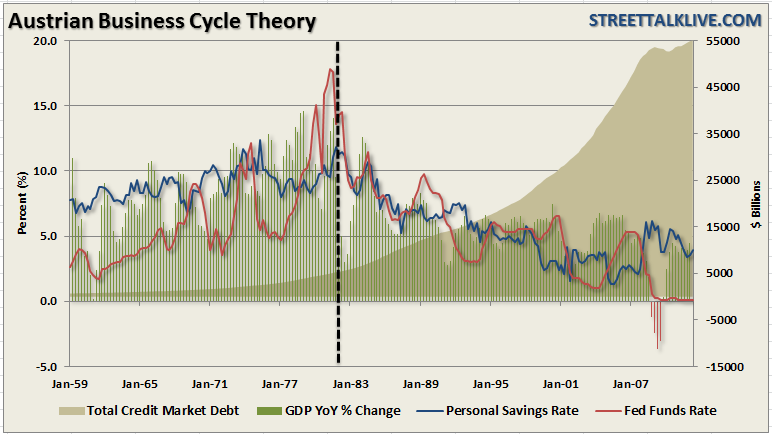

Debt. There isn't a day that passes as of late that the issue of debt doesn't arise. Federal debt and consumer debt (including mortgages) are of the most concern due to its impact on the domestic economy. Debt is, by its very nature, a cancer on economic growth. As debt levels rise it consumes more capital by diverting it from productive investments into debt service. As debt levels spread through the system it consumes greater amounts of capital until it eventually kills the host. The chart below shows the rise of credit market debt and its impact on both personal savings and economic growth.

From the 1950’s through the late 1970’s interest rates were in a generally rising trend with the Federal Funds rate at 0.8% in 1954 and rising to its peak of 19.1% in 1981. Of course, during this time the U.S. was the manufacturing and production powerhouse of the entire global economy post the wide spread devastation of Europe, Germany and Japan during WWII. The rebuilding of Europe and Japan, combined with the years of pent up demand for goods domestically, led to a strongly growing economy and increased personal savings.

However, beginning in 1980 the world changed. The development of communications shrank the global marketplace while the rise of technology allowed the U.S. to embark upon a massive shift to export manufacturing to the lowest cost provider in order to import cheaper goods. The deregulation of the financial industry led to new innovations in financial engineering, easy money and wealth creation through the use of leverage which led to a financial boom unlike any seen in history. The 80-90's was a period of unrivaled prosperity and the envy of every nation on earth.

Unfortunately - it was the greatest economic illusion ever witnessed.

The reality is that the majority of the aggregate growth in the economy was financed by deficit spending, credit creation and a reduction in savings. In turn this reduced productive investment in the economy and the output of the economy slowed. As the economy slowed, and wages fell, the consumer was forced to take on more leverage to maintain their standard of living which in turn decreased savings. As a result of the increased leverage more of their income was needed to service the debt - and with that the "debt cancer" engulfed the system.

The Austrian business cycle theory attempts to explain business cycles through a set of ideas. The theory views business cycles “as the inevitable consequence of excessive growth in bank credit, exacerbated by inherently damaging and ineffective central bank policies, which cause interest rates to remain too low for too long, resulting in excessive credit creation, speculative economic bubbles and lowered savings.”

In other words, the proponents of Austrian economics believe that a sustained period of low interest rates and excessive credit creation results in a volatile and unstable imbalance between saving and investment. In other words, low interest rates tend to stimulate borrowing from the banking system which in turn leads, as one would expect, to the expansion of credit. This expansion of credit then, in turn, creates an expansion of the supply of money.

Therefore, as one would ultimately expect, the credit-sourced boom becomes unsustainable as artificially stimulated borrowing seeks out diminishing investment opportunities. Finally, the credit-sourced boom results in widespread malinvestments. When the exponential credit creation can no longer be sustained a “credit contraction” occurs which ultimately shrinks the money supply and the markets finally “clear” which then causes resources to be reallocated back towards more efficient uses.

