Market movers today - In the euro area, we get a first hint of where inflation is headed in June with the German and Spanish HICP figures out already today. It will be interesting to see if they point to the rise in core inflation we expect to see in tomorrow's euro area figures. The EC's economic confidence indicator for June will also be on the agenda, providing the last piece to the puzzle of how consumer and business sentiment has fared in Q2.

- On an otherwise light day on the data front, markets will continue to look out for clues ahead of tomorrow's G20 meeting in Japan. Tensions are high ahead of the meeting, with Trump warning of additional tariffs if there is lack of progress after G20, while it was also suggested that the US and China have agreed on a tentative truce, according to scmp .

- Norwegian retail sales figures for May and Swedish trade balance figures are due out.

Selected market news

Since the start of the week, global inflation expectations (measured by the 5y5y inflation swap) have declined gradually. Global central banks are now facing a situation where they need to deliver. In the case of the euro area, inflation expectations have gradually erased around half of the jump we saw last week after the Sintra conference. An ECB sources story yesterday suggested that the ECB is looking into the technical details of a potential restart of QE. The question is what, how and when the ECB would announce new policy measures and if this could bring growth and inflation higher. The global cyclical momentum will be conditioned on the result of the ongoing trade war (where the Trump-Xi meeting this weekend is focal) and the size of the stimuli of global central banks, such as the Fed and ECB. As we discussed in Danske Daily yesterday, some FOMC members suggested a 50bp cut would be overdone, which took its toll on markets yesterday. For the Fed, market pricing currently points to -72bp lower central bank pricing by the end of the year, while EONIA pricing (ECB) is -15bp lower by year-end.

The weekly US oil report showed a drop in the stock piles, which led to oil touching a four-week high. However, it fell back slightly after US President Trump warned of additional tariffs if there is lack of progress after this weekend's expected Trump-Xi meeting at the G20 summit. According to the White House, the Trump-Xi meeting will take place on Saturday at 11:30 local time (3:30 CEST). Trump is also set to meet Russia's Putin (Friday at 14:00 local time~6:00 CEST).

The Norwegian LFS-unemployment rate fell to 3.2 % in April, which was stronger than expected, but the details paint a broadly unchanged employment picture than the headline number suggests. The drop in the unemployment rate masks that employment was more or less unchanged, which leads us to conclude that the drop is more noise than a new trend. That said, we favour the less volatile NAV unemployment figure to gauge the labour market (which we expect to come in at 2.2%).

Scandi markets

In Norway, retail sales have been weak since spring last year but surprised to the upside in April after a tentative increase in March. We reckon part of the increase in April was down to seasonal factors around Easter and therefore expect retail sales to fall again by 1.0% m/m in May, but that still implies an improvement in the underlying trend.

In Sweden, the trade balance for May is due. As we have pointed out many times, net exports in goods have deteriorated every year since 2014, despite or maybe supported by the SEK’s depreciation. Global value chains including more expensive imports and strong domestic demand are to blame for this. 2019 has started on a different note: net exports have risen compared to last year, up until April. The flipside is that part of the reason is weaker import growth, which in turn stems from weaker domestic demand.

Fixed income markets

Global yields moved higher yesterday after the Fed’s Bullard said that a 50bp cut by the Fed would be “overdone”. Hence, the market scaled back on Fed pricing, removing most of the probability for a 50bp cut.

The European curve was further weighed down by the EUR1.25bn tap in the 2117 RAGB century bond, though the EUR5.3bn book underlined the dramatic demand for duration among European asset managers. Austria also managed to sell a new 5y bond with a yield below the ECB depo rate. Austria has fulfilled 75% of the EUR20bn funding target, we assume.

Today, Italy will be in the market for the second time this week. This time, the Tesoro will tap up to EUR6bn in the 6Y FRN and the 5Y and 10Y Benchmark bonds. Italy and other periphery markets outperformed yesterday as Reuters ran a story that the ECB is discussing ways to “circumvent” the issuer limit. One possibility apparently being discussed is to strip the ECB of its voting rights, referring to special clauses in bond contracts. It is hard to say if the story holds water. But it underlines that the ECB is ready to make bold moves when it entire credibility is at stake with market inflation expectations falling again.

