Market movers today - The main event in the Nordic region is the Riksbank meeting with the policy announcement at 09:30 CEST. The market is not expecting much and we tend to agree. The most significant piece of new information compared with the April policy meeting is that both the ECB and the Fed have hinted at adding more monetary stimulus. This must have come as a complete surprise to the Riksbank. At the same time, policy makers can point to relatively healthy growth (Q1 GDP came in above expectations), inflation at target and inflation expectations stable at 2%. Hence, the Riksbank is in no particular hurry to hike rates.

- In the US, the ISM non-manufacturing survey is released today, which will be giving an interesting indication of whether the service sector is feeling the pinch from the troubles in the manufacturing sector and global economy. Market consensus expects a reading of 56.5. The service PMI has dropped in recent months to nearly 50, which has been a worry for the Fed. Hence a poor reading today would ignite expectations of a considerable upfront Fed easing.

- We do not believe the UK PMI services index due out today should move much in either direction.

Selected market news

US Treasuries followed the positive sentiment yesterday from the European bond markets on the back of weaker numbers out of the UK, a 'soft' speech by BoE's Carney, the nomination of IMF's Lagarde to become the next head of the ECB and Italy announcing a cut in the budget deficit to 2.04% rather than 2.4% for 2019 (as seen in April). The cut in the budget deficit is the result of a combination of higher revenues and lower spending.

The big surprise yesterday was the nomination of Christine Lagarde as the new head of the ECB. She has been very vocal in terms of keeping up economic stimulus. The reaction in the bond market was positive and another round of QE is likely to be in the cards. See more in our note published this morning, ECB research: IMF's Lagarde to take over from Draghi .

US President Trump announced nominees for the Federal Reserve. Trump said that he is planning to nominee two candidates, Christopher Waller and Judy Shelton, who are both seen to be positive for easing US monetary policy.

German Defence Minister Ursula von der Leyen was nominated as Head of the EU commission. The candidates have to be approved by the EU parliament and there is some opposition from German members of the EU parliament to the German Defence Minister becoming head of the EU commission. However, we expect the nominations to go through.

Scandi markets

First out in Sweden today is June services PMI. It is not very meaningful to make a forecast of these quite volatile data. However, the development over time is similar to manufacturing. The services PMI peaked mid-2017 and has trended lower since. The May figure (53.3) was lowest since April 2016. The main event is the Riksbank meeting with the policy announcement at 09:30 am CEST. The market is not expecting much and we tend to agree. The most significant piece of new information compared with the April policy meeting is that both the ECB and the Fed have hinted at adding more monetary stimulus. This must have come as a complete surprise to the Riksbank. At the same time, policy makers can point to relatively healthy growth (Q1 GDP came in above expectations), inflation at target and inflation expectations stable at 2%. We would say that the Riksbank is in no particular hurry. Current policy guidance (April) says that the plan is to lift the repo-rate late this year or early next year. It could simply drop the first part and wait and see what the ECB and the Fed decide to do policy-wise.

In Norway, housing prices have surprised on the upside so far this year, partly as a correction after the fall in prices in late 2018. As the market seems well balanced, we estimate prices were more or less unchanged in June.

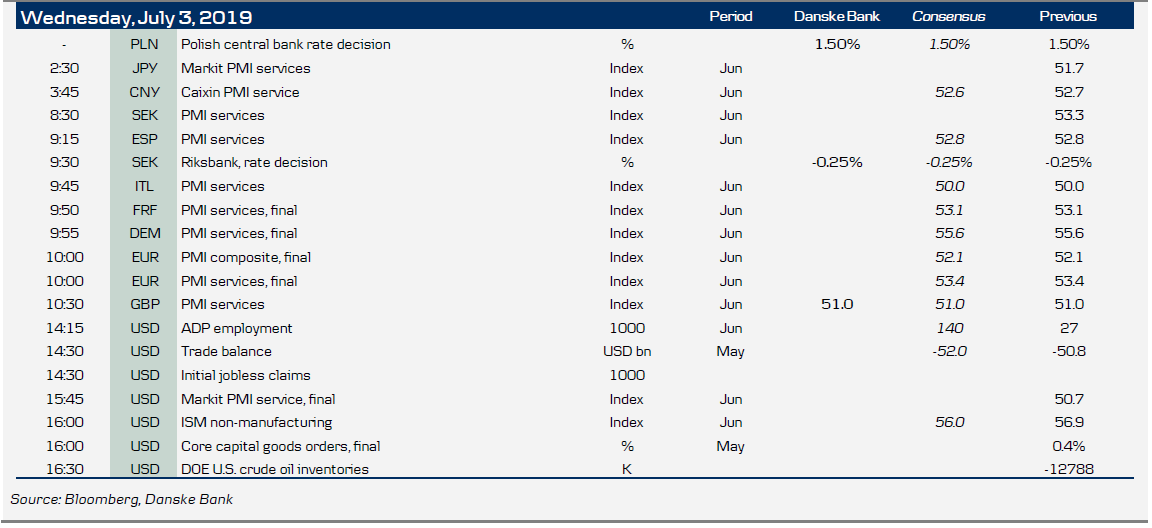

Key figures and events