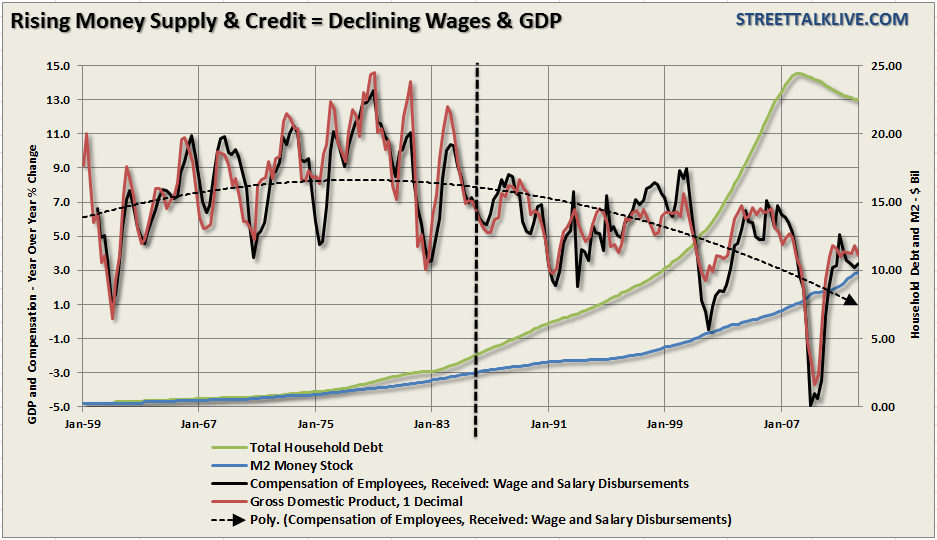

The chart below shows the increasing levels of money supply and debt versus the changes in economic and wage growth. The impact of debt on the economy remains unrecognized by policy makers and central bankers who have failed to understand what the current downturn encompasses. Therefore, these same individuals continue to chase economic theories based on a mistaken belief that the current recession is an ordinary period of falling aggregate demand. However, the reality is something far different.

The reason that the policies which have been enacted by the current Administration up to this point have all but failed, be it “cash for clunkers” to “Quantitative Easing”, is because they were designed to either drag future consumption forward or to slow the deleveraging process. The Keynesian view that "more money in people's pockets" will boost consumer spending, and ultimately grow GDP, has clearly been wrong. It hasn’t happened in 30 years. What is missed is that things like temporary tax cuts, or one time injections, don’t create economic growth but merely reschedules it. While the average American will act on a near-term increase in their take home pay - any increased consumption in the present will be matched by a decrease later when the tax cut is revoked.

This is, of course, assuming the balance sheet at home hasn’t broken. The problem today is that for only the second time in the history of the United States we are in the process of deleveraging the balance sheet of the U.S. economy. As we saw during the period of the “Great Depression” most economists thought that the simple solution was just more stimulus. Work programs, lower interest rates, government spending all didn’t work to stem the tide of the depression era.

The problem is that during a “balance sheet” recession the consumer is forced to pay off debt which detracts from their ability to consume. This is the one facet that Keynesian economics doesn’t factor in. More importantly it also impacts the production side of the equation as well since no act of saving ever detracts from demand. Consumption delayed is merely a shift of consumptive ability to other individuals, and even better, money saved is often capital supplied to entrepreneurs and businesses that will use it to expand, and hire new workers.

So, while classical economics says that production comes first, the problem becomes that during a “balance sheet recession” the economy is put into a stranglehold for productive investment. The continued misuse of capital and continued erroneous monetary policies have instigated not only the recent downturn but actually 30 years of an insidious slow moving infection that has destroyed the American legacy.

This is why we need real reform in government that leads to a smaller government, more clarity for businesses through pro-growth policies, real regulation of Wall Street which separates banks and brokerages, as well as programs and subsidies for bringing back to America those jobs that require a little hard work and a little bit of sweat but create a whole lot of pride and prosperity along the way.

It’s time for our leaders to wake up and smell the burning of the dollar – we are at war with ourselves and the games being played out by Washington to maintain the status quo is slowing creating the next crisis that won’t be fixed with monetary bailout.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Debt - Driving The Economy Since 1980

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.