FX markets

Optimism on trade is boiling ahead of the G20 meeting in Osaka, which starts today, weighing on safe havens. The USD has stabilised somewhat after the recent decline, while the CHF and JPY strength has faded a bit. Notably, EUR/CHF has edged away from the 1.10 area, which may foster SNB action, and USD/JPY climbed towards 108 yesterday. Some parts of the market seem to be pricing a positive outcome at G20 but inflation expectations remain in decline and global data is crucially still weakening. We think USD/JPY continues to have significant downside risks. Indeed, while dollar weakening would help, it likely remains insignificant in terms of turning global macro around, and a trade war premium in USD as likely still present. If a trade truce is agreed by Trump and Xi this weekend, it might initially foster some USD, JPY and CHF weakness and cheer in notably the Scandies and EM but we do not see a long-lived move given (1) already high expectations, and (2) the risk that the US administration has proven it may swiftly change its mind again on these matters.

Separately, EUR/GBP is trading at its highest level since January and inched below our forecast of 0.9. As expected, consumer and business data continues to come in below consensus expectations and however Tory leadership favourite Boris Johnson may be sounding on Brexit, we see little credible progress. We continue to target 0.90 in the cross throughout our forecast horizon.

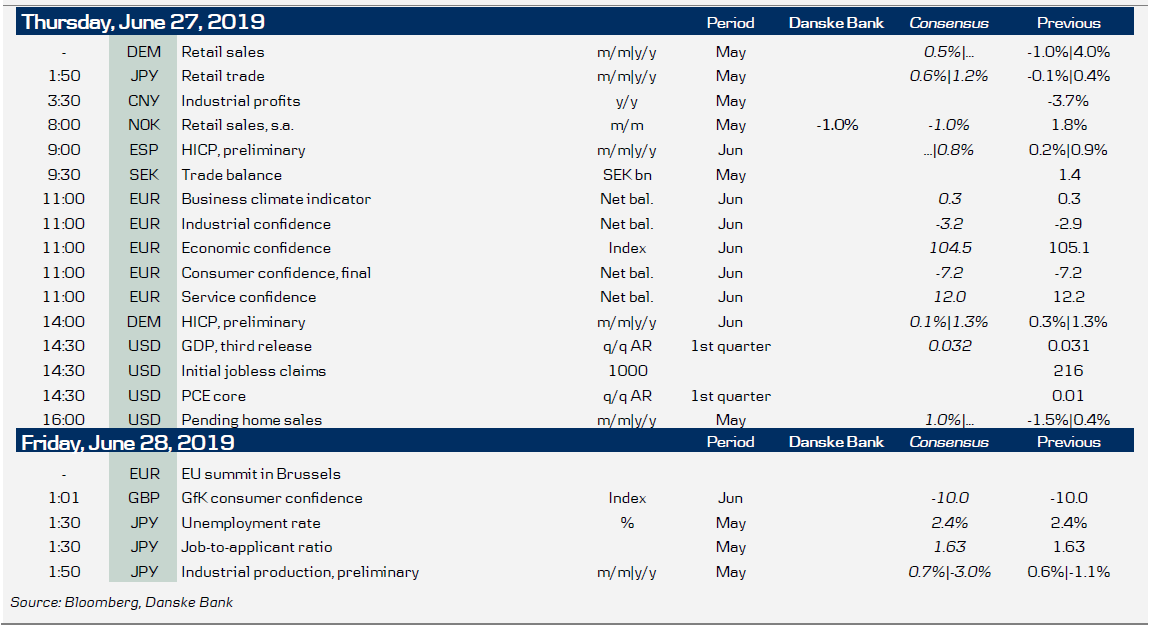

Key figures and events