer on carry, the global environment of a strong USD and decelerating growth will remain a headwind. In this morning’s Reading the Markets Norway we show some simple descriptive EUR/NOK return statistics conditioned on the global manufacturing PMI. If we are right in more downside in the coming months, it spells bad news for the NOK – especially at a time when foreign accounts are afraid of the “usual” year-end weakness. Fundamentally, we still see a correction potential for a stronger NOK but this is unlikely to be a story before 2020 in our view. Near-term risks are instead skewed towards a weaker NOK.

Fixed income markets

We have an estimated EUR17bn coming to the EGB market in supply this week. There are only small coupons from Italy and no redemptions at all during the week. However, the supply comes ahead of significant redemptions and coupons over the rest of October of more than EUR157bn. France (EUR54.2bn), Italy (EUR36.2) and Spain (EUR27.4bn) are the main beneficiaries. In October, the PSPP redemptions are EUR29bn – the highest amount ever. Hence, the underlying flows are very constructive ahead of the start of the new QE programme on 1 November. For more on cash flows, see Government Bonds Weekly. We stay positive on the periphery and argue it is only a matter of time before 10Y Spain and 10Y Portugal also trade negatively. Denmark will tap the usual 2y and 10y benchmark bonds and Germany taps the Oct-24 bobl, both on Wednesday.

Today, will bring the German Länder CPI data, followed by flash HICP inflation. The euro area data are due tomorrow. The latter slumped to only 1.0% in August and 5y5y inflation is back below levels when the ECB September package was announced. With energy price inflation falling further into negative territory and core inflation stuck at 1.0%, we expect headline inflation to print at 0.9% in September. We see a growing risk - given the weak macroeconomic backdrop - that 5y5y inflation will start to fall more pronounced below the 1.20% level, that so far seems to have been a strong support level.

FX markets

The coming week will prove a test of USD strength. On the one hand, the trade war may (or may not) be turning to the financial side as news hitting the wires said the US was considering to restrict Chinese access to US capital markets, on Friday. But over the weekend, this topic was later backtracked. USD strength has been gathering pace in the past week (notably vs. GBP, SEK and EM) and over the coming week we will focus on Fed speeches, US ISM manufacturing and the jobs report. If the environment of strengthening of the broad dollar should turn, we think a good place to start would be the Fed getting ahead of the (global) curve and propelling risk markets higher. For now, that appears somewhat illusive.

EUR/USD dipped below 2019 lows and touched 1.0905 last week. This is testament to just how supportive the current environment remains for the USD. We see at least three reasons for that: (1) a Fed that still appears reactive rather than proactive, (2) continued worries over trade talks and (3) investors having second thoughts regarding Brexit risks, which have otherwise been priced out lately. In sum: do not fight USD strength near term, but we maintain that it will not last forever and still see EUR/USD grinding higher as 2020 progresses (12M target remains 1.15). See FX Strategy - USD: what will it take to halt dollar strength from here?

EUR/GBP went higher last week, hovering now just below 0.89. Last week, we got some indications that the Bank of England may be turning dovish and could be considering to cut rates, rather than staying on hold. We still think this is a hypothetical discussion for now but given we believe we will likely see an extension to Brexit, it’s likely the economy will continue to be under pressure - and inflation has also come down somewhat. Thus, the monetary discussion clearly also favours the GBP staying a bit on the weaker side. For reasons of Brexit, the global or domestic economy or the central bank(s), we continue to think EUR/GBP will trade close to 0.90 in the coming months and see potential for more upside from the current spot level, in the run up to the October deadline.

Key figures and events